Silver Price Analysis: XAG/USD bulls can ignore recent pullback around $27.50

- Silver consolidates the previous day’s gains, refreshes intraday low of late.

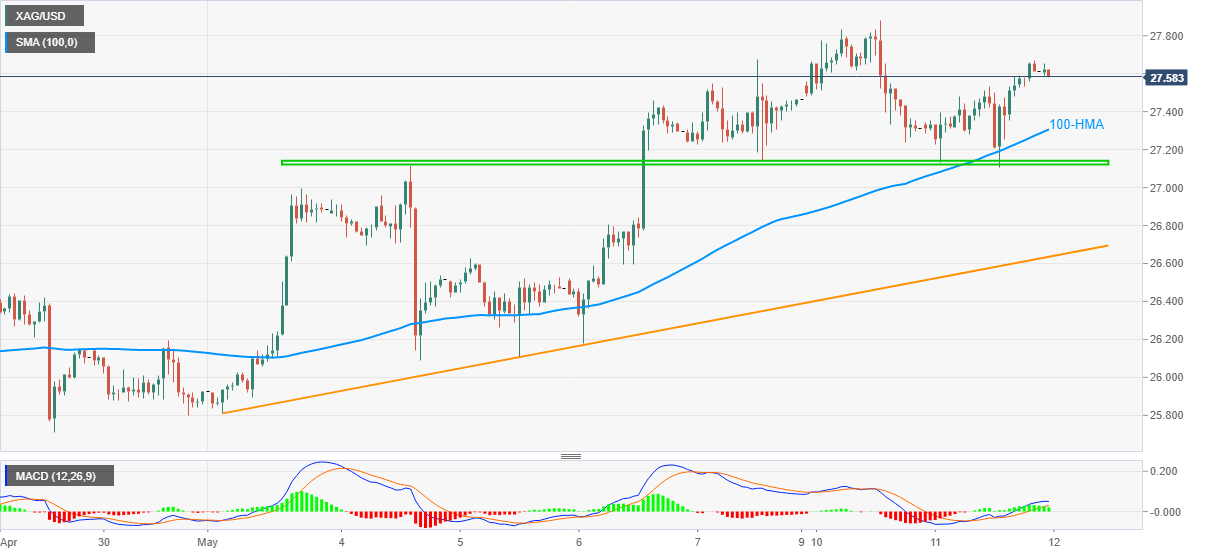

- Clear trading beyond immediate horizontal support, 100-HMA back buyers amid upbeat MACD signals.

- A seven-day-old rising trend line adds to the downside filters.

Silver takes offers around $27.60, down 0.10% intraday, amid the early Asian session on Wednesday. The white metal jumped the most in the week the previous day while keeping the last Thursday’s upside break of a horizontal hurdle, now support.

Also, a sustained up-move beyond 100-HMA and bullish MACD signals amplify support for the commodity buyers.

Hence, the latest top around $27.90 holds the key to the silver’s rally towards late February top near $28.35.

Following that, the $28.00 and the $29.00 round figures may offer intermediate halts before directing the bulls to the yearly peak surrounding the $30.00 psychological magnet.

Meanwhile, a 100-HMA level of $27.30 can act as immediate support ahead of the stated horizontal area from May 04, near $27.10-15.

It’s worth mentioning that the downside moves below $27.10 needs to break the $27.00 threshold, as well as a short-term support line around $26.60, before convincing silver sellers.

Silver hourly chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.