Silver bears lurking at key 4-hour resistance

- XAG/USD bears seek a break of the daily support structure.

- Bulls seek an extension beyond current 4-hour resistance.

The price of silver was also pressured overnight on the rising greenback that corrected the start of the week's performance. XAG/USD lost grip falling from a high of $27.11 to low of $26.09 and ended down some 1.4% on the day.

In Asia today, the price is trading at $26.5150 having travelled between a low of $26.42 and a high of $26.51.

The price is flat in a quieter Asian session while in data from overnight, a wider-than-expected US trade deficit and smaller-than-expected increase in factory new orders impeded further dollar gains.

The stock markets overnight took note of comments from US Treasury Secretary Janet Yellen that higher rates might be needed to cool down the economy if it were to overheat.

Meanwhile, the commodities sector was otherwise well supported despite the greenback’s resurgence.

The CRB index was up some 0.8% by the close of play on Wall Street. The dollar index DXY had climbed 0.3% to 91.278. The days ahead will therefore be critical for the precious metals as the dollar firms and commodities are yet to take full note.

Silver technical analysis

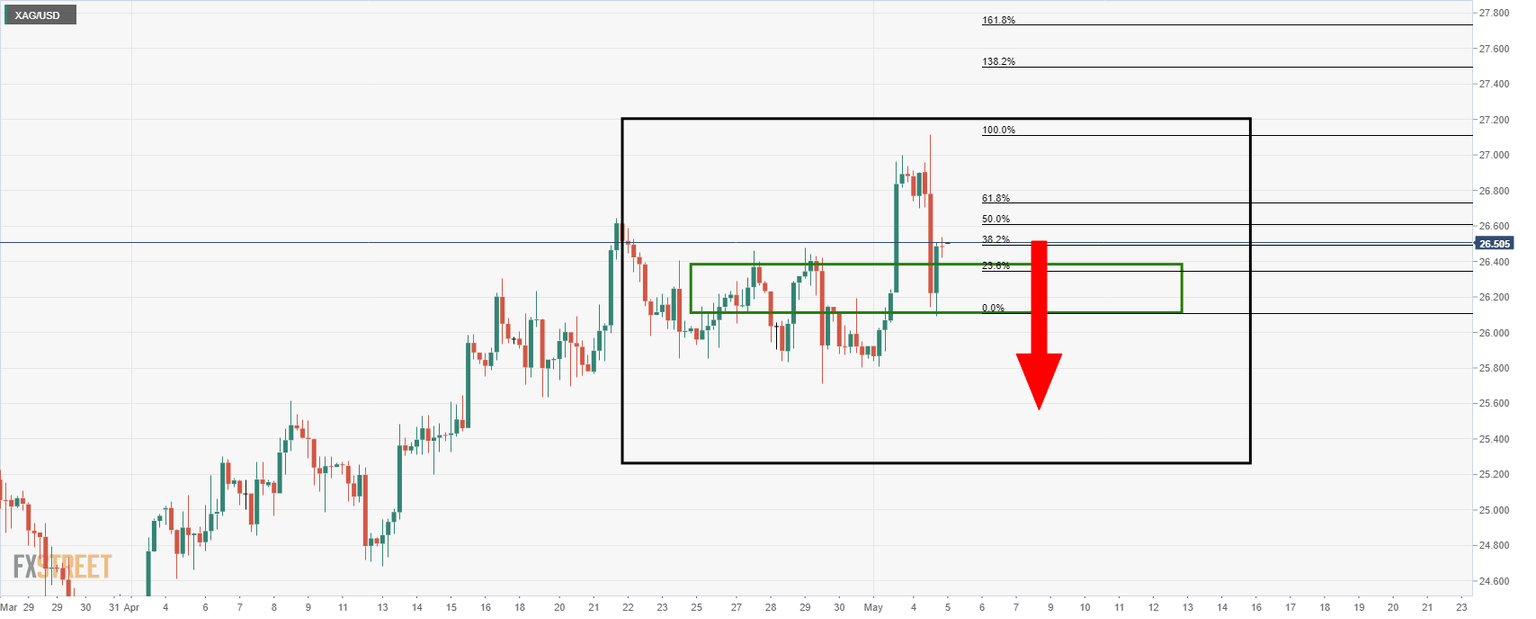

Technically, the price is correcting a sharp offer on the 4-hour time frame following a test of the W-formation’s support on the daily chart.

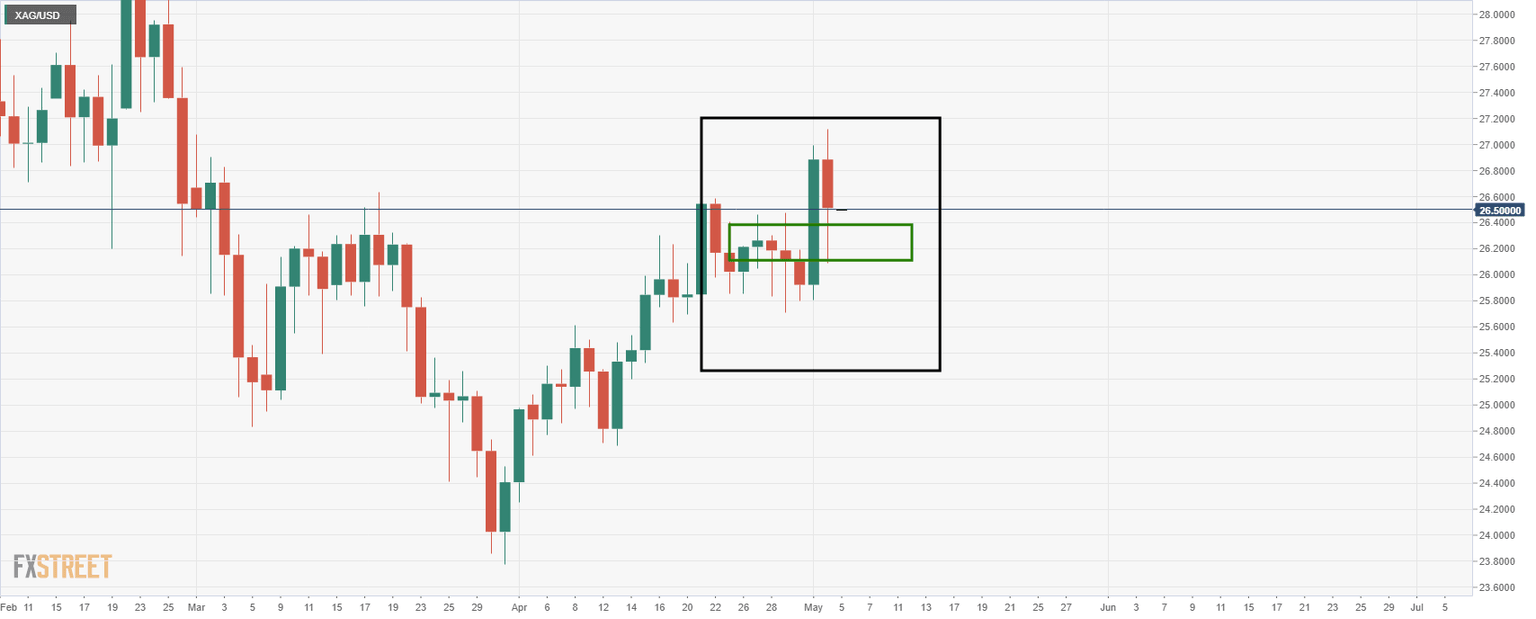

Daily chart

4-hour chart

A break of the recent lows from a daily perspective puts the bears firmly back in control.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.