Pound Sterling Price News and Forecast: GBP/USD trades with mild gains around 1.3440 in Monday’s session.

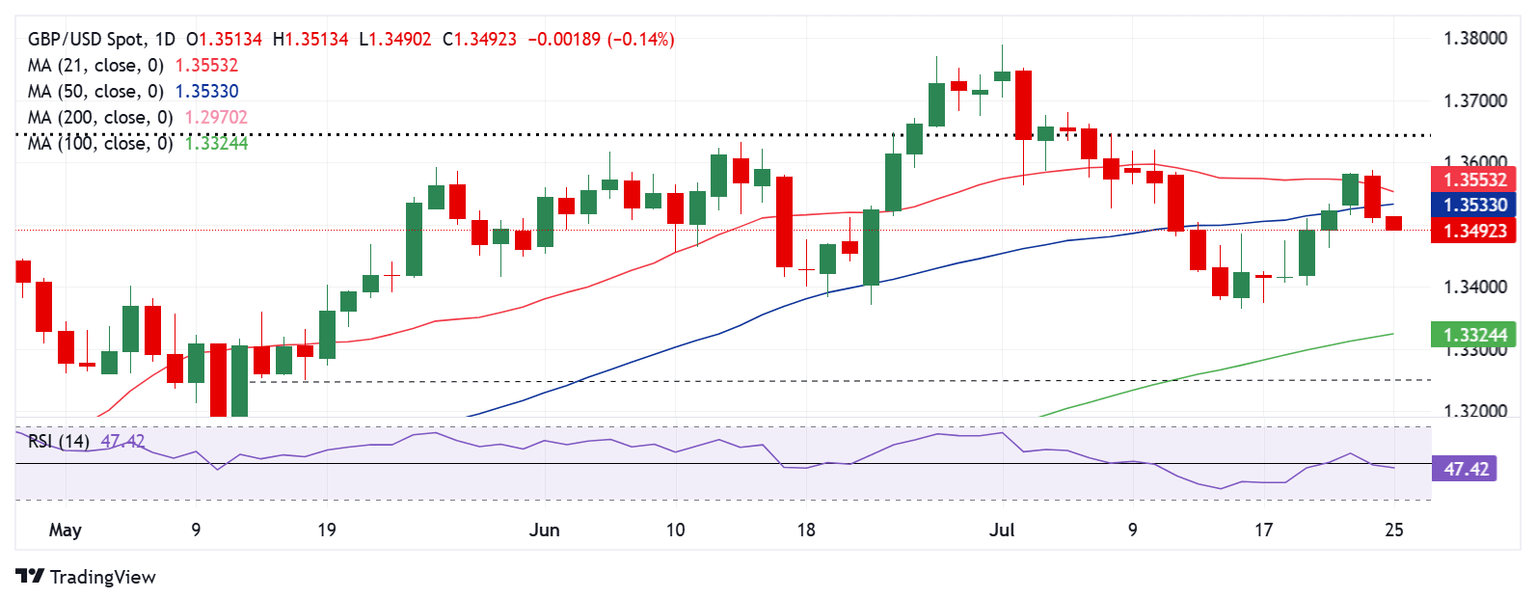

GBP/USD Price Forecast: Retains bullish bias above 1.3550 above the 100-day EMA

The GBP/USD pair posts modest gains near 1.3440 during the Asian trading hours on Monday. The latest optimism fueled by a trade deal between the United States (US) and the European Union (EU) triggers a fresh wave of the global risk-on sentiment, which boosts the Pound Sterling (GBP). All eyes will be on the US Federal Reserve (Fed) interest rate decision later on Wednesday, with no change in rate expected.

Technically, GBP/USD keeps the bullish vibe on the daily chart, with the price holding above the key 100-day Exponential Moving Average (EMA). However, further consolidation or temporary sell-off cannot be ruled out in the near term as the 14-day Relative Strength Index (RSI) holds below the midline near 43.25. Raed More...

GBP/USD Weekly Outlook: Pound Sterling recovery loses momentum ahead of a big week

The Pound Sterling (GBP) staged a solid comeback from two-month lows against the US Dollar (USD) before GBP/USD buyers ran into the 1.3600 hurdle. Despite its retracement in the second half of the week, the GBP/USD pair closed the week with gains as the USD registered its biggest weekly drop in a month.

The Greenback hit its lowest level in two weeks against major currency rivals as easing trade tensions diminished its appeal as a safe-haven asset. Investors cheered US trade deals with Japan, Indonesia, and the Philippines while staying hopeful that an agreement between the US and the European Union (EU) will be reached soon.

GBP/USD climbs closer to mid-1.3400s as trade optimism undermines the safe-haven USD

The GBP/USD pair attracts some buyers during the Asian session on Monday and, for now, seems to have snapped a two-day losing streak to the 1.3400 neighborhood. Spot prices climb back closer to mid-1.3400s in the last hour, though the uptick lacks bullish conviction as traders seem reluctant ahead of this week's key central bank event and data risks.

The US Federal Reserve (Fed) is scheduled to announce its policy decision at the end of a two-day meeting on Wednesday, and investors will look for cues about the future rate-cut path. Apart from this, the Advance US Q2 GDP print, the US Personal Consumption Expenditure (PCE) Price Index, and the closely-watched US Nonfarm Payrolls (NFP) report will drive the US Dollar (USD) and provide a fresh impetus to the GBP/USD pair. Read more...

Author

FXStreet Team

FXStreet