Pound Sterling Price News and Forecast: GBP/USD tumbles to four week low, sellers eye 1.3000

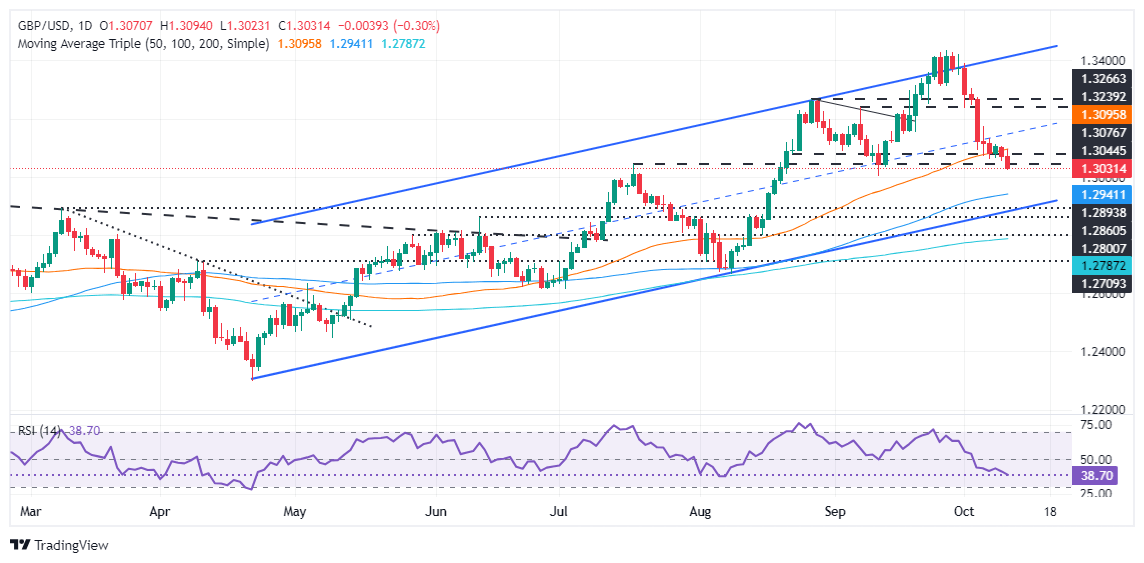

GBP/USD Price Forecast: Tumbles to four week low, sellers eye 1.3000

The Pound Sterling remains on the backfoot against the Greenback, yet it bounced off a four-week low of 1.3010 in early trading during the North American session. The GBP/USD exchanges hands at 1.3040, down 0.54% at the time of writing. Read More...

Pound Sterling slides to monthly low after surprisingly hot US Inflation data

The Pound Sterling (GBP) falls to near the monthly low of 1.3000 against the US Dollar (USD) in Thursday’s North American session. The GBP/USD pair weakens after the release of the United States (US) Consumer Price Index (CPI) data, which showed that price pressures were hotter than expected in September. Read More...

GBP/USD trades with positive bias around 1.3075 area, lacks follow-through ahead of US CPI

The GBP/USD pair trades with a mild positive bias around the 1.3075 area during the Asian session on Thursday, albeit it lacks bullish conviction and remains within the striking distance of a nearly one-month low touched the previous day. Read More...

Author

FXStreet Team

FXStreet