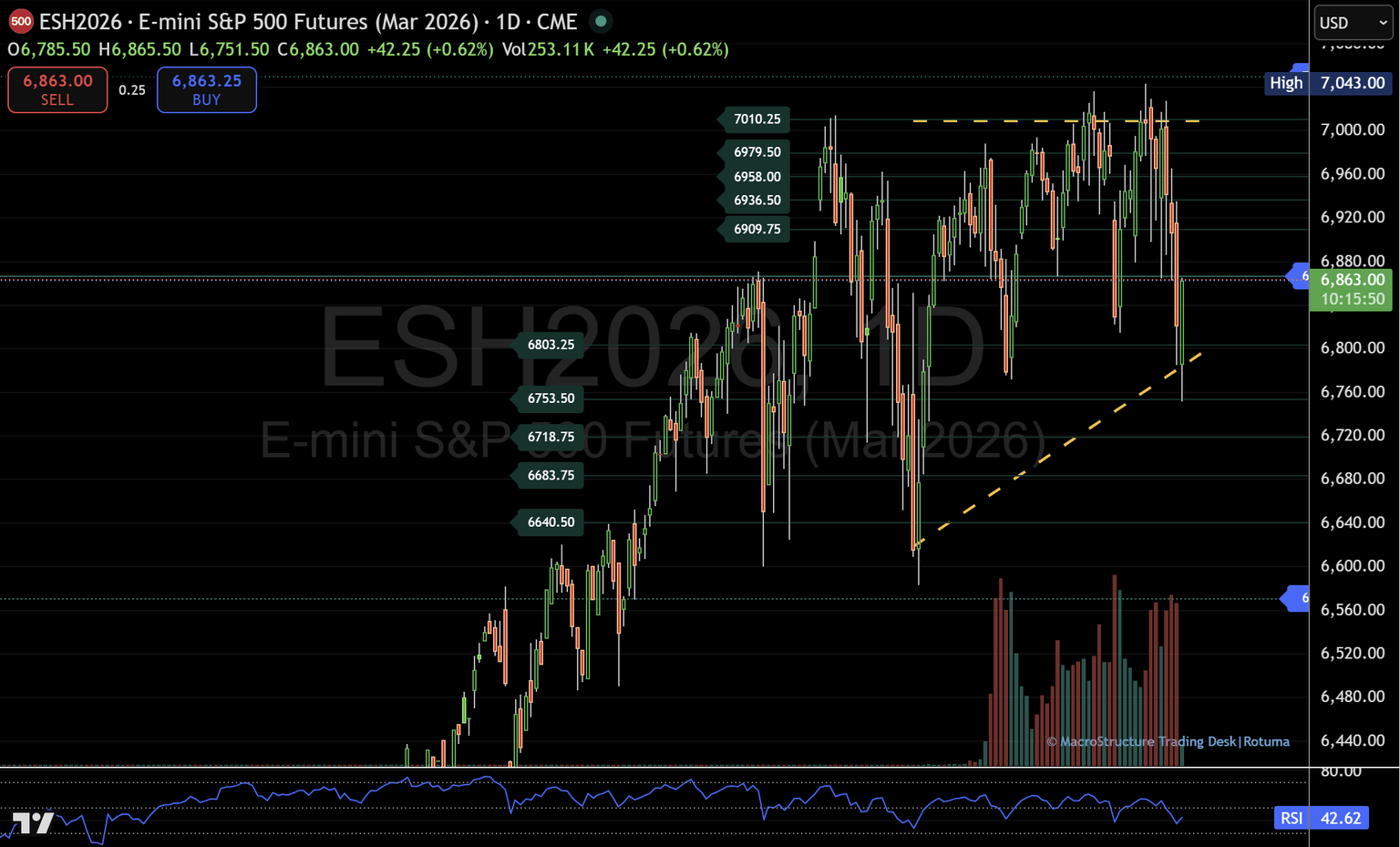

S&P 500 futures press the central pivot as the two-way structure guides the New York setup

ES is rebounding from the lower range after a three-session pullback, with the central pivot now acting as the key decision point for rotation back toward the upper band or continuation inside the lower structure.

ES (S&P 500 Futures) remains governed by the same two-way MacroStructure that has been in place since October 2025. The broader framework continues to function as a rotational environment: Rather than establishing a new directional regime, price has repeatedly moved between predefined internal reference levels as liquidity shifts across sessions.

After completing a rotation into the upper structure earlier in the cycle, ES has rotated back into the lower range over the last three sessions, then responded from 6753 and rebounded toward the daily Central Pivot (CP) at 6866.50 as the market approaches the New York open. In a two-way environment, the central pivot typically acts as the primary decision point — either converting into acceptance that reopens the upper band, or rejecting and keeping the lower structure active.

The central pivot is the New York decision gate

The CP at 6866.50 is the main reference for the session.

- A break and hold above CP would support the observation that the auction is rotating back toward the upper range, with 6909–7010 returning as the next mapped micro reference zone.

- A failure at CP would keep the lower structure in play, with the lower-range ceiling references 6753 and 6803 remaining the key magnets and decision points if downside pressure resumes.

What the tape suggests in mid-London

The mid-London profile/volume picture is constructive, although still incomplete until the pivot confirms:

- POC is positioned at 6803, acting as the current value anchor.

- Volume POC 1 is concentrated between 6753 and 6803, consistent with participation supporting the rebound from the lower boundary.

- Volume POC 2 is building above 6803, suggesting value and participation are attempting to migrate higher.

- Price is trading just below the CP, while cumulative volume shows a green cluster above the POC, reflecting stronger participation on the advance than on pullbacks.

If that behaviour persists into the U.S. session, it increases the probability of a pivot resolution attempt. However, in rotational conditions, the decisive signal is not a touch of the level but whether price can be accepted above the CP and sustain trade on retests.

New York session scenarios

Acceptance above CP: Sustained trade above 6866.50 and defensive pullbacks would align with rotation back into the upper range, bringing 6909–7010 into focus as the next reference band.

Rejection at CP: Failure to sustain above 6866.50 would keep the lower structure active, with 6803 as the first value magnet and 6753 as the key lower reference if liquidation resumes.

As long as ES remains within the two-way structure, the cleanest approach is to treat the session as a pivot decision: acceptance favours rotation to the next band, while rejection favours a return to the lower range references.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.