GBP/USD hits two-week low as pressure mounts

The GBP/USD pair dropped to 1.3602 on Thursday, marking a two-week low amid a strengthening US dollar and growing concerns over the UK’s public finances.

The sell-off intensified after US President Donald Trump confirmed the imposition of 25% tariffs on goods from 14 countries, including Japan and South Korea, effective 1 August. So far, only the UK and Vietnam have secured exemptions from these new tariffs, which are in addition to existing duties on cars, steel, and aluminium.

London is now scrambling to negotiate a US deal to exclude British steel from the tariffs. Failure to do so could see the rate rise to 50%, posing a severe threat to the UK’s already struggling steel industry.

Further pressure on the pound came from a bleak forecast by the Office for Budget Responsibility (OBR), warning that public debt could exceed 270% of GDP by the early 2070s. Key drivers include an ageing population, rising healthcare and pension costs, and heightened geopolitical tensions, which may necessitate increased defence spending – adding further uncertainty to the UK’s long-term fiscal stability.

Technical analysis: GBP/USD

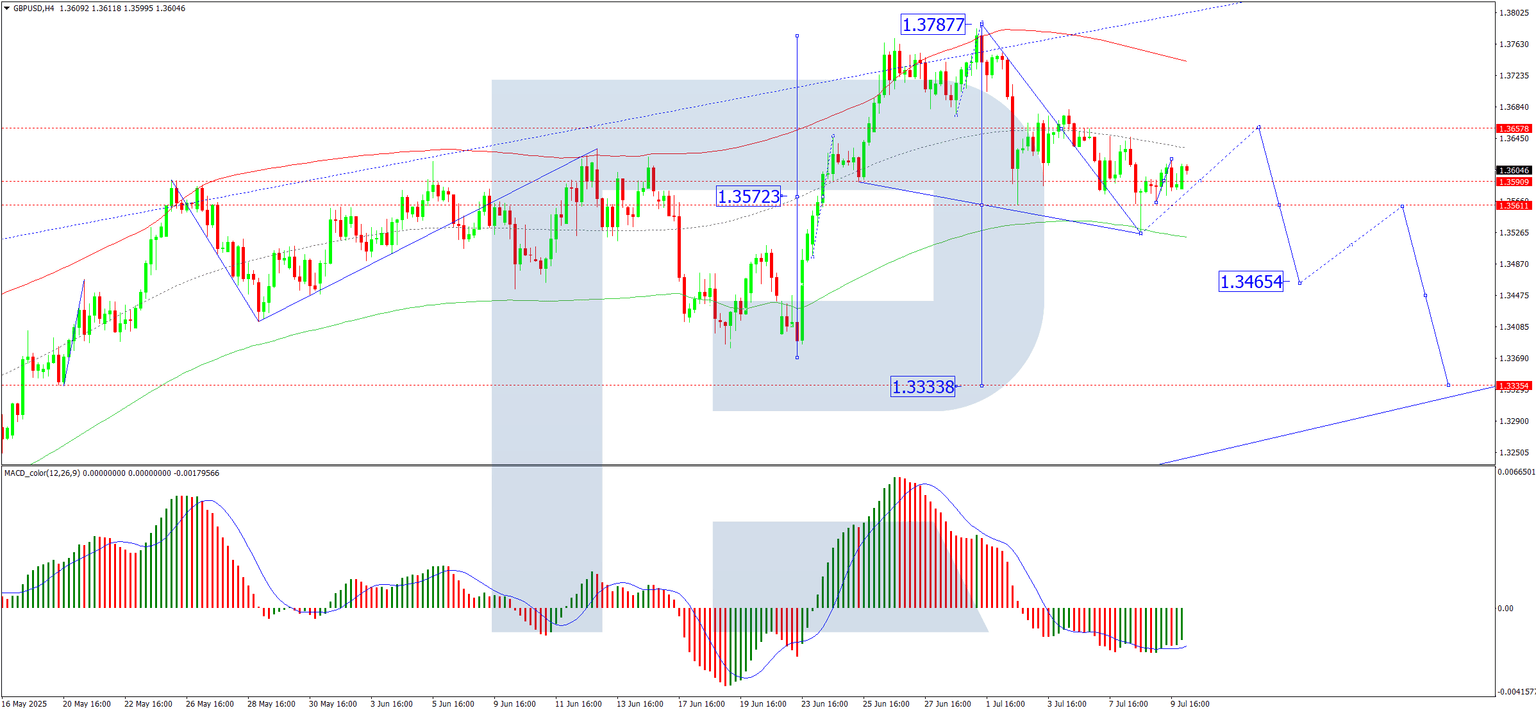

Four-hour chart:

-

The pair completed a downward wave to 1.3525, followed by a recovery to 1.3590

-

Today, we anticipate a narrow consolidation range near this level

-

A breakout upwards could extend the correction to 1.3657, after which a fresh decline towards 1.3520 is expected, with a longer-term target at 1.3465

-

MACD confirmation: The signal line remains below zero, indicating a firm downward trend

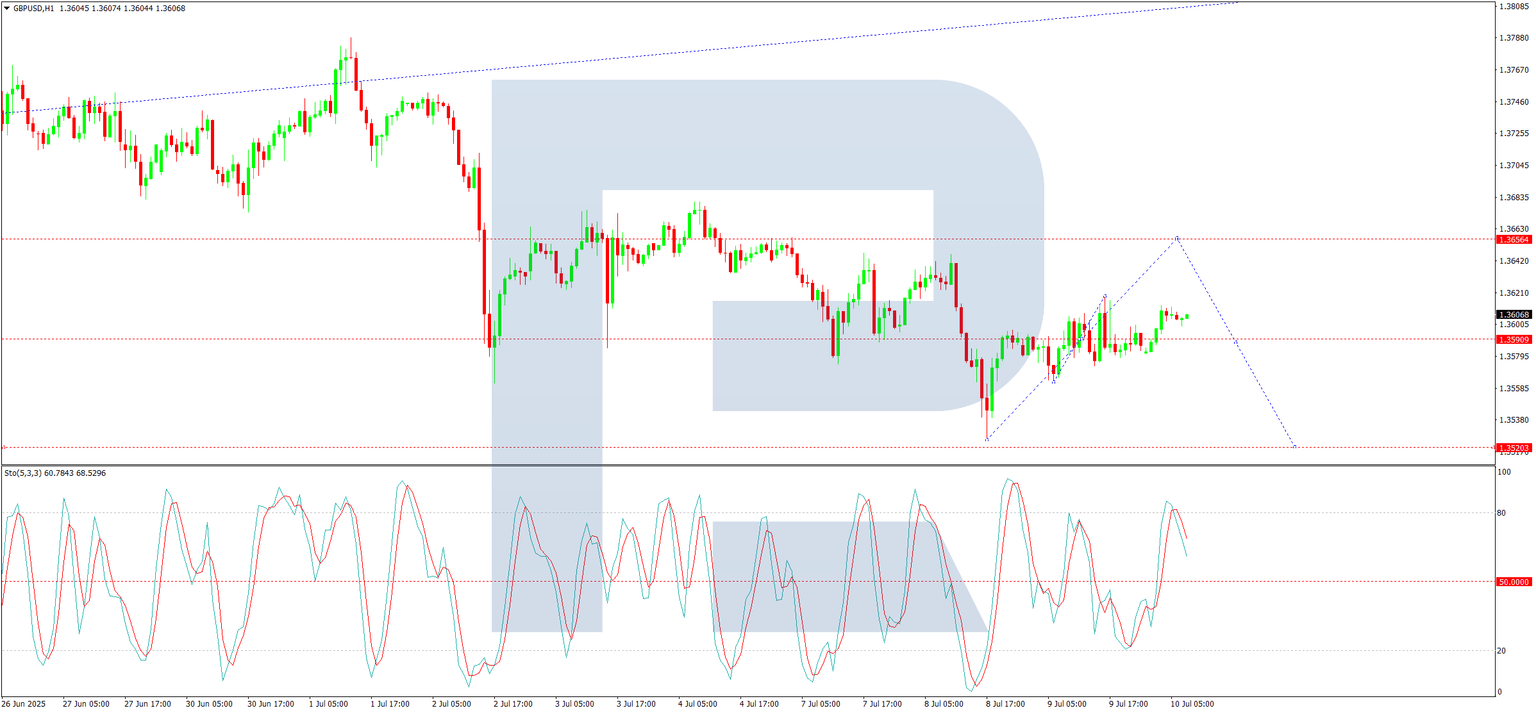

One-hour chart:

-

The market has finished a correction to 1.3590, with consolidation now forming.

-

An upward breakout may push the pair towards 1.3656, but a subsequent drop to at least 1.3520 is likely.

-

Stochastic confirmation: the signal line is below 80, trending downward towards 20.

Conclusion

The GBP/USD remains under downward pressure, with fundamental and technical factors aligning for further weakness. A short-term correction is possible, but the broader trend suggests additional declines ahead.

Author

RoboForex Analysis Department

RoboForex

RoboForex Analysis Department provides timely market insights, expert technical analysis, and actionable forecasts across forex, commodities, indices, and equities.