Pound Sterling trades stable while focus shifts to flash UK/US PMI data

- The Pound Sterling consolidates around 1.3500 against the US Dollar, while investors await updates on US trade talks.

- US President Trump considers a higher tariff baseline rate on imports from the EU.

- Investors eye the flash US S&P Global PMI data for July.

The Pound Sterling (GBP) demonstrates stability against its major peers on Tuesday, with investors awaiting preliminary United Kingdom (UK) S&P Global Purchasing Managers’ Index (PMI) data for July, scheduled for release on Thursday.

Investors will closely monitor the UK PMI data to get cues about whether the impact of a hiring slowdown has started flowing into the economy. The report is expected to show that the overall business activity grew moderately. The Composite PMI is expected to have dropped slightly to 51.9 from 52.0 in June.

UK employers have restricted fresh hiring to offset increased employee costs, following the effectiveness of an acceleration in employers’ contributions to social security schemes.

Meanwhile, market expectations for the Bank of England’s (BoE) interest rate decision in the monetary policy announcement next month will be a key trigger for the Pound Sterling. The BoE is almost certain to cut interest rates by 25 basis points (bps) to 4%.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.06% | 0.03% | 0.09% | -0.01% | 0.18% | 0.27% | -0.08% | |

| EUR | 0.06% | 0.13% | 0.19% | 0.07% | 0.25% | 0.42% | 0.01% | |

| GBP | -0.03% | -0.13% | 0.04% | -0.05% | 0.13% | 0.24% | -0.12% | |

| JPY | -0.09% | -0.19% | -0.04% | -0.08% | 0.08% | 0.26% | -0.23% | |

| CAD | 0.00% | -0.07% | 0.05% | 0.08% | 0.16% | 0.31% | -0.05% | |

| AUD | -0.18% | -0.25% | -0.13% | -0.08% | -0.16% | 0.13% | -0.29% | |

| NZD | -0.27% | -0.42% | -0.24% | -0.26% | -0.31% | -0.13% | -0.41% | |

| CHF | 0.08% | -0.01% | 0.12% | 0.23% | 0.05% | 0.29% | 0.41% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily digest market movers: Pound Sterling flattens against US Dollar

- The Pound Sterling trades broadly sideways against the US Dollar (USD) around 1.3500 during the European trading session on Tuesday. The GBP/USD pair ticks down slightly as the US Dollar gains ground after Monday’s corrective move.

- At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, finds cushion below 98.00. The DXY retraced from its four-week high near 99.00.

- Investors brace for significant volatility in the US Dollar as United States (US) President Donald Trump’s August 1 tariff deadline is approaching and Washington has closed deals with a handful of nations. Also, the US is not expected to reach bilateral deals with its trading partners in the remaining time.

- So far, the US has announced trade deals with the United Kingdom (UK), Vietnam and Indonesia, and a limited pact with China. Washington has sent letters, establishing tariff rates, to 22 nations, notably Japan, Vietnam, Canada, Mexico and the European Union (EU).

- On Monday, US Treasury Secretary Scott Bessent signaled that Washington is more emphasized on “quality” and not “timing” regarding negotiations. “The important thing here is the quality of the deal, not the timing of the deals,” Bessent said in an interview with CNBC on Monday.

- Meanwhile, fresh escalation in trade tensions between the US and the EU could weigh on the US Dollar. EU officials vow to retaliate against levies threatened by Trump. Over the weekend, a report from The Wall Street Journal (WSJ) signaled that the US president is considering a higher baseline tariff rate in a range between 15% and 20% from the 10% previously stated.

- On the domestic front, traders have trimmed bets for the Federal Reserve (Fed) to reduce interest rates in the September meeting.

- Traders pare Fed dovish bets after the release of the US Consumer Price Index (CPI) data for June last week, which showed that prices of products largely imported have increased after the imposition of sectoral tariffs by Donald Trump.

- This week, flash US S&P Global PMI data for July will also be released on Thursday.

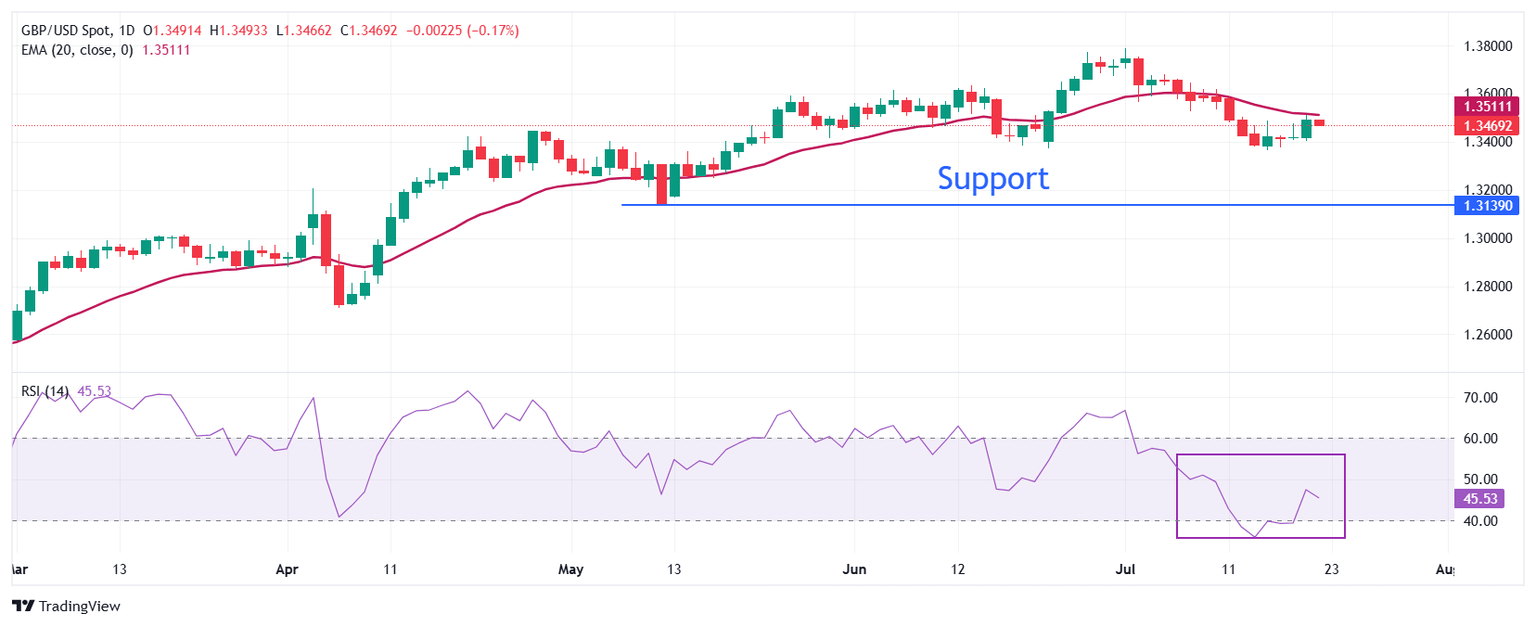

Technical Analysis: Pound Sterling consolidates near 1.3500

The Pound Sterling oscillates in the previous day’s range around 1.3470 against the US Dollar on Tuesday. The near-term trend of the GBP/USD pair is bearish as it faces selling pressure after a recovery move near the 20-day Exponential Moving Average (EMA) around 1.3500

The 14-day Relative Strength Index (RSI) strives to hold above the 40.00 level. A fresh bearish momentum would emerge if the RSI falls below that level.

Looking down, the May 12 low of 1.3140 will act as a key support zone. On the upside, the July 11 high around 1.3585 will act as a key barrier.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.