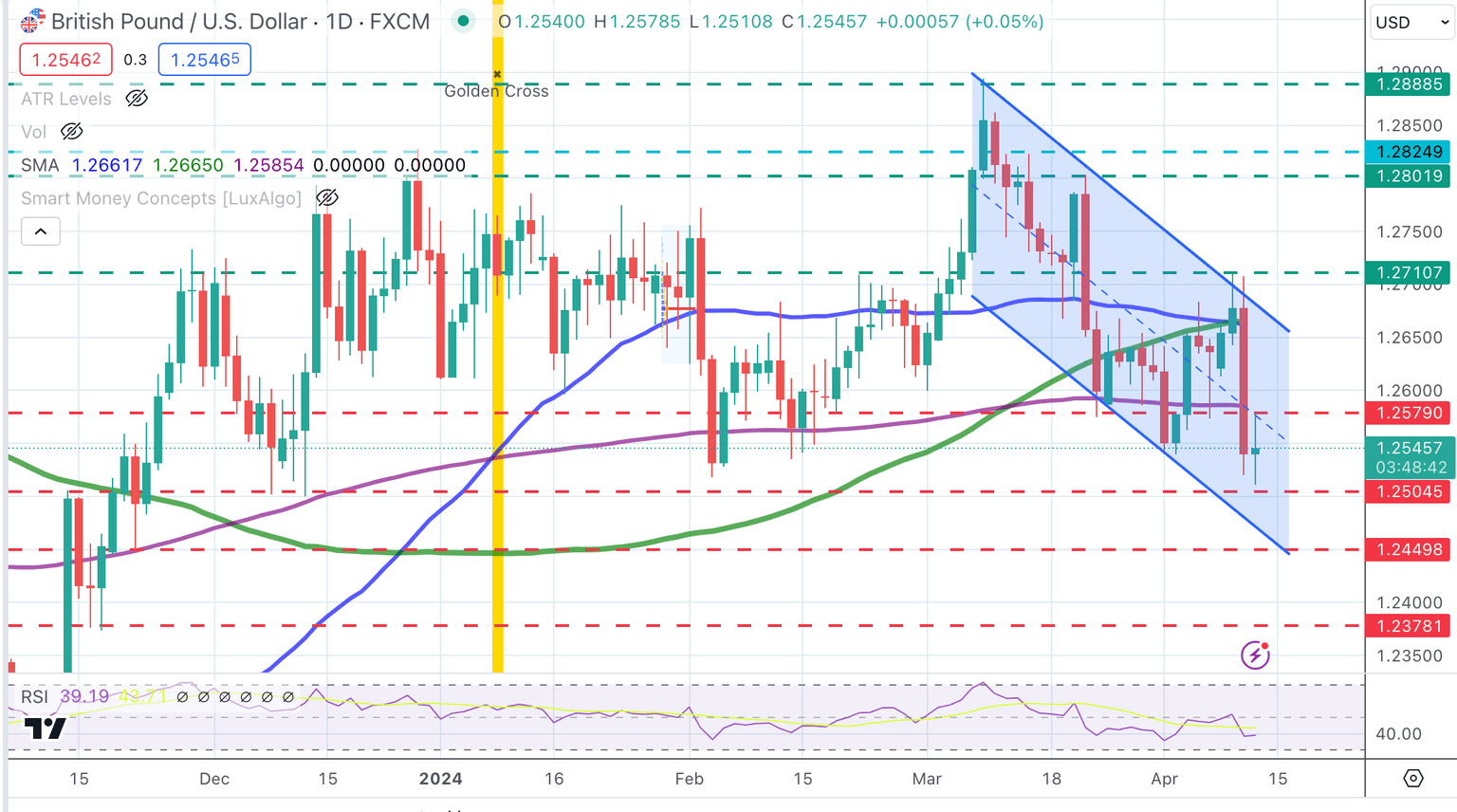

GBP/USD Price Analysis: Pound is under increasing bearish pressure with 1.2500 support in play

- The Pound keeps trading lower with the recent reversal from 1.2700 increasing bearish pressure.

- Higher US yields and market expectations of a ‘higher for longer” Fed outlook are expected to support the USD.

- GBP/USD is ready to test an important support area at 1.2500.

The Sterling keeps trading within a bearish channel from early March lows and seems ready to test an important support area at 1.2500. Wednesday’s long negative candle reflects an impulsive bearish move and gives sellers hope to explore fresh year-to-date lows.

US Treasury yieldskeep[ rallying and investors reassess their expectations of Fed cuts this year which is acting as a tailwind for the US Dollar. US PPI data and the slight increase in US Jobless claims have provided a certain relief although USD reversals remain limited for now.

Oscillators are pointing lower and the bearish cross between the 50 and the 100-day SMAss are adding weight to the pair. On Friday the UK Industrial Production data might give further direction to the pair.

The next supports are 1.2500 and 1.2450. On the upside 1.2600 and 1.2710 are likely to cap upside attempts.

GBP/USD Daily Chart

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.