Silver Price Analysis: XAG/USD slips below $29.00 but buyers stay hopeful

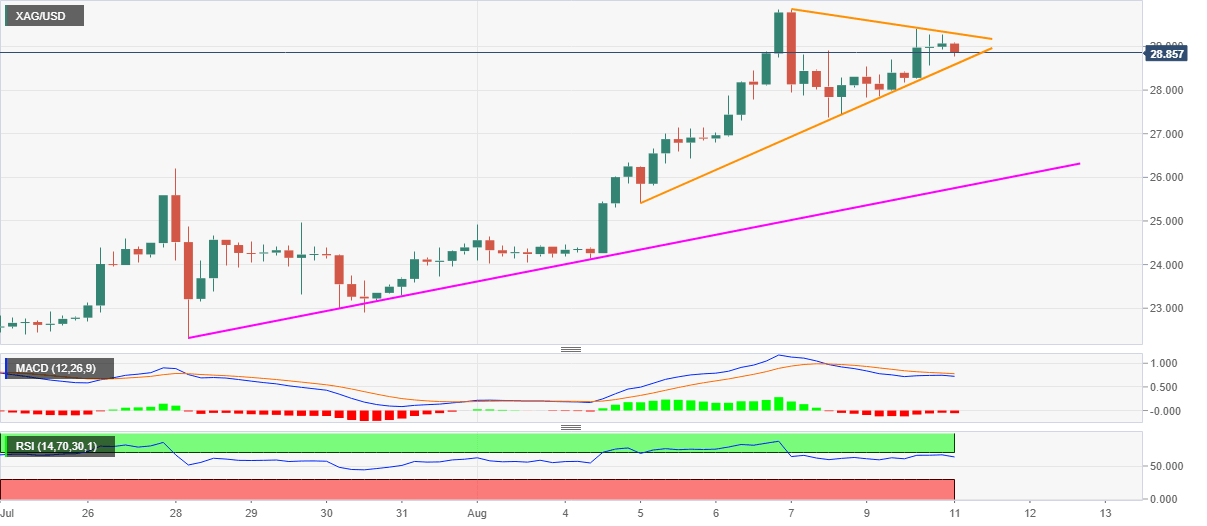

- Silver bears attack lower-end of $28.66-$29.27 trading range.

- Bearish MACD, RSI conditions favor the sellers, short-term ascending trend lines restrict further declines.

- $30.00 becomes the key upside barrier beyond $29.30 immediate resistance.

Silver prices drop to $28.78, down 1.11% on a day, amid the initial hour of Tokyo open on Tuesday. The white metal recently took a U-turn from $29.27 while keeping nearby trading range amid bearish MACD and downward sloping RSI conditions. However, multiple support lines stand tall to challenge the pair sellers and keep the bulls hopeful.

Among the aforementioned support lines, one from August 05, at $28.58 now, gains the immediate market attention ahead of another downside barrier stretched from July 28, currently around $25.75.

In between these trend-lines, July 28 top near $26.20 and $27.00 might entertain the bullion traders.

On the upside, a downward sloping trend line from Friday, at $29.30 now, followed by $30.00 round-figures could restrict the metal’s immediate recovery moves.

However, the precious metal’s ability to cross $30.00 on a daily closing basis enables it to aim for November 2012 bottom surrounding $30.65/70.

Silver four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.