Pound Sterling outperforms on strong UK employment data

- The Pound Sterling outperforms most of its peers on upbeat UK employment data for three months ending February.

- Investors await the UK CPI data for March, which will be released on Wednesday.

- US President Trump will likely announce a temporary suspension of automobile tariffs.

The Pound Sterling (GBP) advances against its major peers, except antipodeans, on Tuesday after the release of the United Kingdom (UK) labor market data for three months ending February. The Office for National Statistics (ONS) reported that the economy added 206K fresh workers, significantly higher than the 144K recorded in three months ending January.

The agency reported that the ILO Unemployment Rate came in line with estimates and the prior release of 4.4%. The scenario of upbeat employment data is favorable for the British currency. However, financial market participants expect that employers could slow down their hiring process in the face of an increase in contributions to social security schemes starting in April.

In the Autumn budget, UK Chancellor of the Exchequer Rache Reeves raised employers’ contribution to National Insurance (NI) from 13.8% to 15%.

Meanwhile, Average Earnings Excluding Bonuses, a key measure of wage growth, grew at a slightly slower pace of 5.9% compared to estimates of 6%. In three months ending January, the wage growth measure rose by 5.8%, downwardly revised from 5.9%. Average Earnings Including Bonuses rose steadily by 5.6% but slower than the expectations of 5.7%.

Mixed Average Earnings data is unlikely to change market expectations for the Bank of England’s (BoE) monetary policy outlook significantly, which indicates that the central bank would cut interest rates in the May policy meeting.

For fresh cues on the interest rate outlook, investors will focus on the UK Consumer Price Index (CPI) data for March, which will be released on Wednesday. Economists expect the UK core CPI – which excludes volatile food and energy prices – to have grown at a steady pace of 3.5%.

Daily digest market movers: Pound Sterling refreshes six-month high against US Dollar

- The Pound Sterling posts a fresh six-month high near 1.3250 during North American trading hours on Tuesday. The GBP/USD pair trades firmly as the US Dollar remains under pressure, with investors losing confidence in its structural attractiveness due to back-and-forth decisions on trade policies by United States (US) President Donald Trump.

- The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades cautiously slightly above the three-year low of 99.00.

- The ever-shifting tariff headlines from US President Trump, from the 90-day pause on reciprocal tariffs on all of its trading partners, except China, to signals of temporary suspension on additional levies on imported vehicles, have forced traders to reassess the safe-haven appeal of the US Dollar.

- On Monday, Donald Trump signaled that he is exploring temporary exemptions for tariffs on imported vehicles and related parts as domestic Original Equipment Manufacturers (OEMs) need more time to set up manufacturing facilities at home. “I’m looking at something to help car companies with it,” Trump said and added, “They’re switching to parts that were made in Canada, Mexico and other places, and they need a little bit of time, because they’re going to make them here,” Bloomberg reported.

- Meanwhile, economic risks prompted by Trump’s policies have stemmed the need for interest rate cuts from the Federal Reserve (Fed). On Monday, Fed Governor Christopher Waller backed monetary policy easing in the scenario of an economic recession despite inflationary pressures remaining escalated. "I expect the risk of recession would outweigh the risk of escalating inflation, especially if the effects of tariffs in raising inflation are expected to be short-lived," Waller said.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.33% | -0.26% | 0.01% | 0.00% | -0.88% | -1.05% | 0.39% | |

| EUR | -0.33% | -0.58% | -0.37% | -0.31% | -1.13% | -1.36% | 0.08% | |

| GBP | 0.26% | 0.58% | 0.23% | 0.27% | -0.55% | -0.79% | 0.66% | |

| JPY | -0.01% | 0.37% | -0.23% | 0.05% | -0.81% | -1.14% | 0.42% | |

| CAD | -0.01% | 0.31% | -0.27% | -0.05% | -0.86% | -1.06% | 0.39% | |

| AUD | 0.88% | 1.13% | 0.55% | 0.81% | 0.86% | -0.24% | 1.23% | |

| NZD | 1.05% | 1.36% | 0.79% | 1.14% | 1.06% | 0.24% | 1.46% | |

| CHF | -0.39% | -0.08% | -0.66% | -0.42% | -0.39% | -1.23% | -1.46% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Technical Analysis: Pound Sterling jumps to near 1.3250

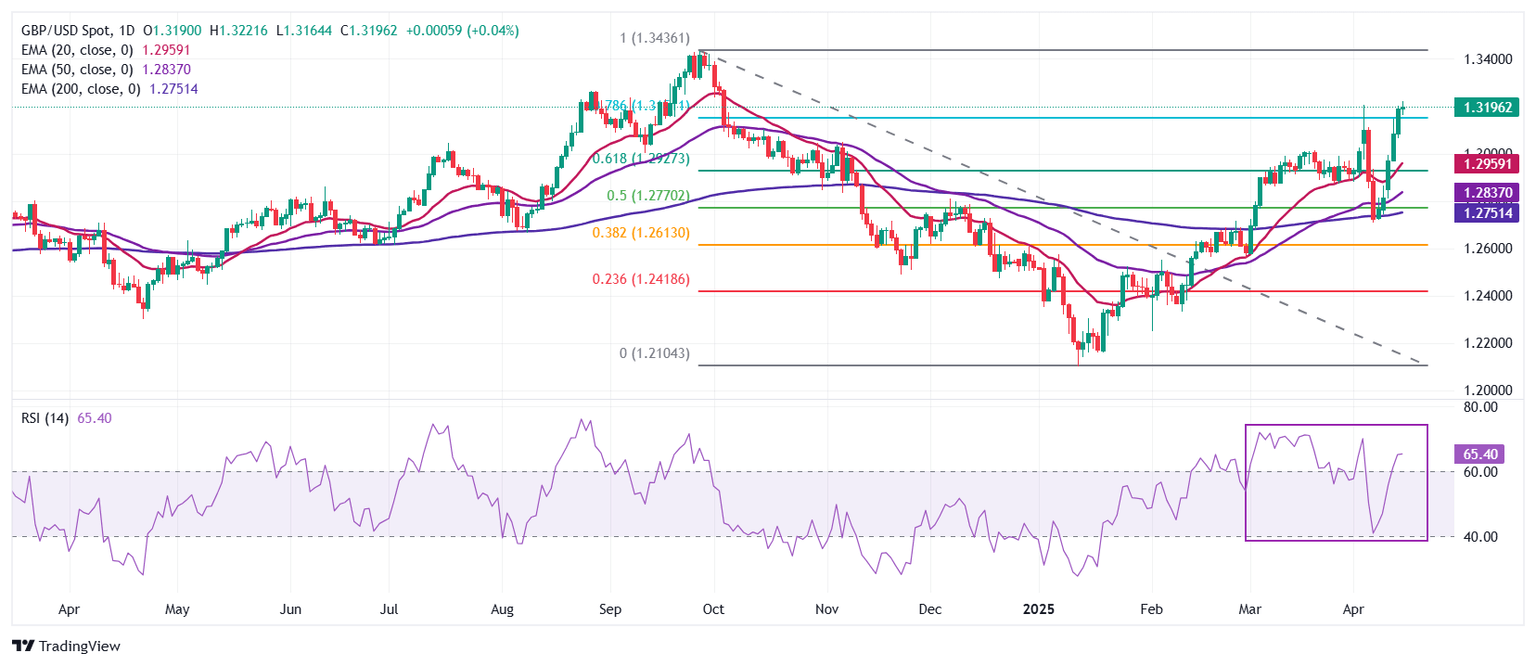

The Pound Sterling extends its winning streak for the sixth trading day and jumps above 1.3200 against the US Dollar (USD) at the time of writing on Tuesday. The near-term outlook of the pair is upbeat as all short-to-long Exponential Moving Averages (EMAs) are sloping higher below the current price.

The 14-day Relative Strength Index (RSI) demonstrates a V-shape recovery from 40.00 to 65.00, suggesting a strong bullish momentum.

Looking down, the 61.8% Fibonacci retracement plotted from late September high to mid-January low, near 1.2927, will act as a key support zone for the pair. On the upside, the three-year high of 1.3430 will act as a key resistance zone.

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

BRANDED CONTENT

The right broker can enhance your trading experience by offering key features suited to your strategy. Discover a curated list of brokers designed to meet various trading preferences.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.