Pound Sterling Price News and Forecast: GBP/USD stabilizes but remains vulnerable

GBP/USD Forecast: Pound Sterling stabilizes but remains vulnerable

Following Wednesday's indecisive action, GBP/USD stays relatively quiet in the European session on Thursday and continues to fluctuate at around 1.3600. Pound Sterling could have a hard time attracting buyers unless the risk mood improves in a noticeable way.

US President Donald Trump reiterated his threat of imposing an additional 10% tariff on any country that aligns with the BRICS group on Wednesday. Trump also shared a new set of tariff letters, unveiling rates on imports from some minor trading partners, such as Libya, Algeria and Philippines. Read more...

GBP/USD hits two-week low as pressure mounts

The GBP/USD pair dropped to 1.3602 on Thursday, marking a two-week low amid a strengthening US dollar and growing concerns over the UK’s public finances.

The sell-off intensified after US President Donald Trump confirmed the imposition of 25% tariffs on goods from 14 countries, including Japan and South Korea, effective 1 August. So far, only the UK and Vietnam have secured exemptions from these new tariffs, which are in addition to existing duties on cars, steel, and aluminium. Read more...

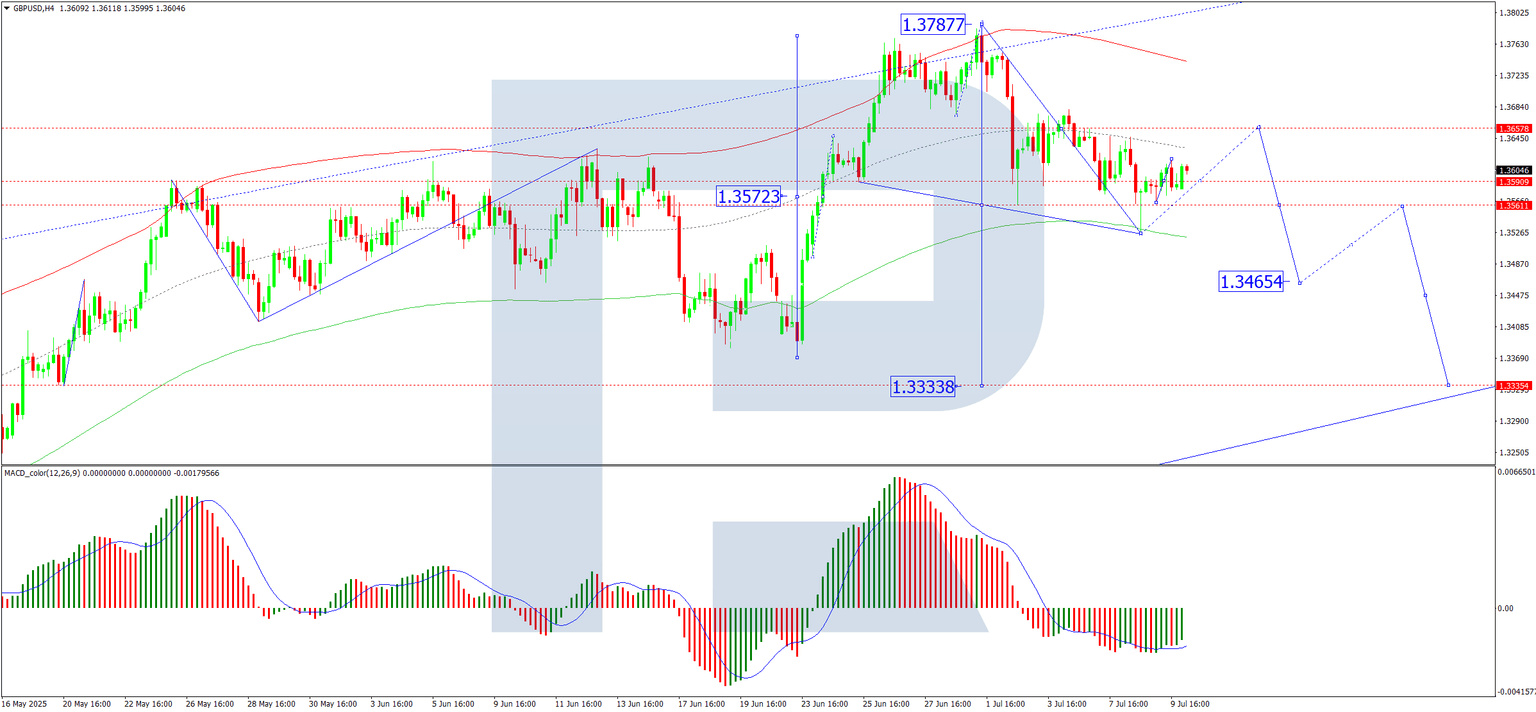

GBP/USD sets the ground for a pivot

GBP/USD is drawing buyers' interest after briefly dipping below its 20-day simple moving average (SMA) and a week after retreating from the three-year high of 1.3787.

Upside pressures may remain intact as risk-on sentiment in global stock markets tends to fuel appetite for the British pound. Technical indicators also support this narrative: the stochastic oscillator is set for a rebound, and the RSI is attempting to avoid a drop below its neutral 50 mark. Read more...

Author

FXStreet Team

FXStreet