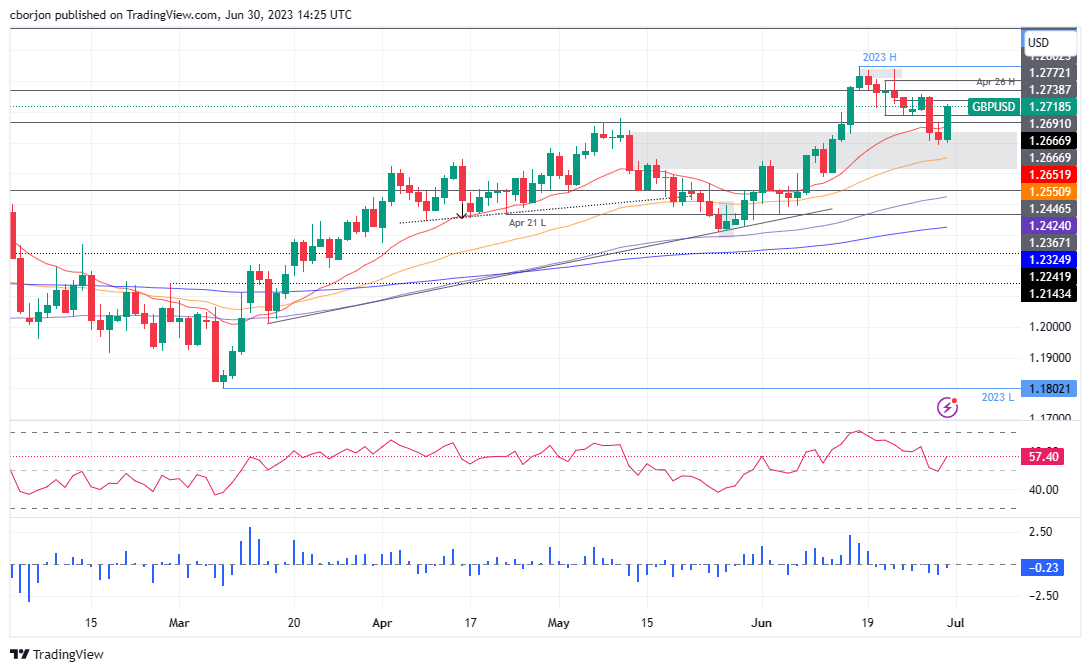

GBP/USD rebounds to 1.2700 as PCE eases in the US, the GBP ends quarter on higher note

GBP/USD recovered lost ground on the last day of the week, month, and quarter, rising more than 0.80% after hitting a daily low of 1.2599. Upbeat data from the United Kingdom (UK) and inflation edging lower in the

United States (US) boosted the Pound

Sterling (GBP), set to finish the month with gains of 2%. At the time of writing, the GBP/USD is trading at 1.2717.

Read More...

GBP/USD recovery fades below 1.2650 despite unimpressive UK GDP, Fed inflation eyed

GBP/USD reverses from intraday high while paring the first daily gains in three around 1.2620 amid early Friday morning in London. In doing so, the Pound

Sterling fails to justify the unimpressive UK Gross Domestic Product (GDP) data while portraying the cautious mood ahead of the key US inflation clues.

Read More...

UK Final GDP expands 0.1% QoQ in Q1 vs. 0.1% expected

The UK economy grew 0.1% on the quarter in the first three months of 2023 vs. 0.1% prior, the final revision confirmed on Friday. The market had expected an expansion of 0.1% in the first quarter.

Read More...