Pound Sterling gains at the start of BoE policy week

- The Pound Sterling trades higher against its major currency peers.

- Trump's nomination of Kevin Warsh as the new Fed chairman has improved the US Dollar’s appeal.

- Investors await the BoE’s monetary policy announcement and the US NFP data.

The Pound Sterling (GBP) outperforms its currency peers at the start of the week, regains ground against the US Dollar (USD) during the European trading session. The GBP/USD pair finds temporary support near 1.3660 and rises slightly above 1.3700 as the US Dollar edges down.

At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades slightly down 0.1% to near 99.00. However, the DXY is still close to its previous week's high of 97.33. The Greenback gained sharply on Friday after United States (US) President Donald Trump nominated Kevin Warsh as the new Federal Reserve (Fed) chairman.

Kevin Warsh’s selection as the successor to current Fed Chair Jerome Powell has resulted in a sharp improvement in the US Dollar’s appeal, given his historic preference for a strong Greenback while he was serving as a Fed governor. Market experts believe that interest rate cuts in Warsh’s tenure would be slower than those of other candidates in the race had they been elected. Also, he was known for opposing Quantitative Easing (QE) in the Fed’s balance sheet under Ben Bernanke’s chairmanship.

A strong recovery in the US Dollar has resulted in a sharp decline in the demand for precious metals and risk-sensitive assets.

Meanwhile, dovish Fed expectations for April’s monetary policy meeting have marginally ticked up after Warsh’s nomination, according to the CME FedWatch tool.

Pound Sterling Price Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the weakest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.12% | -0.21% | 0.03% | 0.09% | -0.03% | -0.05% | 0.15% | |

| EUR | 0.12% | -0.09% | 0.17% | 0.22% | 0.08% | 0.07% | 0.28% | |

| GBP | 0.21% | 0.09% | 0.23% | 0.31% | 0.19% | 0.17% | 0.44% | |

| JPY | -0.03% | -0.17% | -0.23% | 0.05% | -0.08% | -0.10% | 0.17% | |

| CAD | -0.09% | -0.22% | -0.31% | -0.05% | -0.13% | -0.15% | 0.05% | |

| AUD | 0.03% | -0.08% | -0.19% | 0.08% | 0.13% | -0.02% | 0.25% | |

| NZD | 0.05% | -0.07% | -0.17% | 0.10% | 0.15% | 0.02% | 0.27% | |

| CHF | -0.15% | -0.28% | -0.44% | -0.17% | -0.05% | -0.25% | -0.27% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily Digest Market Movers: The BoE is expected to hold interest rates steady at 3.75%

- The Pound Sterling is likely to trade with caution as the Bank of England (BoE) is scheduled to announce its first monetary policy of the year on Thursday. The BoE is expected to hold interest rates steady at 3.75% this week after slashing them by 25 basis points (bps) in the December policy meeting.

- On Thursday, investors will also focus on the release of the BoE monetary policy report to get fresh cues on the current state of the economy. The United Kingdom (UK) central bank is expected to reiterate that the monetary policy will remain on a “gradual downward path” amid weak job market conditions.

- Recent UK labor market data for three months ending November showed that the Unemployment Rate remained steady at 5.1%.

- This week, the GBP/USD pair will also be influenced by a string of US employment-related and Purchasing Managers’ Index (PMI) data. The major highlight will be the Nonfarm Payrolls (NFP) figures for January, which will be released on Friday. Investors will pay close attention to the US NFP to get fresh cues on the Fed’s monetary policy outlook.

- In Monday’s session, investors will focus on the US ISM Manufacturing Purchasing Managers’ Index (PMI) data for January, which will be published at 15:00 GMT, and is expected to be higher at 48.3 from 47.9 in December. Though the manufacturing sector activity appears to have slightly improved, it continued to decline. A figure below 50.0 is considered a contraction in the business activity.

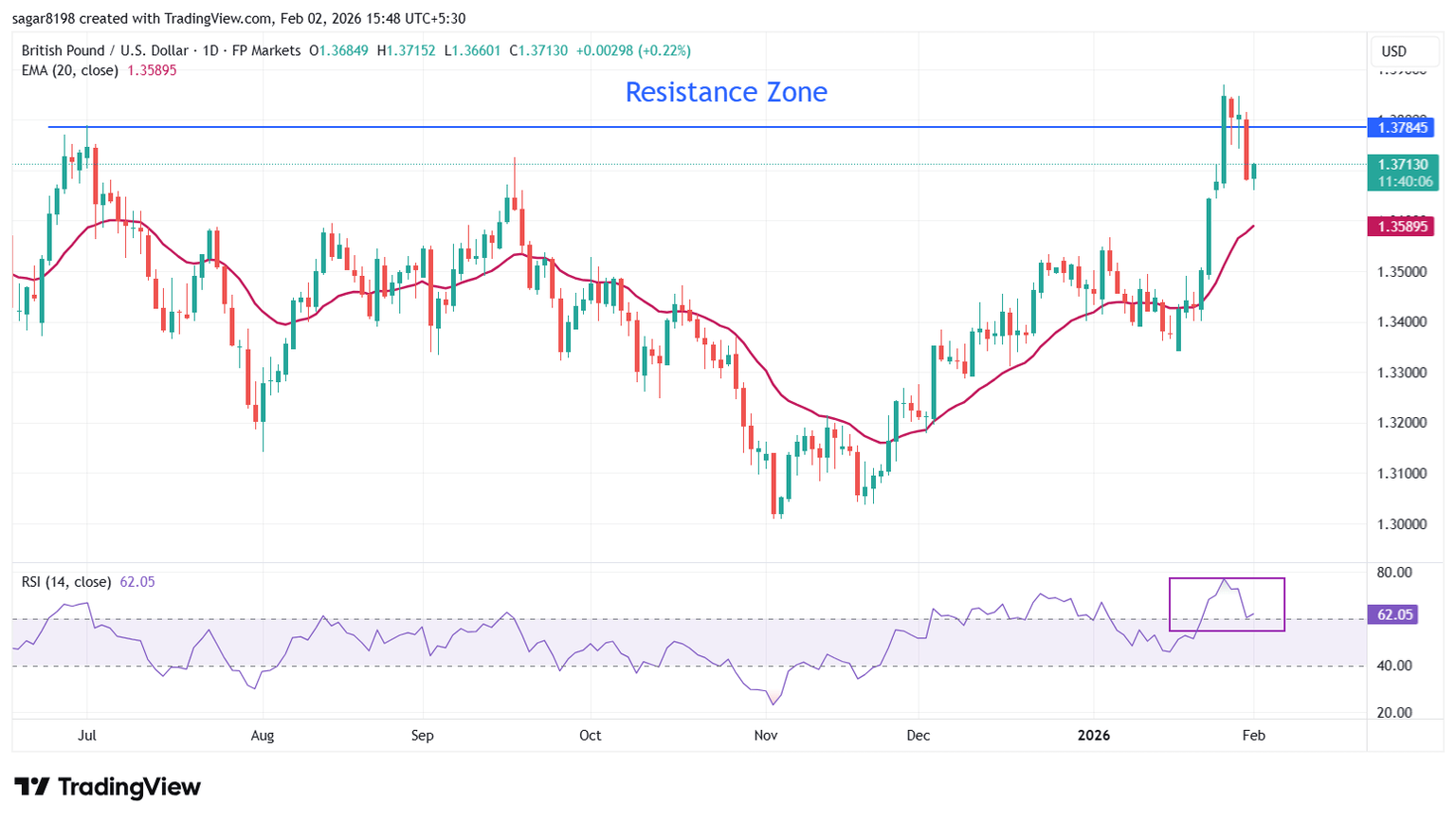

Technical Analysis: GBP/USD holds key 20-day EMA

The Pound Sterling trades marginally higher to near 1.3710 against the US Dollar as of writing. On Friday, the GBP/USD pair fell sharply after failing above the key resistance of 1.3785 last week. The price still holds above the 20-day Exponential Moving Average (EMA), signifying that a strong upside trend remains intact.

The 14-day Relative Strength Index (RSI) cools down to near 60.00 from overbought levels of 80.00, in what seems a steady advance, hinting at a possible return of bulls.

On the upside, the January high of 1.3869 will remain a key barrier for the bulls. Looking down, the 20-day EMA will act as a major support zone.

Economic Indicator

BoE Interest Rate Decision

The Bank of England (BoE) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoE is hawkish about the inflationary outlook of the economy and raises interest rates it is usually bullish for the Pound Sterling (GBP). Likewise, if the BoE adopts a dovish view on the UK economy and keeps interest rates unchanged, or cuts them, it is seen as bearish for GBP.

Read more.Next release: Thu Feb 05, 2026 12:00

Frequency: Irregular

Consensus: 3.75%

Previous: 3.75%

Source: Bank of England

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.