Pound Sterling Price News and Forecast: GBP/USD recovers slightly from over-one-month low.

GBP/USD steadily climbs above mid-1.3200s amid a softer USD; bulls lack conviction

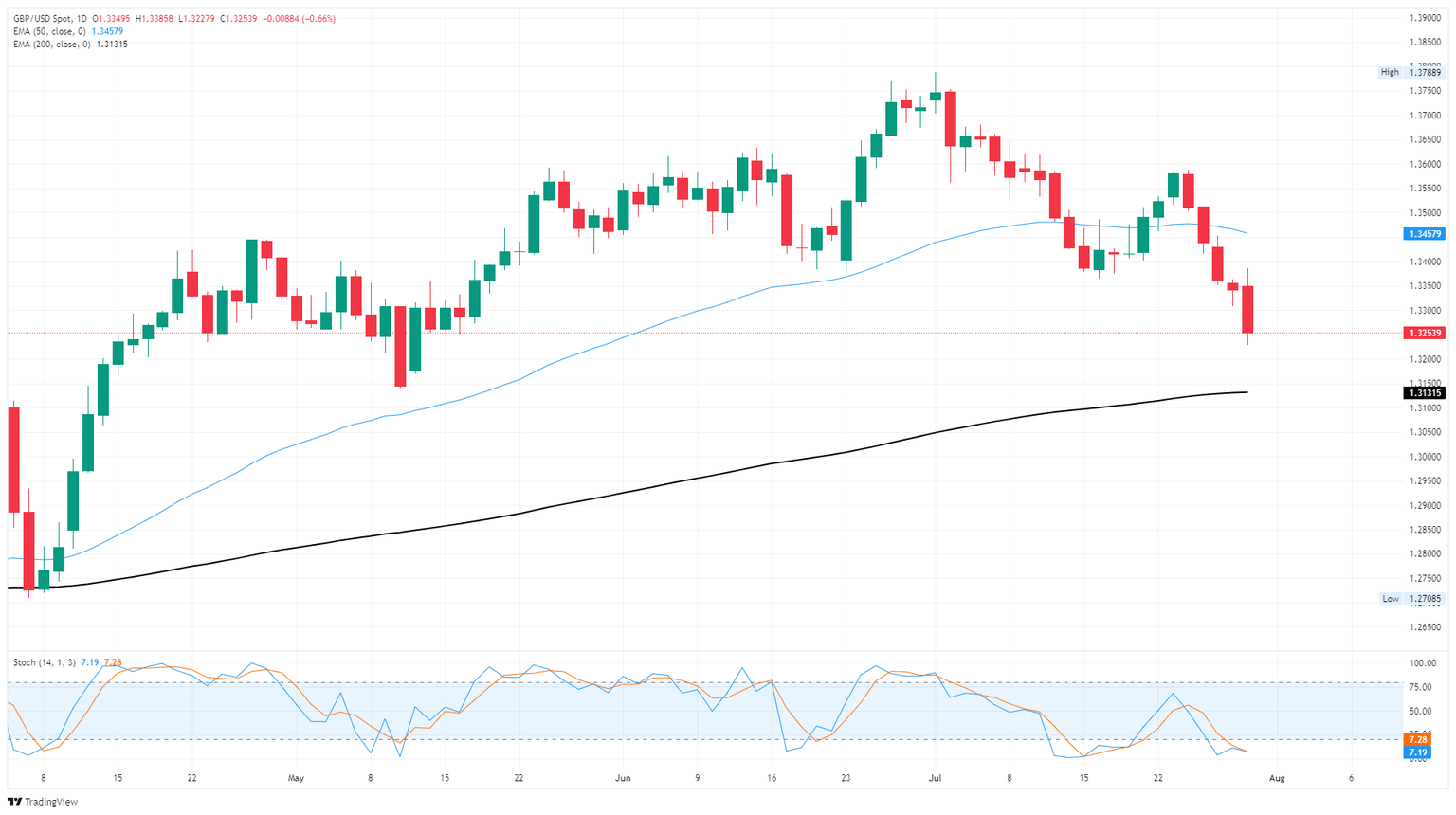

The GBP/USD pair attracts some buyers during the Asian session on Thursday and reverses a part of the previous day's decline to the lowest level since May 13. Spot prices currently trade just above mid-1.3200s, though the fundamental backdrop warrants some caution before positioning for any meaningful recovery.

The US Dollar (USD) enters a bullish consolidation phase following Wednesday's post-FOMC spike to a two-month peak and is seen as a key factor acting as a tailwind for the GBP/USD pair. Any meaningful USD depreciation, however, seems elusive in the wake of the Federal Reserve's (Fed) hawkish tilt. In fact, Fed Chair Jerome Powell, while speaking to reporters during the post-meeting press conference, showed no preference for cutting rates at the next meeting in September. Read more...

GBP/USD extends losses after Fed trims rate cut expectations

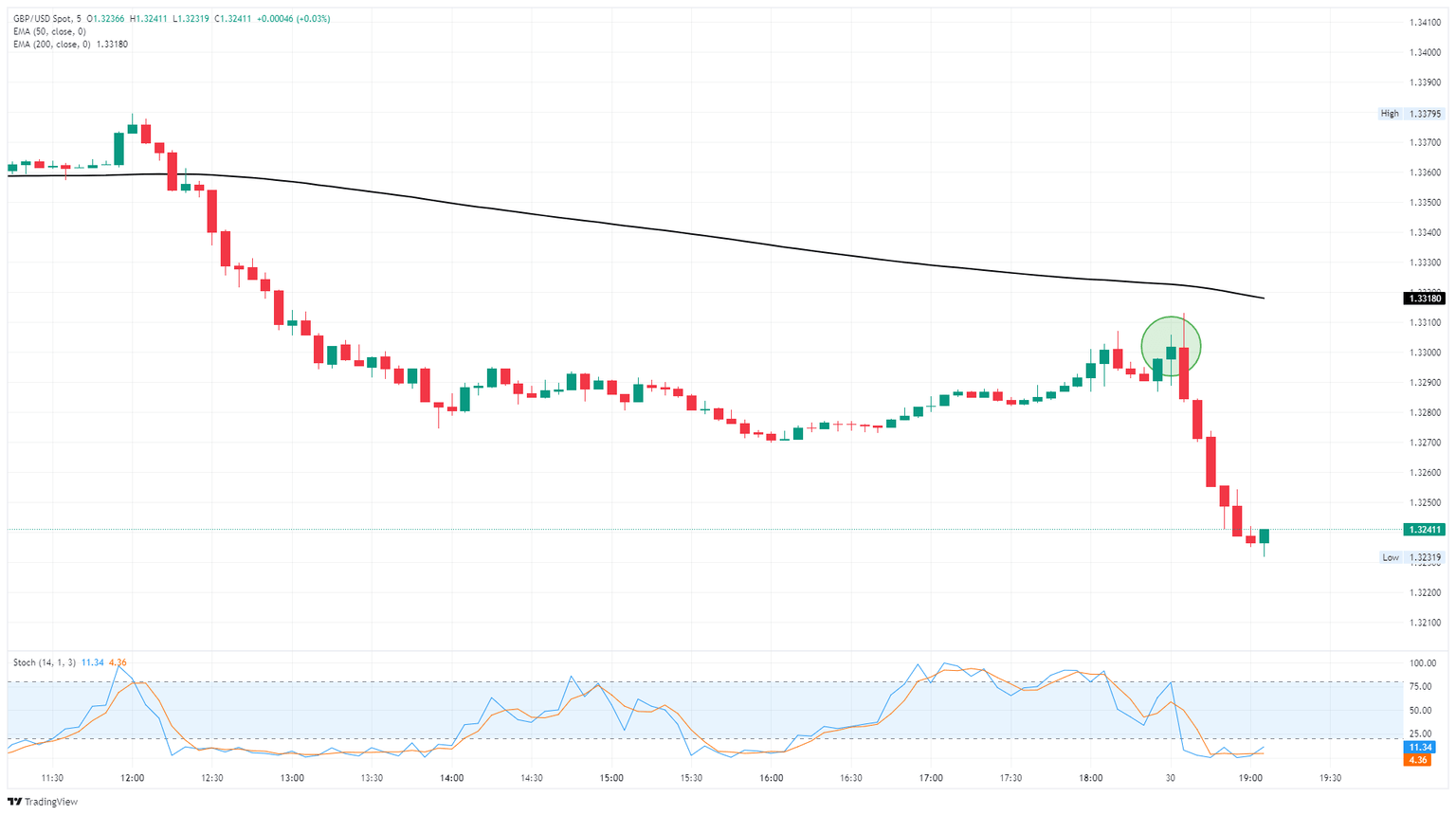

GBP/USD sank for a fifth straight session on Wednesday, falling as the US Dollar (USD) catches a broad-market bid after the Federal Reserve (Fed) held rates steady and stuck to its stubborn wait-and-see stance, trimming hopes for a September rate cut. With odds of a rate cut on September 17 flying out the window, newfound market pressure will be on a hefty raft of economic data coming out of the United States (US) throughout the back half of the trading week.

US PCE inflation, due on Thursday, is expected to accelerate slightly, with analysts anticipating an uptick to 0.3% MoM in June compared to the previous month’s 0.2%. A resurgence of inflationary pressure is the last thing investors want, as it could spell doom for ongoing rate cut expectations. Read more...

GBP/USD falls as cautious Fed beats back investor sentiment

GBP/USD sank after the Federal Reserve's (Fed) latest interest rate call. The Fed held interest rates steady on Wednesday, as expected by the markets. However, a cautious Fed Chair Jerome Powell noted that inflation risks continue to hang over policymakers, and the Fed remains concerned that inflationary impacts still loom ahead, crimping odds of extra rate cuts through the remainder of this year.

Fed Chair Powell tamped down on expectations of immediate rate cuts, noting that despite the progress the Fed has made on inflation thus far, sticky price issues still remain. Fed policymakers are poised to wait for two additional rounds of both inflation and labor data before making a final decision to cut interest rates in September, cooling market hopes for a near-term rate cut. Read more...

Author

FXStreet Team

FXStreet