GBP/USD sets the ground for a pivot

-

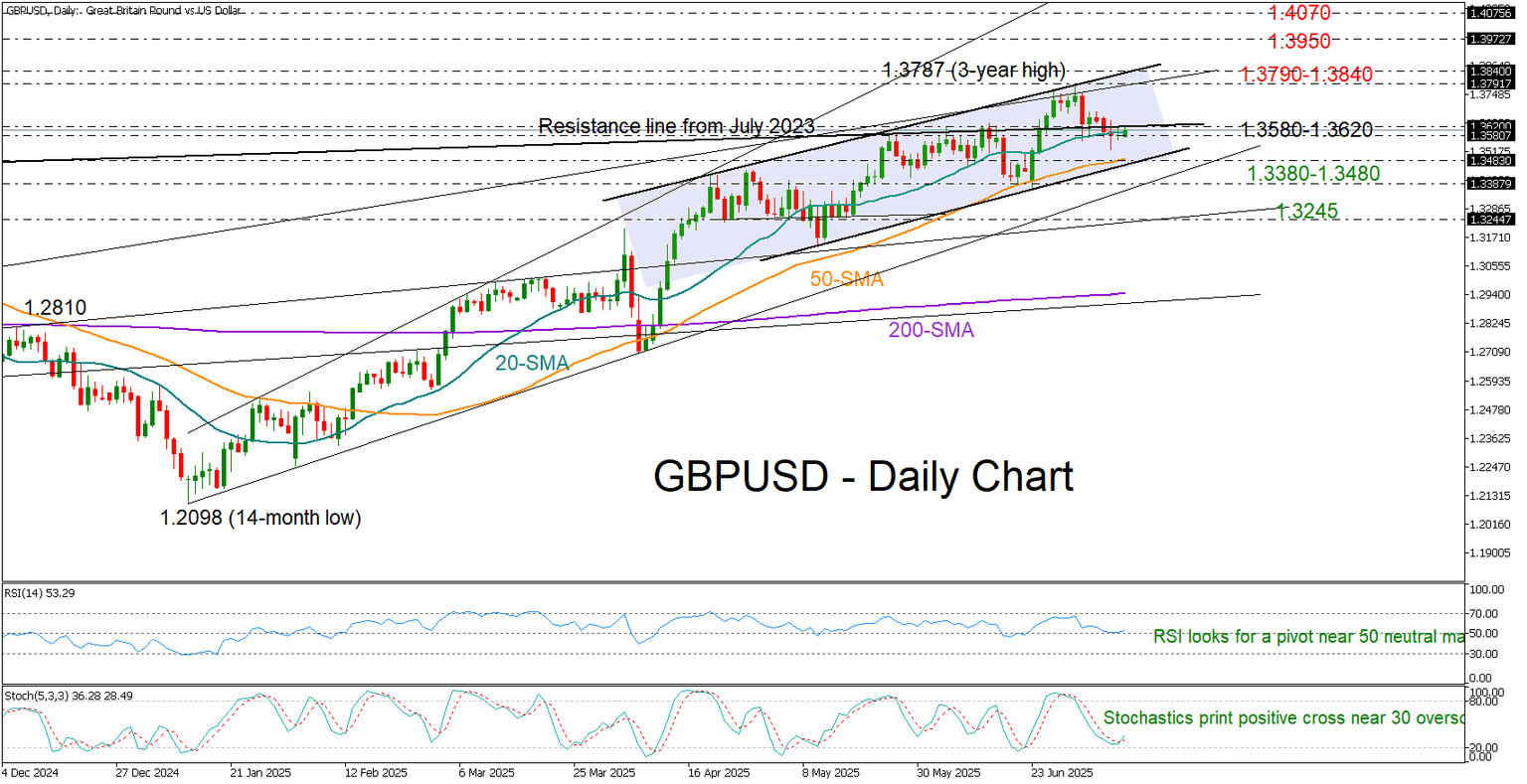

GBP/USD selling pressures ease shortly after pullback from 3-year high.

-

Technical signals favor bullish rotation; break above 1.3620 is needed.

GBP/USD is drawing buyers' interest after briefly dipping below its 20-day simple moving average (SMA) and a week after retreating from the three-year high of 1.3787.

Upside pressures may remain intact as risk-on sentiment in global stock markets tends to fuel appetite for the British pound. Technical indicators also support this narrative: the stochastic oscillator is set for a rebound, and the RSI is attempting to avoid a drop below its neutral 50 mark.

However, traders may remain cautious until the price successfully overcomes the nearby resistance at 1.3620. A decisive close above this level could be the catalyst for an extended move back to the 1.3787 peak and the upper boundary of the bullish channel at 1.3840. Additional increases could then target the 1.3950–1.4070 zone, last seen in June–July 2021.

On the downside, a break below the channel support at 1.3480 – especially if followed by a drop beneath the key 2025 trendline support at 1.3385 – could confirm a bearish continuation toward 1.3245.

In summary, GBP/USD may be poised for another bullish wave, with confirmation coming on a break above 1.3620. Otherwise, attention could turn back to the channel’s lower boundary.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.