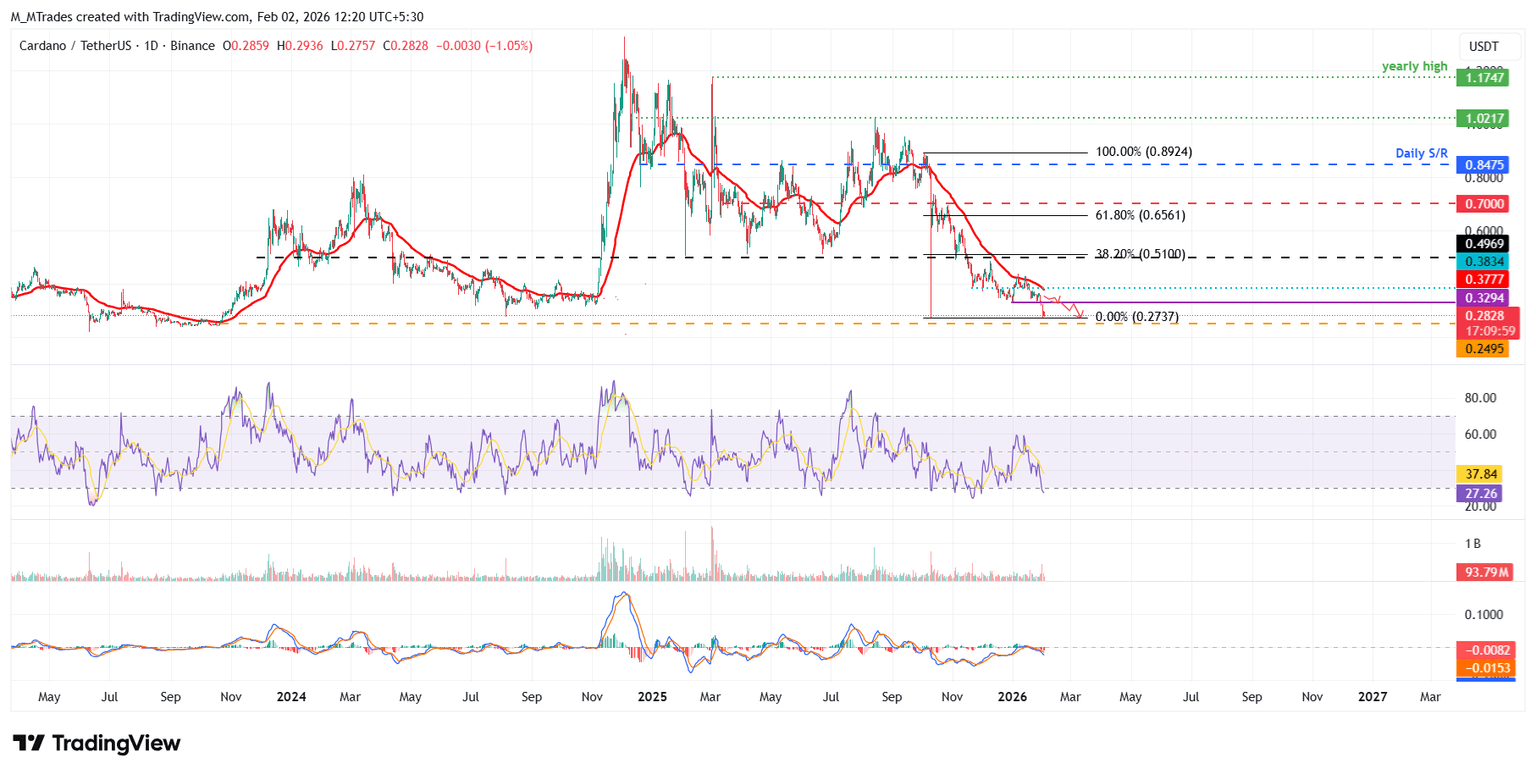

Cardano Price Forecast: ADA dips below $0.28 as bears eye October 2023 lows

- Cardano's price extends its correction on Monday, following a 15% loss the previous week.

- Santiment data indicate that ADA whales are offloading tokens, increasing the selling pressure.

- The technical outlook suggests a deeper correction ahead, with bears targeting a level not seen since October 20, 2023.

Cardano (ADA) price trades in red, slipping below $0.28 at the time of writing on Monday, following a correction of more than 15% in the previous week. The broader crypto market remains under pressure, with Bitcoin (BTC) slipping below $75,000 on Monday. On-chain data shows ADA whales are offloading tokens, while on the technical side the outlook is bearish, with Cardano close to a price level not seen since October 21, 2023.

Whales are offloading ADA tokens, increasing selling pressure

Santiment’s Supply Distribution data supports a bearish outlook for Cardano, as the number of large-wallet holders (whales) is reducing exposure to the token.

The metric indicates that whales holding between 100,000 and 1 million (red line), 1 million and 10 million (yellow line), and 10 million and 100 million (blue line) ADA tokens have shed 160 million tokens since Thursday.

%20%5B10-1770015488036-1770015488038.59.42%2C%2002%20Feb%2C%202026%5D.png&w=1536&q=95)

Cardano Price Forecast: ADA bears aiming for $0.25 mark

Cardano price corrected by more than 15% over the previous week, retesting the October 10 low of $0.27 on Saturday. As of Monday, ADA is trading red at around $0.28.

If ADA continues its downward trend, it could extend the decline toward the October 21, 2023, low of $0.24.

The Relative Strength Index (RSI) on the daily chart stands near 27, indicating strong bearish momentum and oversold conditions. The Moving Average Convergence Divergence (MACD) indicator showed a bearish crossover on January 18, which remains intact and thus further supporting the negative outlook.

If ADA recovers, the first significant resistance emerges at $0.32, which aligns with daily resistance.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.