Pound Sterling Price News: Shrugs off strong US labor data as traders stay committed to Fed easing

GBP/USD shrugs off strong US labor data as traders stay committed to Fed easing

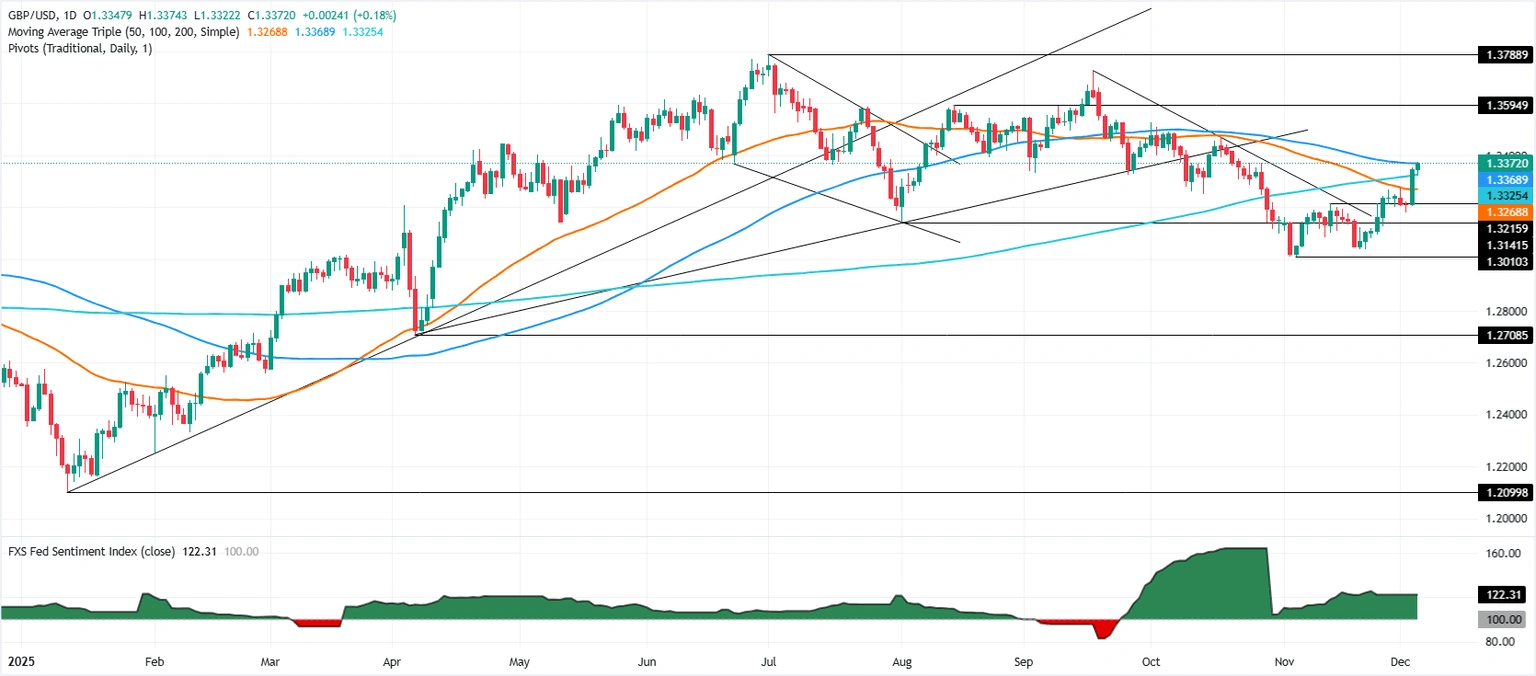

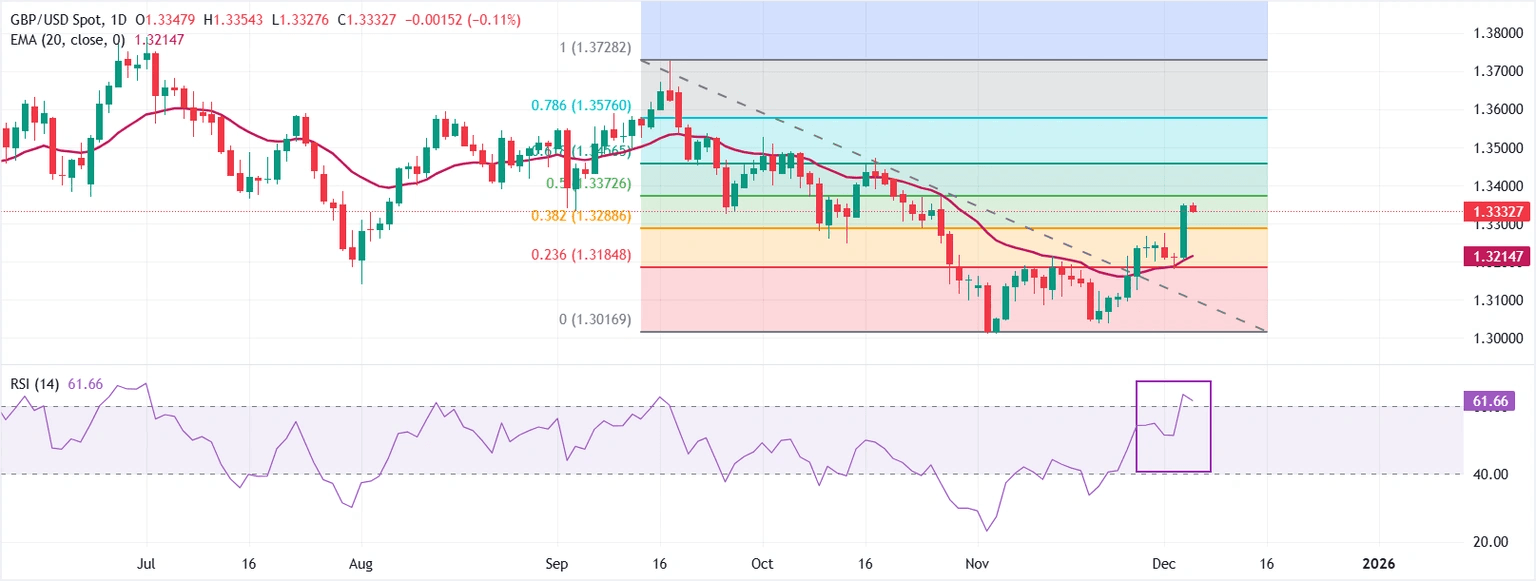

The Pound Sterling (GBP) rises against the US Dollar (USD) during the North American session on Thursday, even though US jobs data suggests that the labor market remains solid, and the expectations that the Federal Reserve (Fed) will cut rates remain high. At the time of writing, the GBP/USD trades at 1.3367, up 0.12%, its highest level since the end of October. Read More...

Pound Sterling trades broadly upbeat against US Dollar amid firm Fed dovish bets

The Pound Sterling (GBP) clings to gains near its over-a-month high around 1.3350 against the US Dollar (USD) during the European trading session on Thursday. The GBP/USD pair demonstrates strength as the US Dollar remains on back foot amid reinforced dovish Federal Reserve (Fed) expectations and the Pound Sterling continues to outperform since the budget announcement last week. Read More...

GBP/USD softens below 1.3350 on renewed US Dollar demand

The GBP/USD pair loses ground to around 1.3330 during the Asian trading hours on Thursday. The major pair retreats from nearly a two-month high amid renewed US Dollar (USD) demand. However, the rising bets of a Federal Reserve (Fed) rate cut next week might cap its downside. Traders will take more cues from the US weekly Initial Jobless Claims report later on Thursday. Read More...

Author

FXStreet Team

FXStreet