Pound Sterling remains on the defensive around 1.2550

GBP/USD remains on backfoot below 1.2570, UK GDP data looms

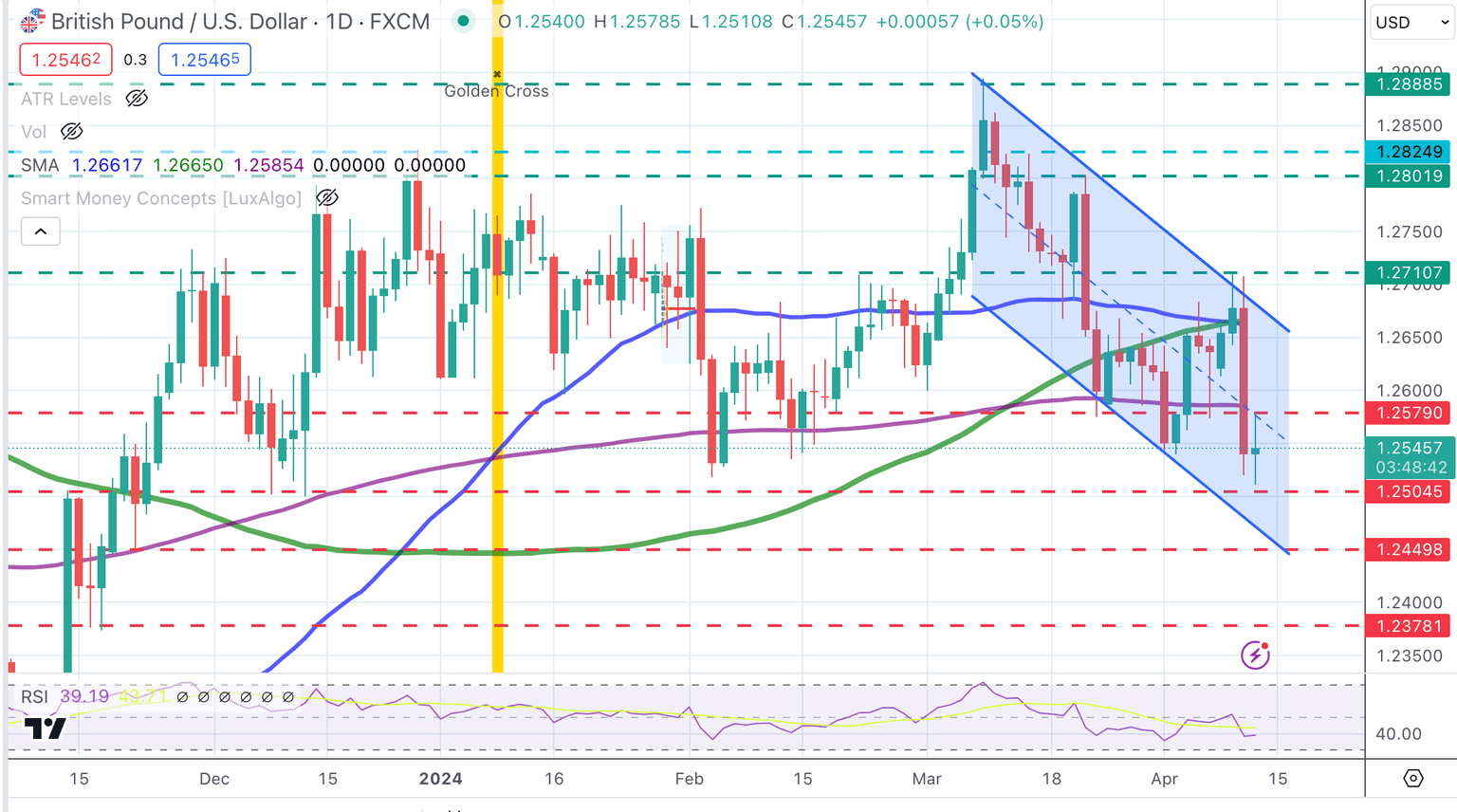

The GBP/USD pair remains on the backfoot near 1.2550 during the early Asian session on Friday. The market expects that the Bank of England (BoE) will cut its interest rate sooner than the US Federal Reserve (Fed) weighs on the Pound Sterling (GBP) and the major pair. Later on Friday, investors will monitor the UK monthly Gross Domestic Product (GDP) for February and the preliminary US Michigan Consumer Sentiment Index for April.

The hotter-than-expected CPI inflation reading this week triggers speculation that the Fed will have to push back the number and timing of interest rate cuts this year. Fed officials believe the US central bank had reached the peak of the current rate-tightening cycle and monetary policy was well positioned to react to the economic outlook, including the possibility of keeping rates higher for longer if inflation declines gradually. The hawkish remarks from the Fed lift the Greenback and drag the GBP/USD pair lower. Read more...

GBP/USD Price Analysis: Pound is under increasing bearish pressure with 1.2500 support in play

The Sterling keeps trading within a bearish channel from early March lows and seems ready to test an important support area at 1.2500. Wednesday’s long negative candle reflects an impulsive bearish move and gives sellers hope to explore fresh year-to-date lows.

US Treasury yields keep rallying and investors reassess their expectations of Fed cuts this year which is acting as a tailwind for the US Dollar. US PPI data and the slight increase in US Jobless claims have provided a certain relief although USD reversals remain limited for now. Read more...

Author

FXStreet Team

FXStreet