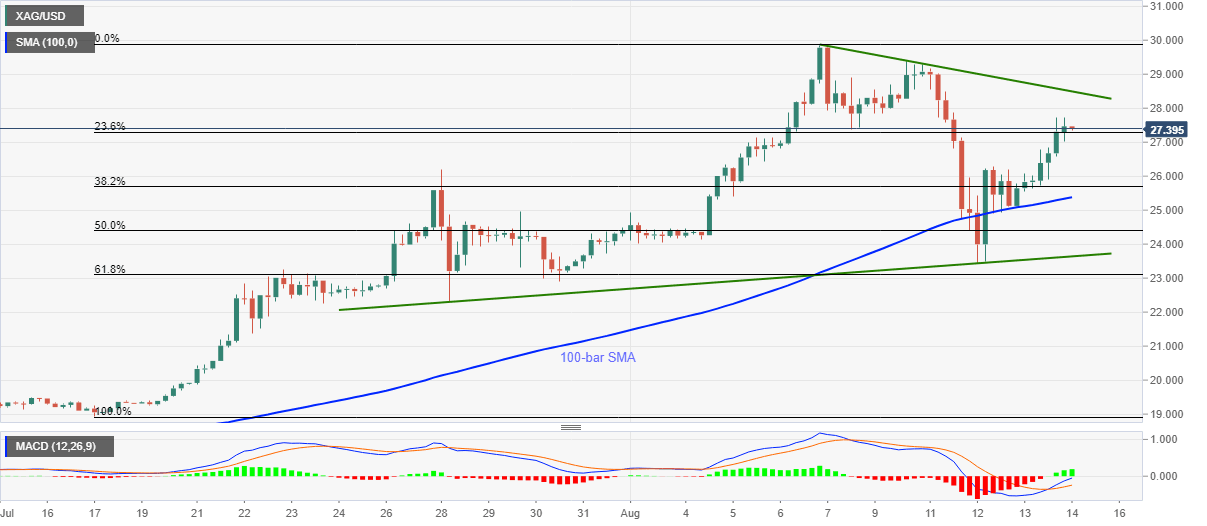

Silver Price Analysis: XAG/USD fails to keep upside momentum beyond $27.00

- Silver prices take a U-turn from a three-day high near $27.70.

- One-week-old falling trend line restricts immediate upside ahead of the multi-year high around $29.85.

- 100-bar SMA, short-term rising trend line keep buyers hopeful.

Silver drops to $27.40, down 0.33% on a day, as markets in Tokyo open for trading on Friday. In doing so, the bullion snaps the previous two-day rise despite bullish MACD and a sustained run-up beyond the near-term key supports.

As a result, sellers are likely to take fresh entries, targeting Wednesday’s high of $26.30, if the quote drops below $27.00 round-figures.

Though, the white metal’s downside past-$26.30 will be challenged by 10-bar SMA level of $25.37 and an ascending trend line from July 28, at $23.43 now.

On the contrary, the commodity’s fresh rise beyond the latest high around $27.70 will aim for a descending trend line from August 06, currently around $28.50.

Additionally, buyers will not hesitate to challenge the recently refreshed multi-year high near $29.85 on the break of nearby resistance line.

Silver four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.