Pound Sterling Price News and Forecast: GBP/USD trades in negative territory around 1.3195 on Friday

GBP/USD holds below 1.3200 ahead of US NFP data

The GBP/USD pair extends the decline to near 1.3195 during the Asian trading hours on Friday. The Pound Sterling (GBP) edges lower against the Greenback due to rising expectations of the Bank of England (BoE) rate cut next week. Investors brace for the US July employment data, including Nonfarm Payrolls (NFP) and the Unemployment Rate, which will be published later on Friday.

The Cable remains under selling pressure amid escalating price pressures and cooling labor market conditions. BoE’s policymakers cut its benchmark rate by 25 basis points (bps) at the May meeting, and analysts expect a similar outcome on August 7. Money markets indicate there is an 89% odds that the BoE will lower borrowing costs in August, according to Reuters. Read more...

GBP/USD declines further as Greenback rally continues

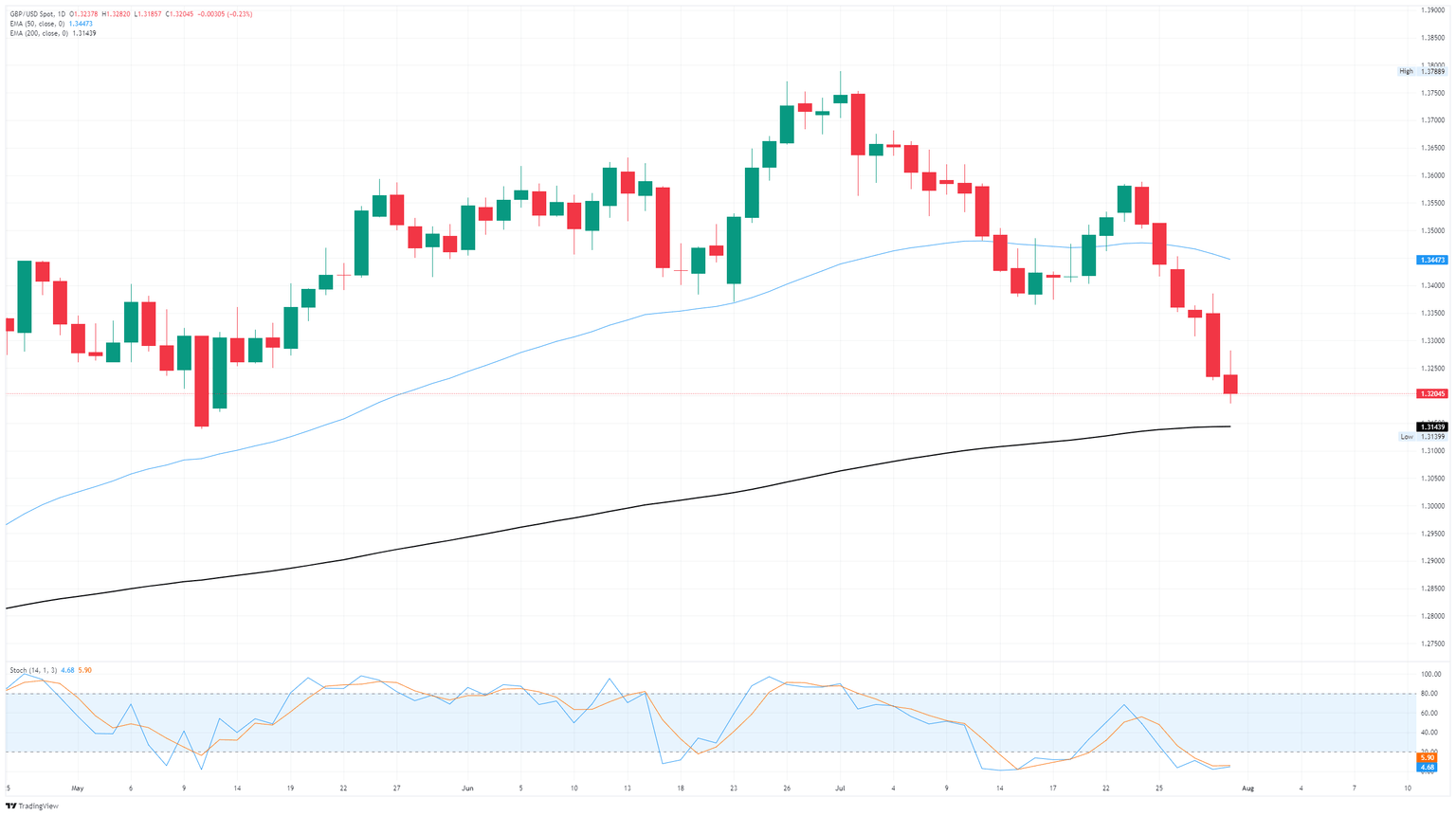

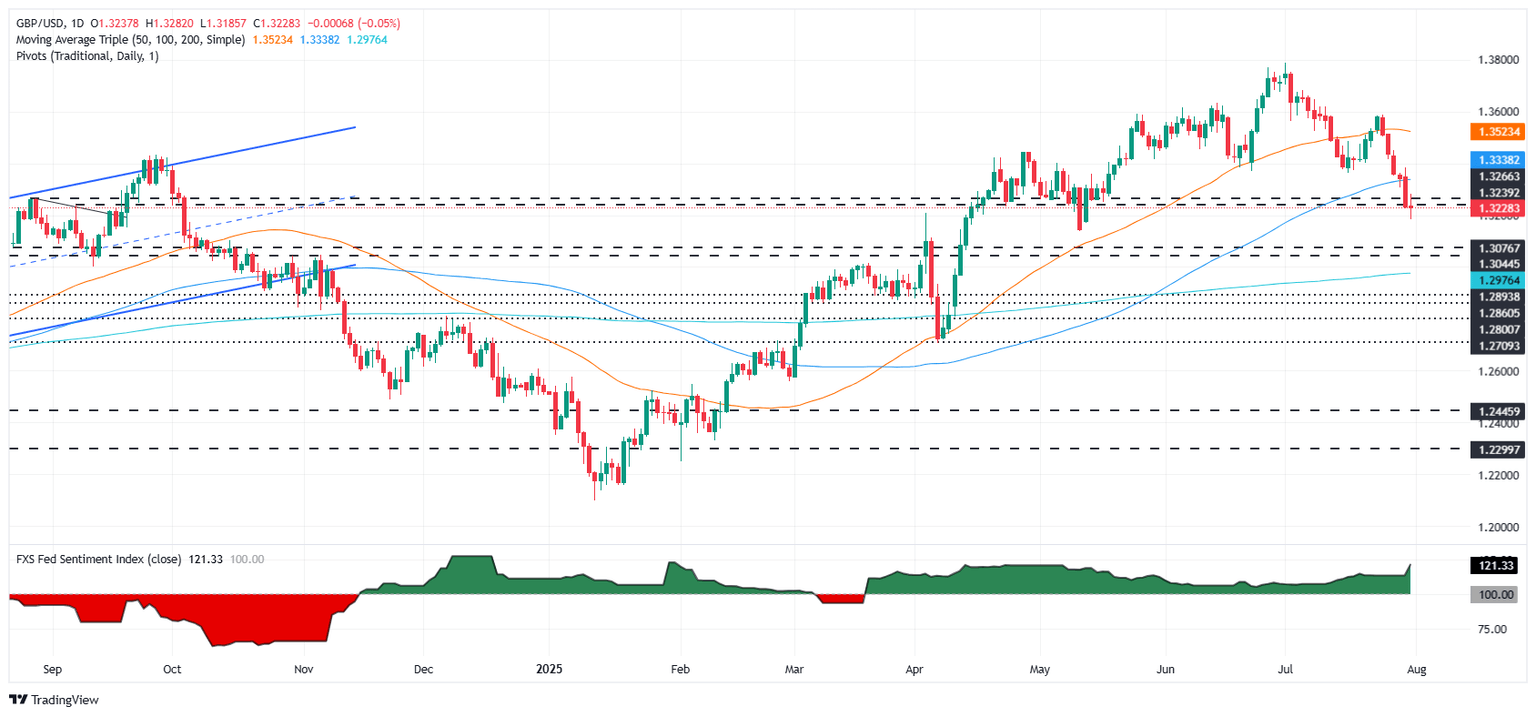

GBP/USD sank again on Thursday, falling for a sixth straight session and dragging the Pound Sterling (GBP) down nearly 3% top-to-bottom from last week’s peak near 1.3588. Cable is getting dragged back into bearish territory as the US Dollar (USD) catches a broad-market bid on renewed interest rate woes amid rebounding US inflation data and a looming Nonfarm Payrolls (NFP) report on Friday.

United States (US) economic data remains far more robust than many market watchers and policymakers had feared when the Trump administration kicked off a never-ending cycle of tariff threats and subsequent walk backs. Global reciprocal tariffs have routinely been announced, delayed, and re-announced, but key double-digit tariffs on core industries like steel and aluminum imports, as well as foreign cars, are already beginning to bite around the edges of key inflation metrics. Read more...

GBP/USD slips as Fed pushes back on September cut, US data support Dollar

The GBP/USD posted moderate losses during the North American session on Thursday after the Federal Reserve (Fed) held rates on Wednesday and failed to provide forward guidance for the September meeting. This, along with solid US jobs data and an uptick in inflation, boosted the Dollar. The pair trades at 1.3214 after reaching a high of 1.3281.

On Wednesday, Powell and Co. decided to keep policy as it is on a 9-2 split decision, with Governors Bowman and Waller opting for a 25-bps rate cut. Powell pushed back against Trump’s comments that they might ease policy in September and said that they would adopt a meeting-by-meeting approach. Read more...

Author

FXStreet Team

FXStreet