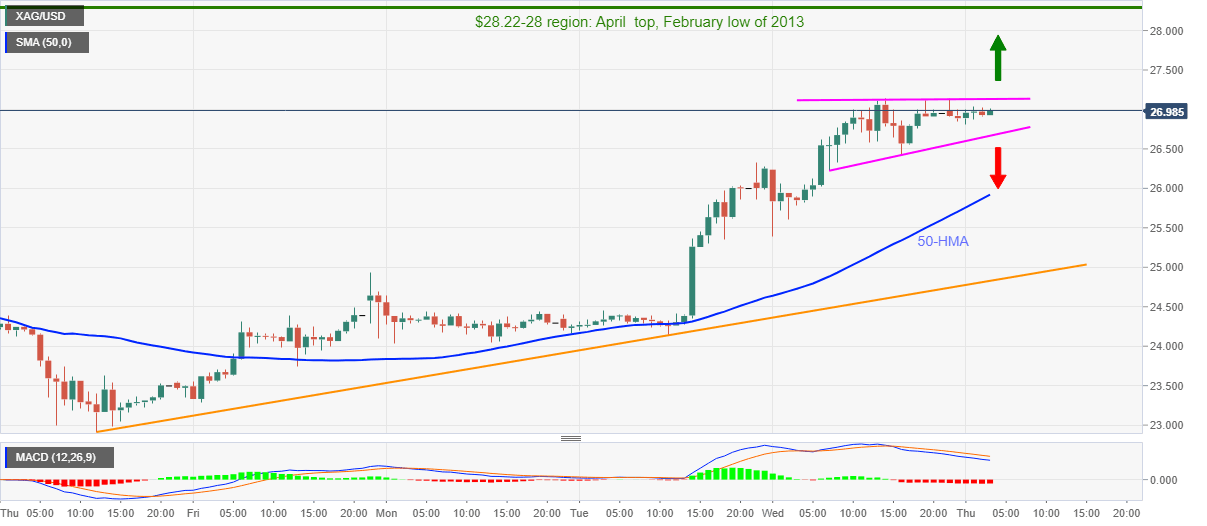

Silver Price Analysis: XAG/USD stuck in an ascending triangle around $27.00

- Silver bulls struggling in a choppy range near the highest level since April 2013.

- Bearish MACD failures to extend the run-up keep sellers hopeful.

- 50-HMA can entertain short-term sellers, bulls may eye $28.22/28 are during further upside.

Silver prices stay mildly bid while trading near $27.00, up 0.20% on the day, during the early Thursday. The white metal refreshed the multi-month high before a few hours but failed to rise further beyond $27.14.

With the repeated pullback from $27.00, coupled with bearish MACD, the bullion forms an ascending triangle chart pattern on the hourly play.

While the sellers are waiting for a clear break of $26.65 to portray a fresh downside towards a 50-HMA level of $25.92, bulls may have to provide a daily closing past-$27.14 to aim for $28.00.

However, the quote’s further upside past-$28.00 becomes tough as the February 2013 low joins April 2013 top to highlight $28.22/28 as the key upside hurdle.

On the contrary, an ascending trend line from July 30, at $24.82 now, could entertain bears as soon as 50-HMA fails to stop them.

Silver hourly chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.