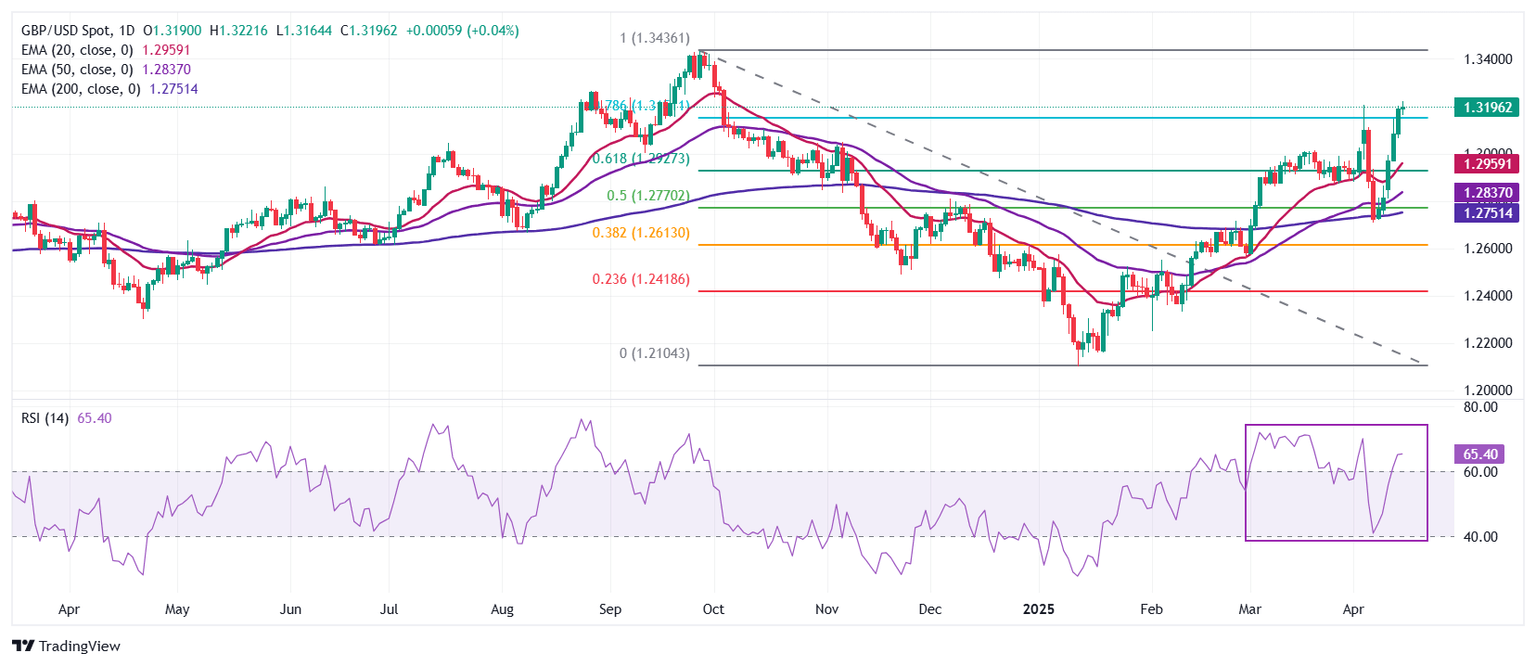

Pound Sterling Price News and Forecast: GBP/USD reached a fresh six-month high at 1.3256 on Wednesday

GBP/USD extends rally to fresh six-month highs near 1.3250 ahead of UK CPI data

The GBP/USD pair continues its winning streak that began on April 8, trading around 1.3250 during Wednesday’s Asian session. Earlier in the day, it touched a fresh six-month high at 1.3256. The pair has maintained strong momentum, boosted by improved global risk sentiment after US President Donald Trump announced exemptions for key technology products from his new “reciprocal” tariffs.

In the UK, labor market data showed on Tuesday that the unemployment rate held steady at 4.4% in February, in line with expectations. Wage growth, however, remained robust, maintaining pressure on the Bank of England (BoE). Read more...

GBP/USD hits 6-month high above 1.3200 as markets shun USD amid tariff turmoil

The Pound Sterling (GBP) rose and refreshed six-month highs against the US Dollar (USD) on Tuesday as the financial markets' narrative remains linked to the US imposing tariffs. Cable shrugged off soft United Kingdom (UK) jobs data; hence, GBP/USD rallied 0.36% and is trading at 1.3233.

Market mood remains positive, to the detriment of safe-haven currencies like the Greenback, which has depreciated over 5.34% during the last three weeks, according to the US Dollar Index (DXY). Read more...

Pound Sterling outperforms on strong UK employment data

The Pound Sterling (GBP) advances against its major peers, except antipodeans, on Tuesday after the release of the United Kingdom (UK) labor market data for three months ending February. The Office for National Statistics (ONS) reported that the economy added 206K fresh workers, significantly higher than the 144K recorded in three months ending January.

The agency reported that the ILO Unemployment Rate came in line with estimates and the prior release of 4.4%. The scenario of upbeat employment data is favorable for the British currency. However, financial market participants expect that employers could slow down their hiring process in the face of an increase in contributions to social security schemes starting in April. Read more...

Author

FXStreet Team

FXStreet