Pound Sterling Price News and Forecast: GBP/USD retreats from a multi-month top amid some market repositioning

GBP/USD trades with negative bias below mid-1.2900s, downside seems limited ahead of US CPI

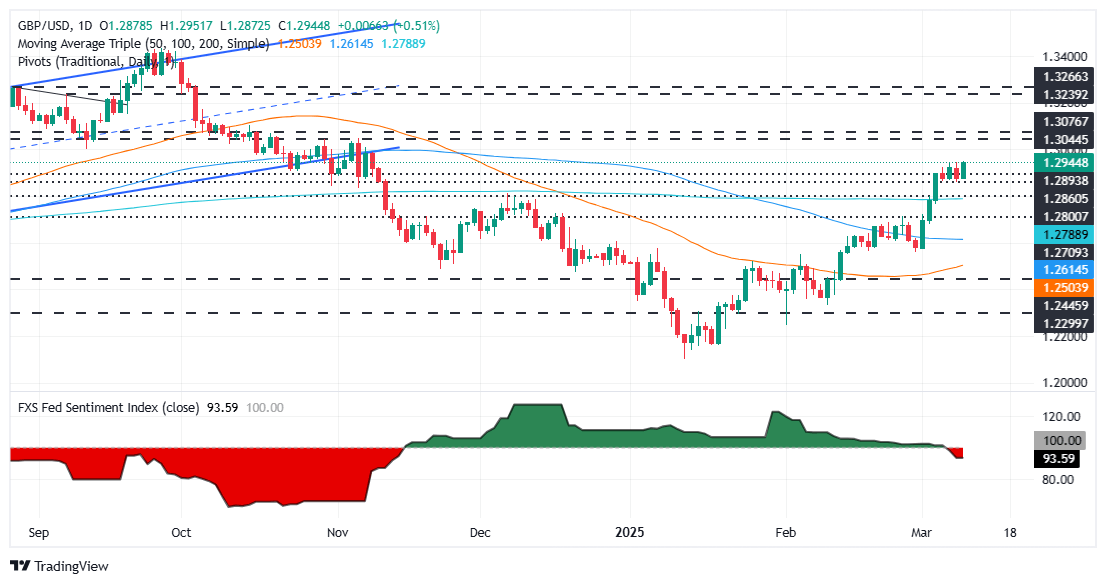

The GBP/USD pair edges lower during the Asian session on Wednesday and erodes a part of the previous day's strong move up to over a four-month peak, around the 1.2965 area. Spot prices currently trade around the 1.2935 region, though the downtick lacks bearish conviction as traders keenly await the release of the US consumer inflation figures before placing fresh directional bets.

The US Consumer Price Index (CPI) report will play a key role in influencing market expectations about the Federal Reserve's (Fed) rate-cut path, which, in turn, will drive the US Dollar (USD) demand and provide a fresh impetus to the GBP/USD pair. In the meantime, some repositioning trade ahead of the crucial data assists the buck to recover a part of the previous day's slide to its lowest level since mid-October and acts as a headwind for the currency pair. Read more...

GBP/USD shrugs off tariff fears as Pound continues to recover ground

GBP/USD extended its recent bullish rally on Tuesday, shrugging off ongoing trade war concerns that are weighing down American market centers. Cable rose a little over one-half of one percent, clipping into the 1.2950 level for the first time in 18 weeks.

US data remains the focal point for GBP/USD traders. UK economic data remains extremely limited on the data docket this week, but key US data releases are lined up one after another throughout most of this week. The US JOLTS job openings data was a bit stronger than anticipated, offering some stability to shaken markets. Job postings rose to 7.74M in January, exceeding the forecast of 7.63M and up from December’s revised figure of 7.51M, adjusted down from 7.6M. Read more...

GBP/USD climbs above 1.2920 as trade war fears weaken USD

The Pound Sterling (GBP) extended its gains versus the US Dollar (USD) on Tuesday as the latter continued to plunge due to controversial trade policies by United States (US) President Donald Trump. He announced an additional 25% tariff on aluminum and steel imports from Canada, as the latter applied duties on electricity imported to New York, Michigan and Minnesota. The GBP/USD pair is trading at 1.2945 up 0.53%.

The market mood remains dismal due to the ongoing trade war, favoring most G10 currencies except the Greenback. The US Job Openings and Labor Turnover Survey (JOLTS) report revealed that vacancies increased in January from 7.508 million to 7.740 million, exceeding forecasts of 7.63 million. Read more...

Author

FXStreet Team

FXStreet