GBP/USD rebounds to 1.2700 as PCE eases in the US, the GBP ends quarter on higher note

- GBP/USD surges more than 0.50% following strong UK economic data and easing US inflation.

- US Core PCE inflation cools, while UK Q1 GDP dodges recession, giving GBP the upper hand.

- Sterling’s rally fueled by expectations of less aggressive Fed action; US Dollar Index drops by 0.50%.

GBP/USD recovered lost ground on the last day of the week, month, and quarter, rising more than 0.80% after hitting a daily low of 1.2599. Upbeat data from the United Kingdom (UK) and inflation edging lower in the United States (US) boosted the Pound Sterling (GBP), set to finish the month with gains of 2%. At the time of writing, the GBP/USD is trading at 1.2717.

Stellar UK GDP data and slowing US inflation bolstered the Pound Sterling, past 1.2700 vs. the US Dollar

The latest inflation report in the US eased some pressure on the Federal Reserve (Fed) as the central bank struggles to curb sticky inflation. The Fed’s preferred gauge for inflation, the Core PCE, rose less than expected, coming at 0.3% MoM, below the prior’s month 0.4%, while annual-based figures diminished to 4.6% from 4.7%. Headline inflation rose by 3.8% YoY, below April’s 4.4%, while PCE climbed 0.1% month-over-month, lower than 0.4% in the previous report.

Across the pond, the UK economic docket featured the Gross Domestic Product (GDP) release of the first quarter, with the country missing a recession, expanded by 0.1% QoQ, as high inflation hurts households’ disposable income, as shown by the Office for National Statistics (ONS) figures. Given that inflation remains at around 8.7%, the Bank of England (BoE) is expected to raise rates to 5.5%, as shown by money market futures, though investors remain worried that higher Bank Rates would tip the UK economy into a recession.

Following the release of the US data, the GBP/USD increased from around 1.2640s to 1.2690s as investors began to price in a less aggressive Fed. Consequently, US Treasury bond yields dropped, while a measure of the buck’s value, the US Dollar Index, has dropped more than 0.50%, exchanging hands at 102.769 on Friday.

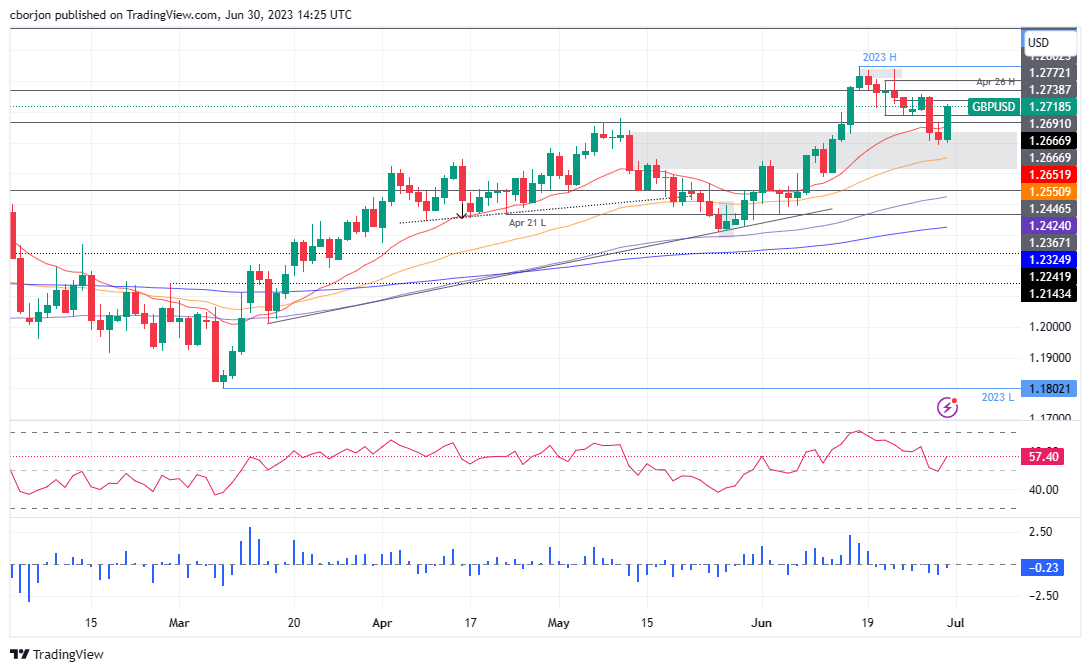

GBP/USD Price Analysis: Technical outlook

After falling for two straight days, the GBP/USD bounced off the weekly lows. On its recovery, GBP/USD must surpass the June 21 daily low turned resistance at 1.2691, so they can recapture 1.2700 and resume its uptrend. In that outcome, the GBP/USD’s next resistance levels would be the June 28 daily high at 1.2752, followed by the 1.2800 figure.

Conversely, if GBP/USD prints a daily close below 1.2690, it will exacerbate a re-test of the current week’s low of 1.2590.

Of note, the Relative Strength Index (RSI) aims upward after dipping to its neutral line, while the three-day Rate of Change (RoC) shows sellers losing momentum, opening the door for further upside.

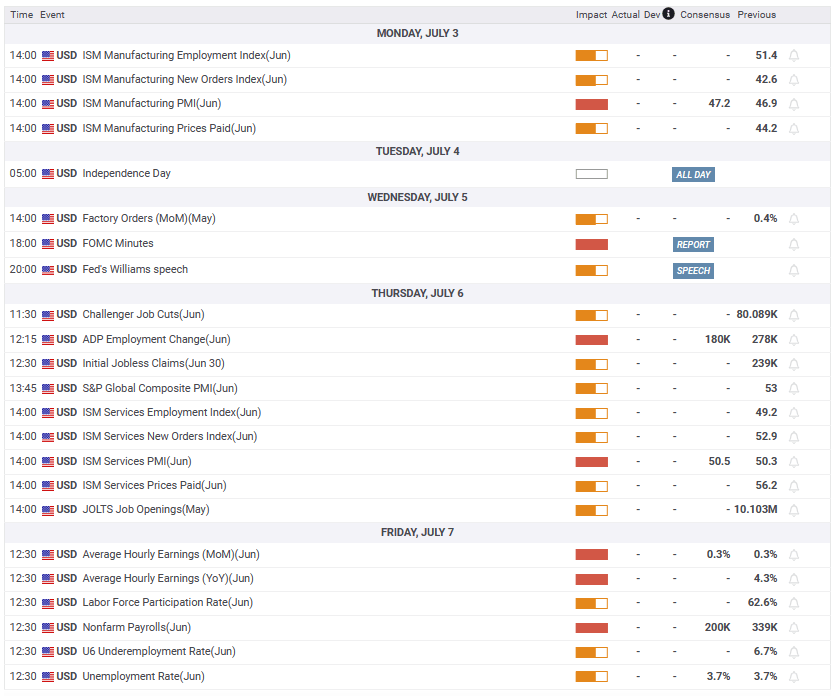

Upcoming events

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.