Pound Sterling Price News and Forecast: GBP/USD sellers look to retain control [Video]

![Pound Sterling Price News and Forecast: GBP/USD sellers look to retain control [Video]](https://editorial.fxsstatic.com/images/i/gbp-usd-001_XtraLarge.jpg)

GBP/USD Forecast: Pound Sterling sellers look to retain control

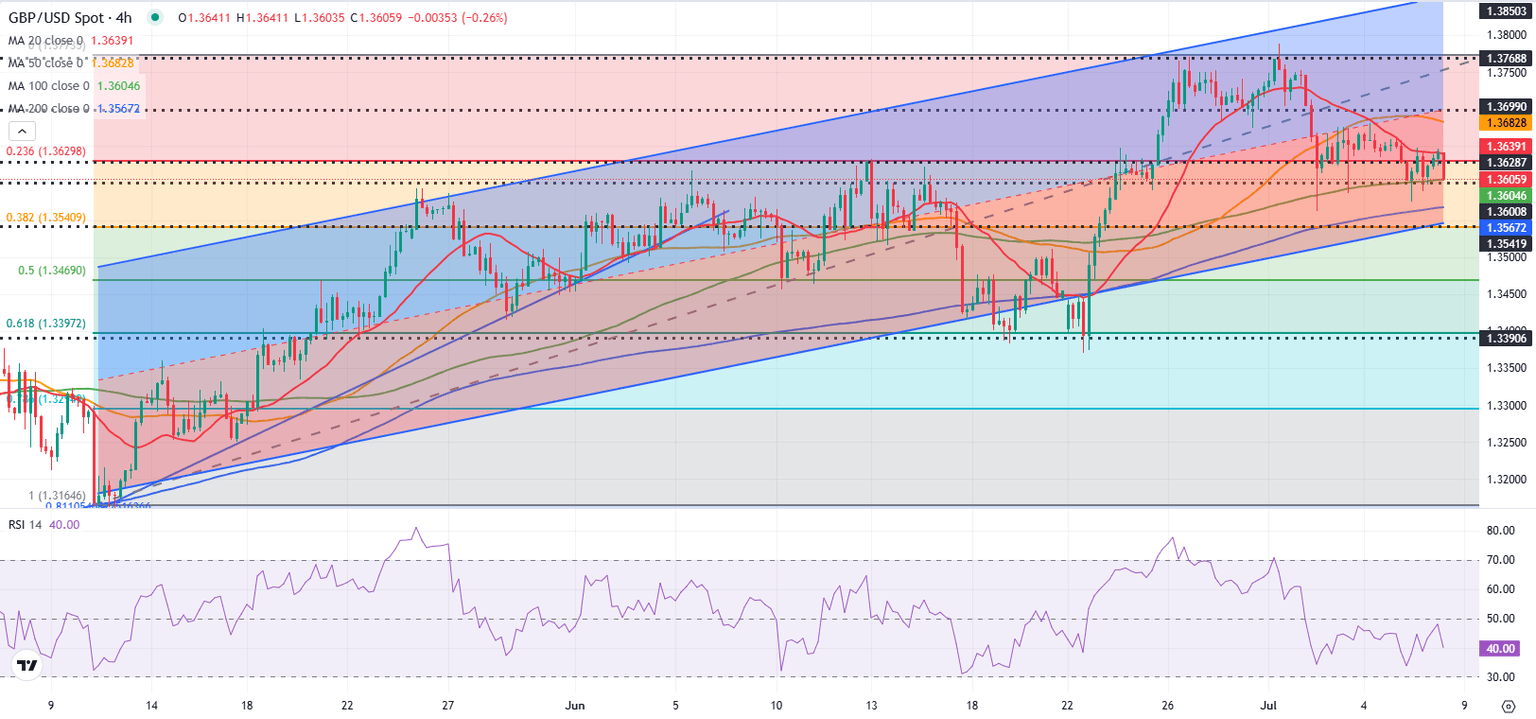

After losing more than 0.3% on Monday, GBP/USD staged a rebound early Tuesday but failed to gather momentum. The pair stays in a consolidation phase slightly above 1.3600 in the European session.

The cautious market mood helped the US Dollar (USD) gather strength at the beginning of the week and caused GBP/USD to push lower. Although the White House announced that the deadline for the implementation of tariffs will be pushed to August 1, safe-haven flows dominated the action as the letters sent out by US President Donald Trump to trading partners showed that Japan and South Korea were to face 25% tariffs. Read more...

GBP/USD Elliott Wave technical analysis [Video]

The GBP/USD daily chart indicates a bullish trend based on Elliott Wave principles. Price action is impulsive, forming orange wave 3 within the broader navy blue wave 5. This structure points to continued upward movement, though a correction in orange wave 4 is expected next.

With orange wave 2 behind us, the pair is progressing through orange wave 3, showing strong bullish momentum. The structure’s impulsive nature indicates solid directional movement. The invalidation level is set at 1.33486 — a drop below this would invalidate the current wave count and imply a shift in market trend. Read more...

Author

FXStreet Team

FXStreet