Pound Sterling Price News and Forecast: GBP/USD slides as UK GDP misses estimates, factory activity contracts

Pound Sterling slides as UK GDP misses estimates, factory activity contracts

The Pound Sterling faces selling pressure in Thursday’s North American session after the release of the United Kingdom's (UK) monthly Gross Domestic Product (GDP) and factory data for November. The Office for National Statistics (ONS) reported that the economy returned to growth after contracting in October. However, the growth rate was slower than projected. The economy rose by 0.1% after declining at a similar pace in October. Economists expected the economy to have expanded by 0.2%. Read More...

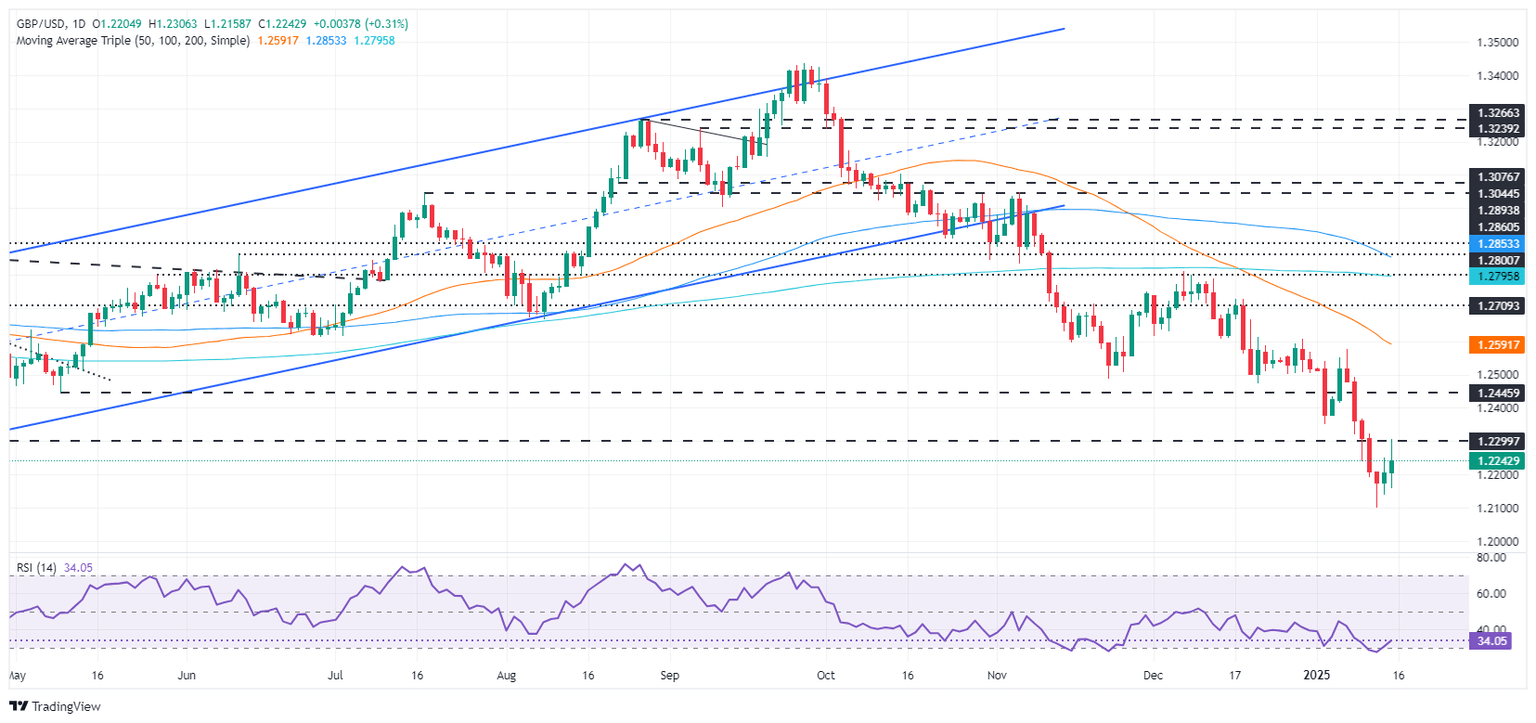

GBP/USD edges lower to near 1.2200 as UK Gilt yields drop

GBP/USD edges lower after two days of gains, trading around 1.2220 during the Asian hours on Thursday. The Pound Sterling (GBP) receives downward pressure following lower-than-expected inflation data from the United Kingdom (UK) released on Wednesday. Read More...

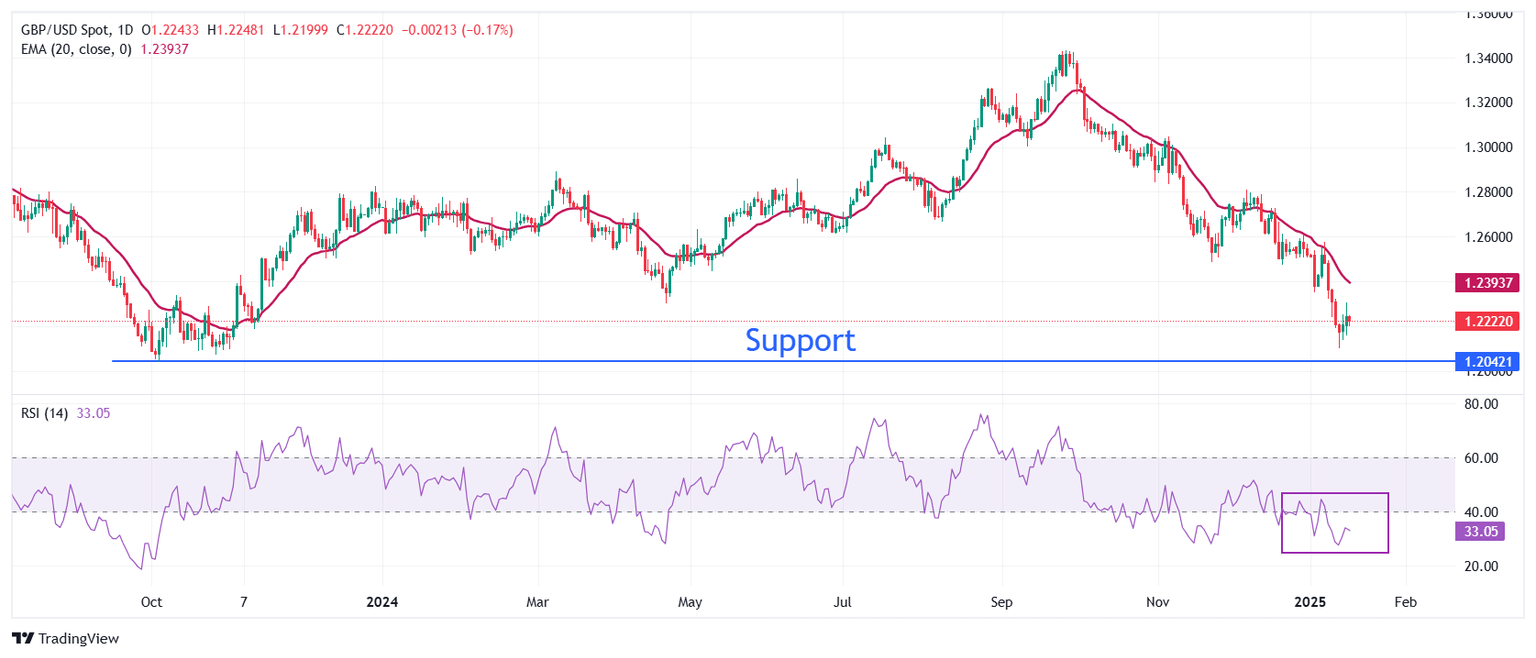

GBP/USD Price Forecast: Edges up, stabilizes near 1.2250

The Pound Sterling posted modest gains on Wednesday after hit seesawing in a wide range of 1.2154 - 1.2306 during the day, yet stabilized at current exchange rates. At the time of writing, the GBP/USD trades at 1.2241, set to close below Tuesday’s high of 1.2249. Read More...

Author

FXStreet Team

FXStreet