GBP/USD outlook: Cable falls sharply on political turmoil in UK

GBP/USD

British pound fell across the board on Wednesday following fresh political storm in the UK, after finance minister Reeves’ budget plan was strongly hurt by a series of significant changes in welfare reform bill that undermined the position of the fin min Reeves, as well as PM Starmer, who gave his full support to the finance minister.

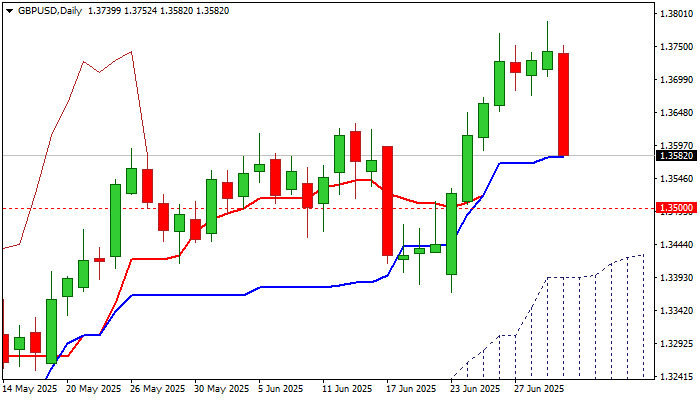

Fresh weakness (Cable was down almost 1% for the day) adds to reversal signal that is developing on daily chart, as today’s action was shaped in long bearish candle, after the pair has registered six consecutive daily gains.

Technical picture weakens on daily chart as south-heading 14-d momentum is cracking the centreline, in attempts to break into negative territory and bears pressure important support at 1.3579 (50% retracement of 1.3370/1.3788, reinforced by converged daily Tenkan/Kijun-sen) while situation on 4-hr and hourly charts shows that bears gained control.

Break of 1.3579 trigger to open way for further weakness and expose targets at 1.3530 (Fibo 61.8%) and 1.3500 (psychological) guarding more significant support at 1.3397 (top of ascending and thickening daily cloud).

Broken 200HMA (1.3642) offers solid resistance, along with 1.3674 (low of recent range).

Res: 1.3618; 1.3642; 1.3674; 1.3712.

Sup: 1.3530; 1.3500; 1.3469; 1.3397.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.