Pound Sterling Price News and Forecast: GBP/USD rebounds but remains vulnerable [Video]

![Pound Sterling Price News and Forecast: GBP/USD rebounds but remains vulnerable [Video]](https://editorial.fxsstatic.com/images/i/gbp-usd-001_XtraLarge.jpg)

GBP/USD Forecast: Pound Sterling rebounds but remains vulnerable

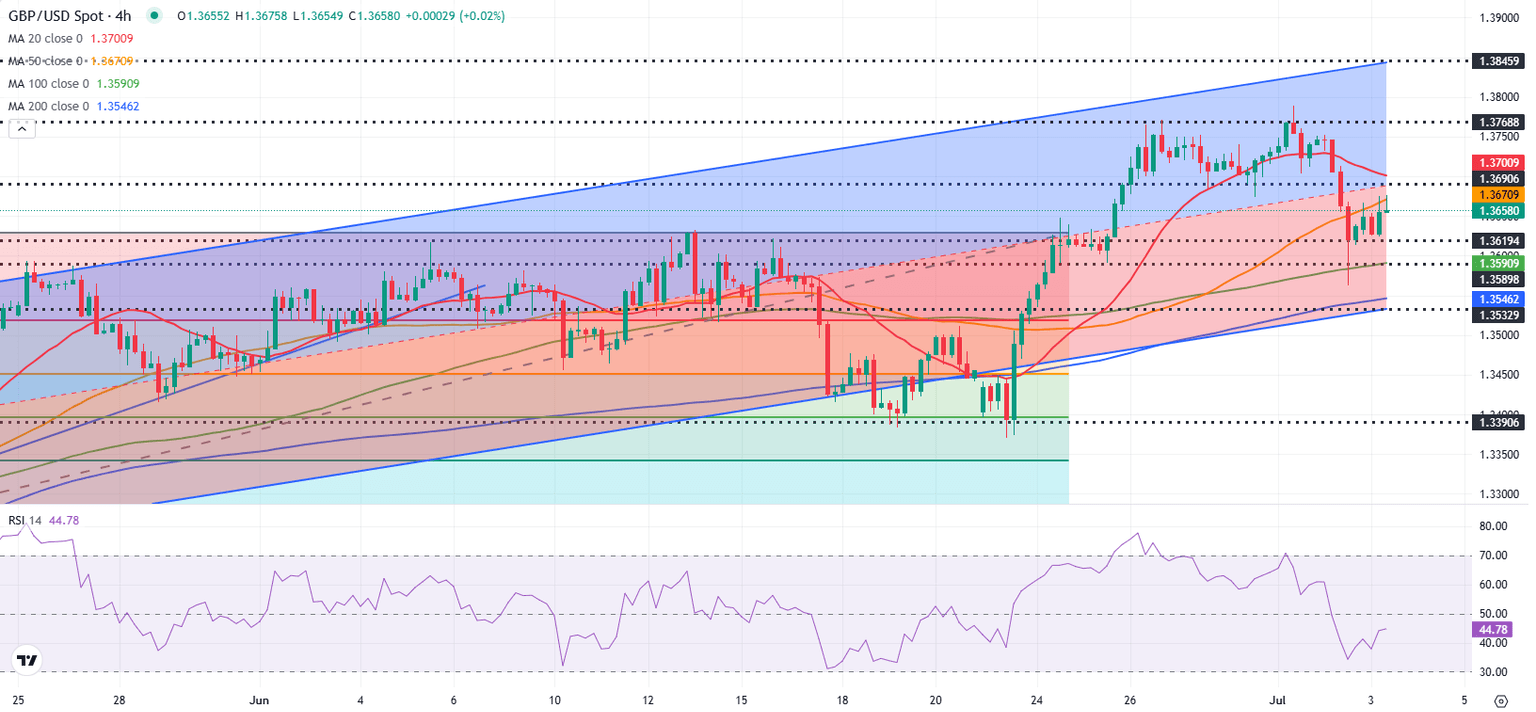

GBP/USD came under heavy bearish pressure on Wednesday and lost about 0.8%. The pair stages a rebound early Thursday but trades well below 1.3700. Markets will keep a close eye on political developments in the UK and scrutinize the June employment report from the US.

British Prime Minister Keir Starmer's refusal to guarantee that finance minister Rachel Reeves will remain in her position until the next election triggered a selloff in UK government bonds during the European session on Wednesday, causing Pound Sterling to weaken against its major rivals. Read more...

GBP/USD outlook: Cable falls sharply on political turmoil in UK

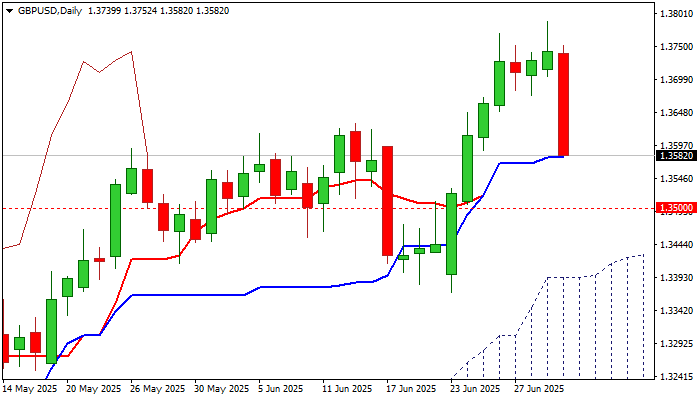

British pound fell across the board on Wednesday following fresh political storm in the UK, after finance minister Reeves’ budget plan was strongly hurt by a series of significant changes in welfare reform bill that undermined the position of the fin min Reeves, as well as PM Starmer, who gave his full support to the finance minister.

Fresh weakness (Cable was down almost 1% for the day) adds to reversal signal that is developing on daily chart, as today’s action was shaped in long bearish candle, after the pair has registered six consecutive daily gains. Read more...

GBP/USD Elliott Wave analysis [Video]

The Elliott Wave analysis for GBPUSD on the daily chart indicates a bullish market setup. The pair is displaying impulsive behavior, pointing to strong upward momentum. The current wave count marks Gray Wave 3 within Orange Wave 5, suggesting a dynamic segment of the bullish structure where third waves are known for powerful price action. Read more...

Author

FXStreet Team

FXStreet