Pound Sterling flattens against US Dollar, Fed's policy under spotlight

- The Pound Sterling trades near 1.3350 against the US Dollar, with investors awaiting the Fed’s monetary policy announcement.

- Investors expect the Fed to leave interest rates steady.

- A slowdown in the UK labor demand paves the way for more interest rate cuts by the BoE.

The Pound Sterling (GBP) trades cautiously near 1.3350 against the US Dollar (USD) during the European trading session on Wednesday as investors await the Federal Reserve’s (Fed) monetary policy announcement at 18:00 GMT.

At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, holds onto gains near the new monthly high of 99.00 posted on Tuesday.

According to the CME FedWatch tool, bond markets are almost fully pricing in that the Fed will leave interest rates steady in the range of 4.25%-4.50%. This would be the fifth straight policy meeting in which the US central bank will hold borrowing rates at the current levels.

Investors will pay close attention to Fed Chair Jerome Powell’s press conference for fresh cues on the monetary policy outlook for the remainder of the year. At least two out of the 12 members of the Federal Open Market Committee (FOMC), Fed Vice Chair for Supervision Michelle Bowman and Governor Christopher Waller, are expected to support lowering interest rates. Before the blackout period, both policymakers argued in favor of an interest rate reduction as early as this month, citing downside risks to the labor market.

On the contrary, other officials stated that there should be no rush for interest rate cuts as the impact of tariffs imposed by Washington on various imports has started feeding into prices. The Consumer Price Index (CPI) report for June also showed that prices of products that are largely imported in the US have increased partly due to the levies.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.05% | -0.15% | -0.10% | 0.15% | 0.28% | 0.09% | -0.04% | |

| EUR | -0.05% | -0.18% | -0.24% | 0.07% | 0.19% | 0.04% | -0.05% | |

| GBP | 0.15% | 0.18% | -0.04% | 0.31% | 0.40% | 0.25% | 0.15% | |

| JPY | 0.10% | 0.24% | 0.04% | 0.33% | 0.46% | 0.27% | 0.14% | |

| CAD | -0.15% | -0.07% | -0.31% | -0.33% | 0.13% | -0.06% | -0.16% | |

| AUD | -0.28% | -0.19% | -0.40% | -0.46% | -0.13% | -0.15% | -0.25% | |

| NZD | -0.09% | -0.04% | -0.25% | -0.27% | 0.06% | 0.15% | -0.10% | |

| CHF | 0.04% | 0.05% | -0.15% | -0.14% | 0.16% | 0.25% | 0.10% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Daily digest market movers: Pound Sterling trades flat against its peers

- The Pound Sterling trades almost flat against its major peers, except the Japanese Yen (JPY), on Wednesday. The British currency is expected to remain under pressure in the medium term as the Bank of England (BoE) is almost certain to cut interest rates in next week’s monetary policy meeting.

- Traders have become increasingly confident that the BoE will reduce its key borrowing rates on August 7 as United Kingdom (UK) labor market conditions have cooled down, following an increase in employers’ contributions to social security schemes.

- The latest survey from the Confederation of British Industry (CBI) showed on Monday that households’ spending has diminished due to a slowdown in the labor demand. The agency reported that retail sales declined for the tenth straight month in July. However, the pace of decline in retail sales was less severe than what was seen in June.

- In the US, investors will also focus on the preliminary Q2 Gross Domestic Product (GDP) and Personal Consumption Expenditure Price Index (PCE), and the ADP Employment Change data for July, which will be published during the North American session.

- The data is expected to show that the economy grew at 2.4% after contracting by 0.5% in the first quarter of the year. Meanwhile, core PCE inflation, which is the Fed’s preferred inflation gauge, is expected to have grown at a more moderate pace of 2.4% compared to the 3.5% increase seen in the previous quarter.

- Economists expect the US private sector to have added 78K fresh workers in July after the 33K decline seen in June.

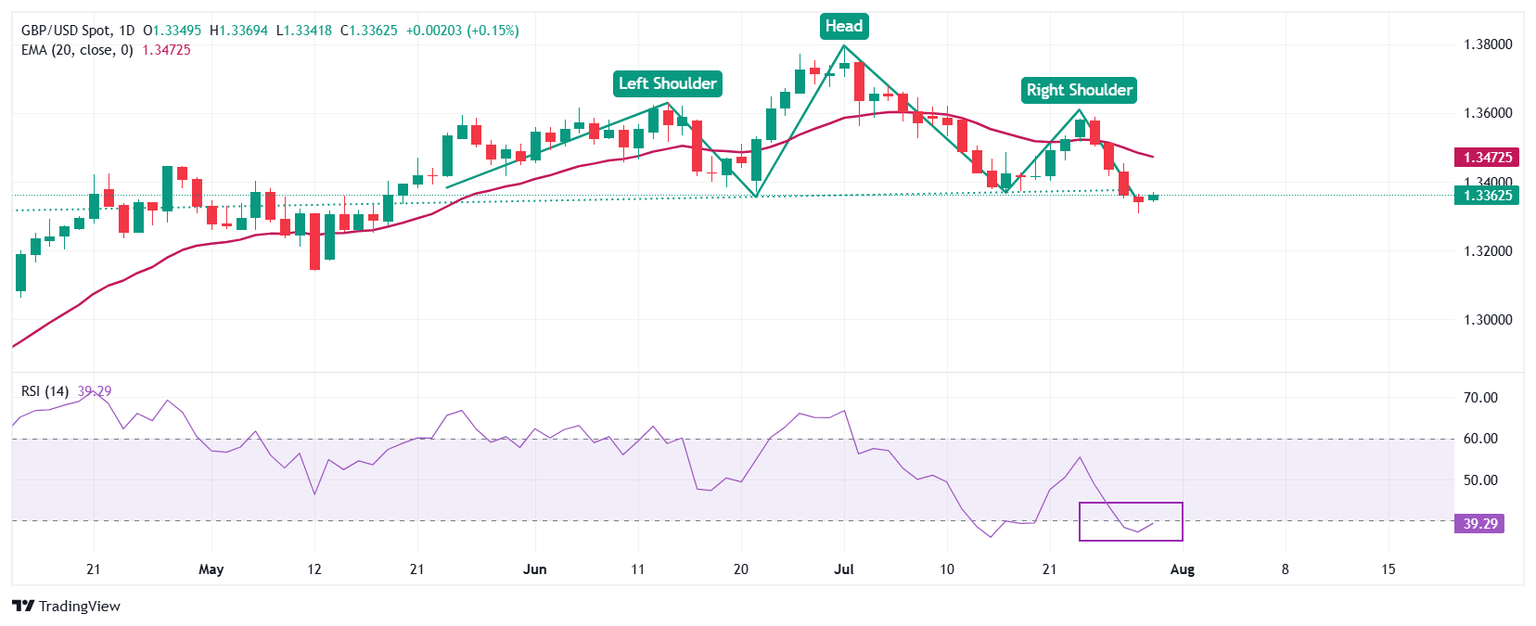

Technical Analysis: Pound Sterling forms H&S chart pattern

The Pound Sterling strives to hold the immediate support of 1.3300 against the US Dollar on Wednesday. The near-term trend of the GBP/USD pair remains bearish as the 20-day Exponential Moving Average (EMA) slopes downwards to near 1.3473.

The formation of a Head and Shoulder (H&S) chart pattern also suggests that the overall trend is bearish. The neckline of the H&S formation is plotted near 1.3413.

The 14-day Relative Strength Index (RSI) oscillates below 40.00, indicating that the bearish momentum is intact.

Looking down, the May 12 low of 1.3140 will act as a key support zone. On the upside, the July 1 high around 1.3790 will act as a key barrier.

Economic Indicator

Gross Domestic Product Annualized

The real Gross Domestic Product (GDP) Annualized, released quarterly by the US Bureau of Economic Analysis, measures the value of the final goods and services produced in the United States in a given period of time. Changes in GDP are the most popular indicator of the nation’s overall economic health. The data is expressed at an annualized rate, which means that the rate has been adjusted to reflect the amount GDP would have changed over a year’s time, had it continued to grow at that specific rate. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Wed Jul 30, 2025 12:30 (Prel)

Frequency: Quarterly

Consensus: 2.4%

Previous: -0.5%

Source: US Bureau of Economic Analysis

The US Bureau of Economic Analysis (BEA) releases the Gross Domestic Product (GDP) growth on an annualized basis for each quarter. After publishing the first estimate, the BEA revises the data two more times, with the third release representing the final reading. Usually, the first estimate is the main market mover and a positive surprise is seen as a USD-positive development while a disappointing print is likely to weigh on the greenback. Market participants usually dismiss the second and third releases as they are generally not significant enough to meaningfully alter the growth picture.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.