Pound Sterling Price News and Forecast: GBP/USD the cable dips further on renewed risk aversion

GBP/USD Forecast: Pound Sterling to have a hard time attracting buyers post-BOE

GBP/USD has gone into a consolidation phase below 1.2200 early Friday after having lost more than 200 pips on Thursday. Following the Bank of England's (BOE) policy announcements, the pair could find it difficult to gain traction even if the US Dollar come under renewed selling pressure.

As expected, the BOE raised its policy rate by 50 basis points (bps) to 3.5% following the December policy meeting. Two members of the Monetary Policy Committee (MPC), Silvana Tenreyro and Swati Dhingra, however, voted to keep the policy rate unchanged at 3%. The policy statement further revealed that the BOE expects the new fiscal plan to lower the 2023 Consumer Price Forecast for the second quarter by about 0.75%. Read more...

GBP/USD outlook: The cable dips further on renewed risk aversion

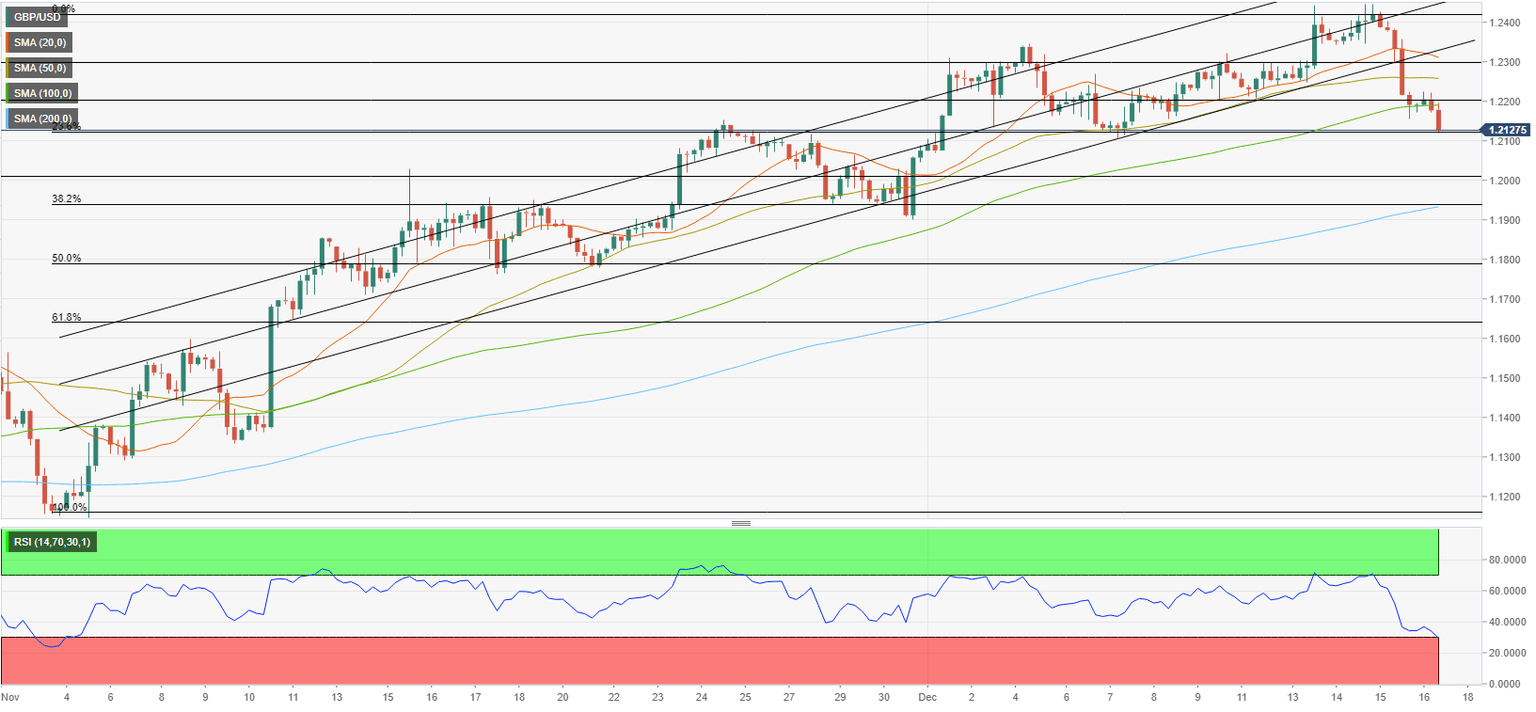

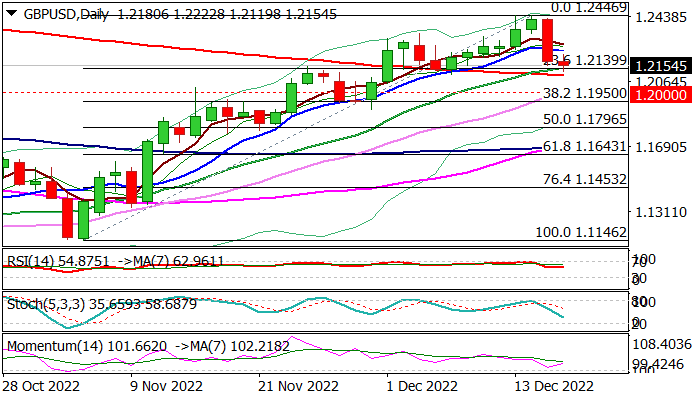

Cable remains in red on Friday and extends lower after nearly 2% drop on Thursday, pressured by renewed risk aversion after major central banks showed unexpectedly hawkish stance and prompted investors into safety of dollar.

Weaker than expected UK retail sales in November added to weakened sentiment, which offset potential positive impact upbeat UK services PMI.

Technical studies on daily chart weakened, although indicators are still positively aligned, but formation of reversal pattern and overbought studies on weekly chart warn of deeper pullback. Read more...

GBP/USD holds steady near 1.2200 despite weaker UK Retail Sales, upside seems limited

The GBP/USD pair attracts some buying on Friday and recovers a part of the previous day's heavy losses to a one-week low. The pair sticks to its modest intraday gains above the 1.2200 mark through the early European session and moves little following the release of the UK macro data.

The UK Office for National Statistics reported that Retail Sales dropped by 0.4% in November against the anticipated growth of 0.3% and the 0.9% increase recorded in the previous month. Furthermore, sales excluding the auto motor fuel unexpectedly fell by 0.3% MoM as compared to the 0.7% rise in October. The data validates a bleak outlook for the UK economy, which, along with a dovish 50 bps rate hike by the Bank of England on Wednesday, supports prospects for some meaningful downside for the GBP/USD pair. Read more...

Author

FXStreet Team

FXStreet