GBP/USD rises amid US Dollar weakness, mixed Fed messages

The Pound Sterling posted solid gains against the Greenback on Wednesday after bouncing from a seven-week low of 1.2539 on Tuesday. Federal Reserve officials crossing the newswires and weaker-than-expected US services sector data are a headwind for the US Dollar, which tumbled for the second day in a row. The

GBP/USD trades at 1.264, gains 0.56%.

Read More...

Pound Sterling recovers as weak US Services PMI improves market sentiment

The Pound Sterling (GBP) climbs to near 1.2600 against the US Dollar in Wednesday’s early American session on multiple tailwinds. A sharp decline in the US Dollar after the release of the downbeat United States ISM Services PMI and the upbeat United Kingdom (UK) Manufacturing PMI has improved the appeal of the GBP/USD pair. The US ISM reported that the Services PMI remained significantly lower at 51.4 from the consensus of 52.7 and the former reading of 52.6. The

US Dollar Index (DXY) corrected to 104.40 after poor Services PMI data.

Read More...

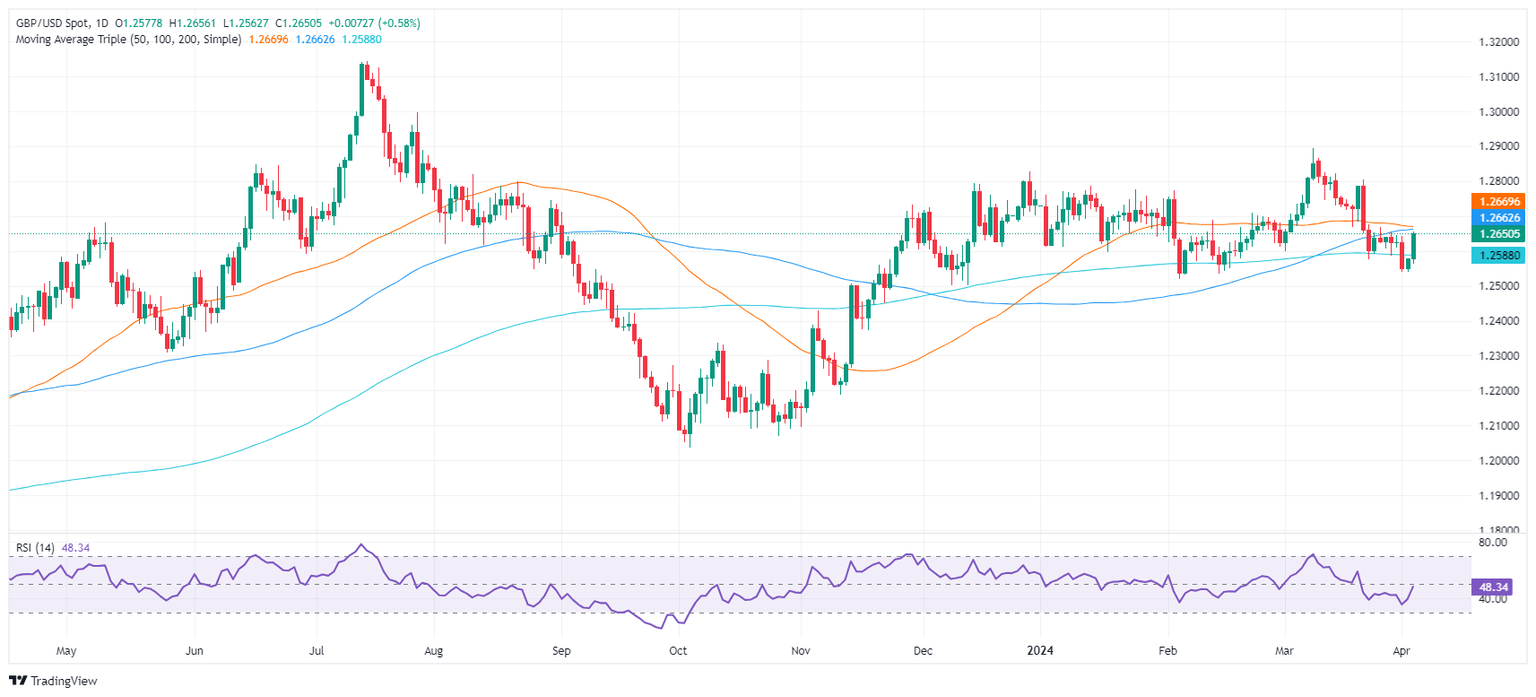

GBP/USD Price Analysis: The next downside target is seen at 1.2540

The GBP/USD pair recovers some lost ground and currently trades around 1.2580 on Wednesday during the early European session. The decline of the USD Index (DXY) and the dismal market mood in the UK economy act as a tailwind for the major pair. Later on Wednesday, the ADP Employment Change and the ISM Services

PMI will be due. Also, Federal Reserve (Fed) Chair Jerome Powell's speech will be a closely watched event.

Read More...

-638477175754585793.png&w=1536&q=95)