GBP/USD outlook: The cable dips further on renewed risk aversion

GBP/USD

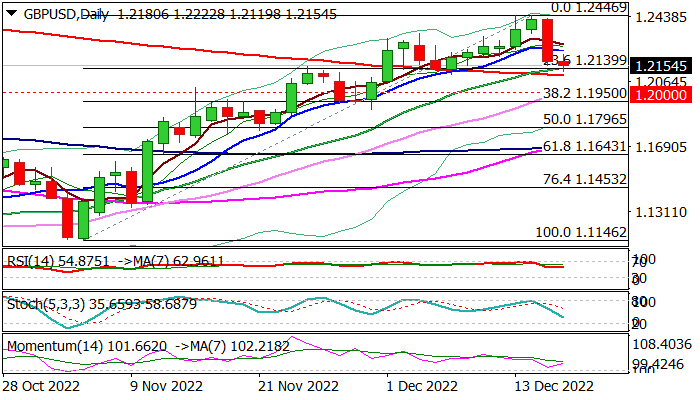

Cable remains in red on Friday and extends lower after nearly 2% drop on Thursday, pressured by renewed risk aversion after major central banks showed unexpectedly hawkish stance and prompted investors into safety of dollar.

Weaker than expected UK retail sales in November added to weakened sentiment, which offset potential positive impact upbeat UK services PMI.

Technical studies on daily chart weakened, although indicators are still positively aligned, but formation of reversal pattern and overbought studies on weekly chart warn of deeper pullback.

Fresh bears cracked initial Fibo support at 1.2219 (23.6% of 1.1146/1.2446 upleg) and pressure pivotal 200 DMA (1.2098), where headwinds could be expected.

Break here would risk extension towards key supports at 1.2000/1.1950 (psychological / Fibo 38.2%) break of which would sideline larger bulls and open way for deeper correction of an uptrend from Sep 26 multi-decade low (1.0342).

Broken daily Tenkan-sen (1.2276) reverted to solid resistance which should cap and keep fresh bears in play.

Res: 1.2239; 1.2276; 1.2446; 1.2520.

Sup: 1.2098; 1.2000; 1.1950; 1.1900.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.