Silver Price Analysis: XAG/USD drops to multi-week lows, bears eye $25

- Silver extends its slide after closing in the red on Thursday.

- Next target on the downside could be seen at $25.

- Near-term bearish outlook to remain intact unless XAG/USD reclaims $27.

Following Tuesday's rebound, the XAG/USD pair lost its traction on Wednesday and fell more than 2%. With the greenback preserving its strength, silver extended its slide and touched its lowest level since late January at $25.62. As of writing, XAG/USD was down 0.75% on the day at $25.90.

Silver technical outlook

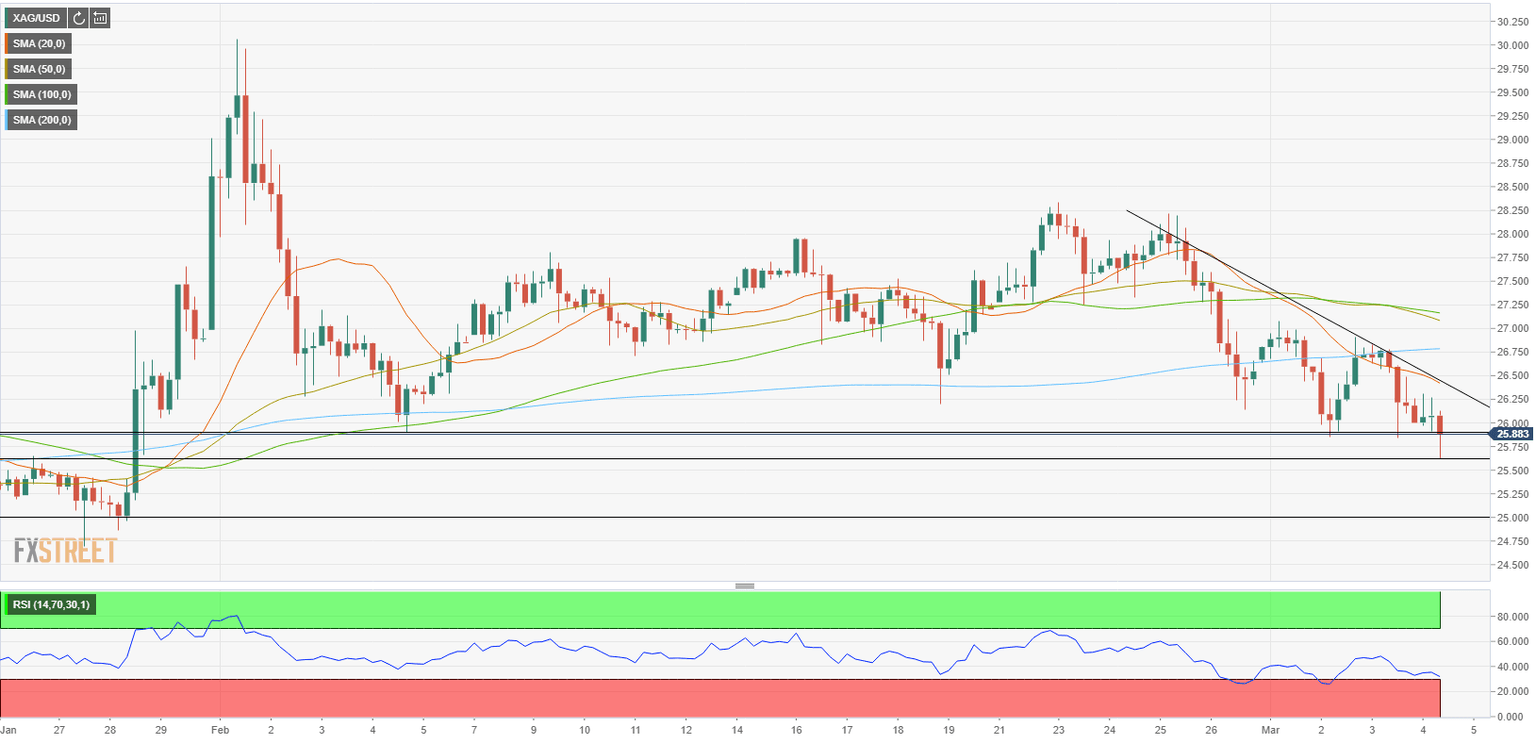

On the four-hour chart, XAG/USD continues to trade below the one-week-old descending trend line. On the same chart, the Relative Strength Index (RSI) indicator is staying within a touching distance of 30, suggesting that the pair could make a technical correction before the next leg down.

However, unless the pair manages to break above the trend line, which is currently located around $26.40, and recapture the $26.80-$27.20 area (200 and 100 SMAs), sellers are likely to try to remain in control of prices.

On the downside, the initial support is located at $25.60 (multi-week lows) and XAG/USD could continue to push lower toward $25 (psychological level, static support) if a four-hour candle closes below that level.

Additional levels to watch for

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.