Silver Price Analysis: Bulls trying to retake control above $24.00

- Silver bounces off intraday low to challenge the short-term resistance line.

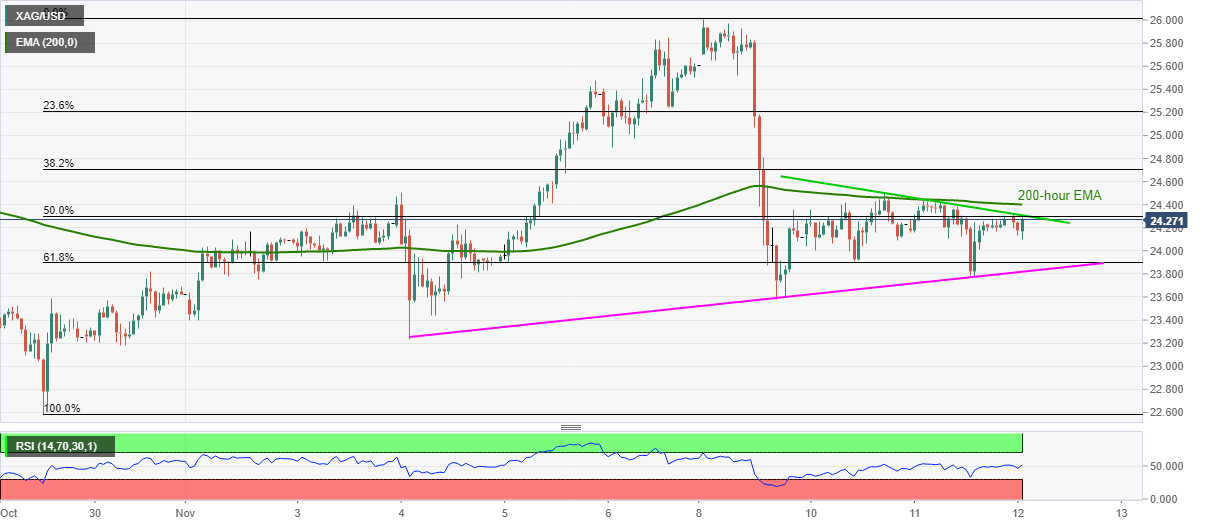

- 50% Fibonacci retracement, 200-hour EMA add to the upside barriers.

- One-week-old rising trend line will probe the bears.

Silver prices take a U-turn from intraday low while rising to $24.25 during early Thursday. In doing so, the metal buyers attack a falling trend line from Tuesday and 50% Fibonacci retracement of October 29 to November 08 upside.

With the normal RSI conditions favoring continuation of the recent corrective recovery, the bullion can overcome the $24.30 immediate resistance confluence. Though, 200-hour EMA near $24.40 stands tall to challenge the bulls afterward.

It should, however, be noted that the precious metal’s ability to cross $24.40 will aim for Friday’s low near $24.90 before eyeing the upside move towards the $25.50 and the monthly peak surrounding $26.00.

Meanwhile, 61.8% Fibonacci retracement level near $23.90 offers nearby support to watch should the commodity refreshes intraday low of $24.09.

If at all the silver sellers dominate past-$23.90, an ascending trend line from previous Wednesday, at $23.80 now, will be in the spotlight.

Silver hourly chart

Trend: Sideways

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.