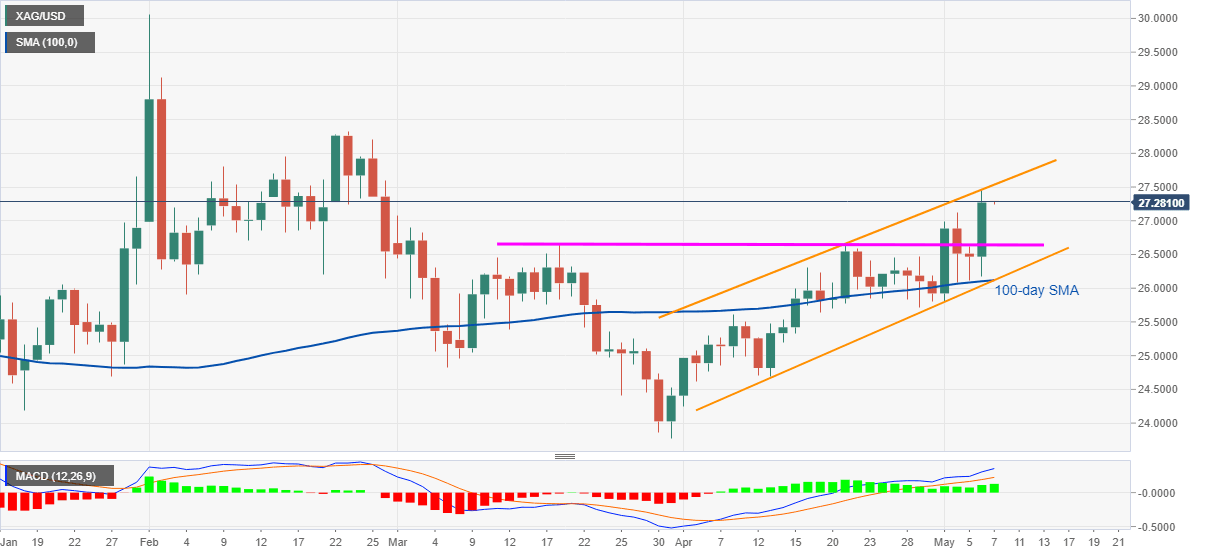

Silver Price Analysis: XAG/USD battles immediate ascending channel resistance above $27.00

- Silver pokes 10-week top inside a bullish chart pattern.

- Upbeat MACD signals back the buyers but a pullback can’t be ruled out.

- 100-day SMA strengthens the monthly rising channel’s support.

Following its jump to the highest levels since late February the previous day, silver seesaws around $27.30 during the initial Asian session trading on Friday. The white metal pushed the upper line of a one-month-old rising channel while refreshing the highest levels since February 26 on Thursday.

Although bullish MACD signals join the rising channel pattern, the resistance line of the stated bullish formation may hinder the commodity’s north-run around $27.55.

Should the silver prices rally beyond $27.55, the $28.00 threshold and February 23 high near $28.35 will be on the buyer’s radar ahead of the yearly peak close to $30.00.

Meanwhile, pullback moves may revisit the $27.00 round figure before resting on the horizontal support from March 18, around $26.65.

However, any further weakness past $26.65 will be challenged by the support line of the stated channel and 100-day SMA around $26.15-10.

Overall, silver is likely to keep the upward trajectory but intermediate pullbacks can’t be ruled out.

Silver daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.