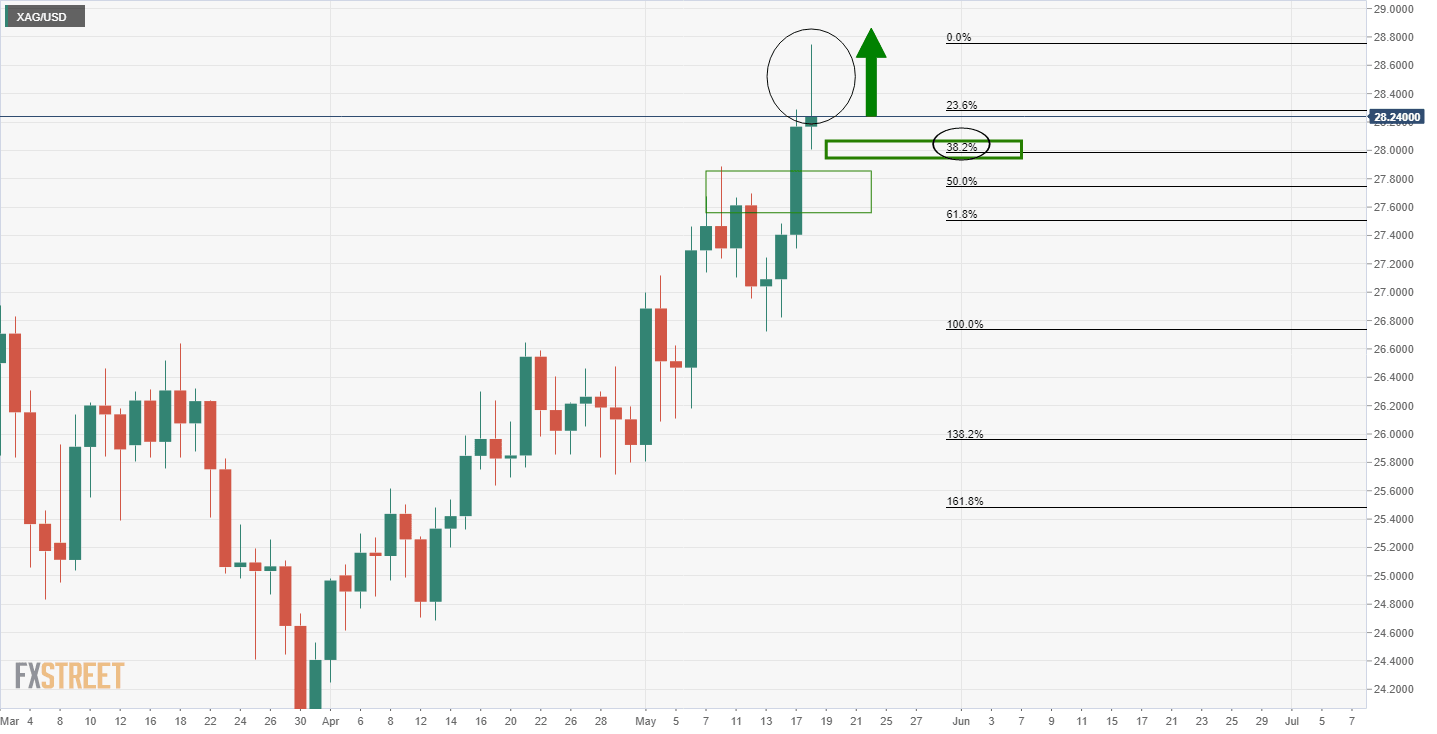

Silver bulls seeking upside continuation from deep correction

- US dollar under pressure in risk-on markets.

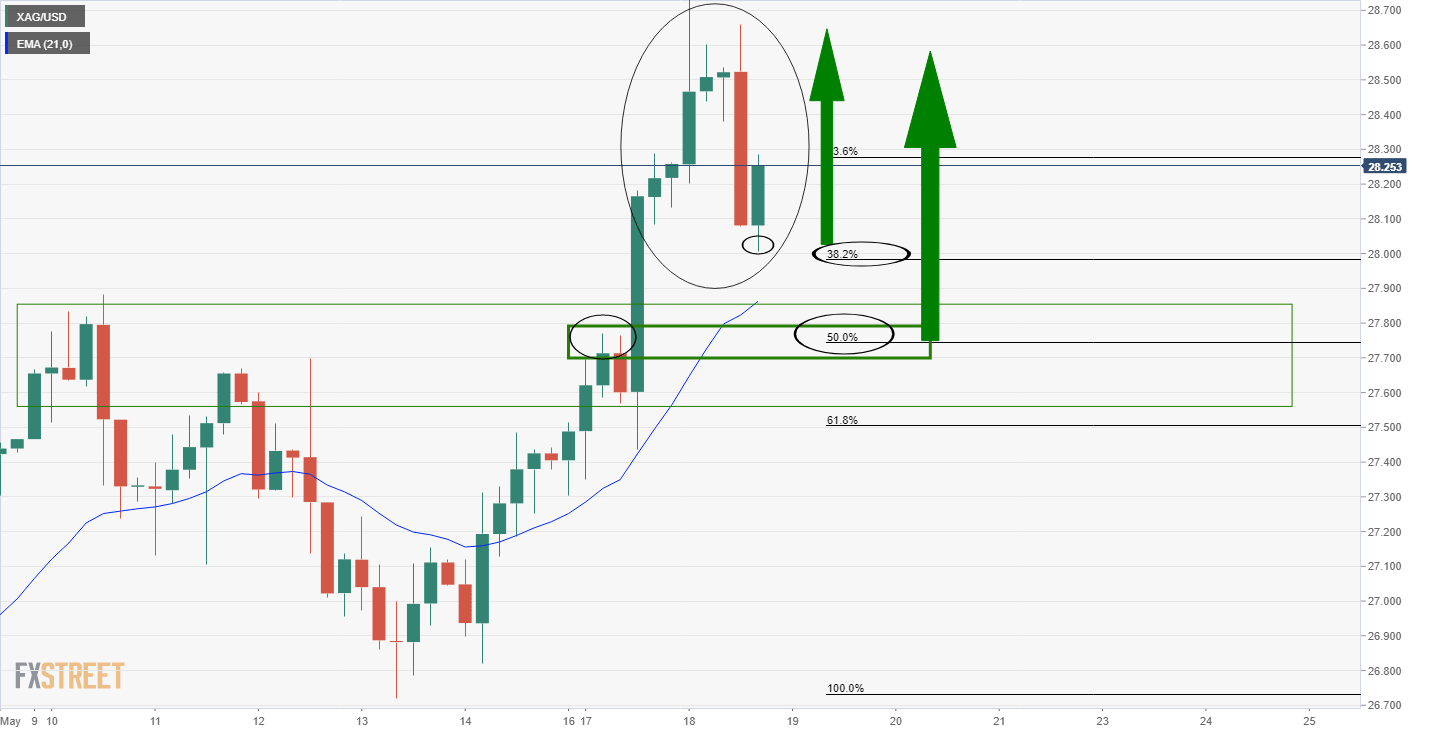

- XAG/USD bulls give back space to a 38.2% Fibo zone.

The price of silver is better bid and extending the daily bull rally that commenced early April. At the time of writing, XAG/USD is trading at $28.25 and is up some 0.3% on the day so far. XAG/USD has travelled from a low of $28.01 fuelled by a sinking US dollar.

The US dollar extended its slide on Tuesday, falling to the lowest level since late February.

Investors are taking on more risk which has seen a flight from the greenback. Meanwhile, US Treasury yields have stalled as market participants grew increasingly confident that the Federal Reserve will hold off on hiking interest rates.

''With investors sounding the alarm over inflation, institutional interest in the precious metals complex is likely to continue rising following months of outflows,'' analysts at TD Securities said in remarks on the precious metals complex.

TD Securities expects this period of high inflation to prove transitory, but there remains a substantial amount of uncertainty surrounding the path for inflation.

''In this context, silver and industrial precious metals could also outperform as a short period of extraordinary industrial demand fuels further gains,'' the analysts argued.

Silver technical analysis

Meanwhile, from a daily perspective, the market is set to close higher and therefore leave a compelling bullish wick on the charts that would be expected to be filled in over forthcoming sessions.

With that being said, there is still scope for a deeper retracement and the 4-hour time frame offers a vantage point that illustrates the 50% mean reversion level and the confluence of prior resistance:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.