Pound Sterling Price News and Forecast: GBP/USD rally could lose steam after UK inflation [Video]

![Pound Sterling Price News and Forecast: GBP/USD rally could lose steam after UK inflation [Video]](https://editorial.fxsstatic.com/images/i/GBPUSD-bearish-object_XtraLarge.png)

GBP/USD Forecast: Pound Sterling rally could lose steam after UK inflation data

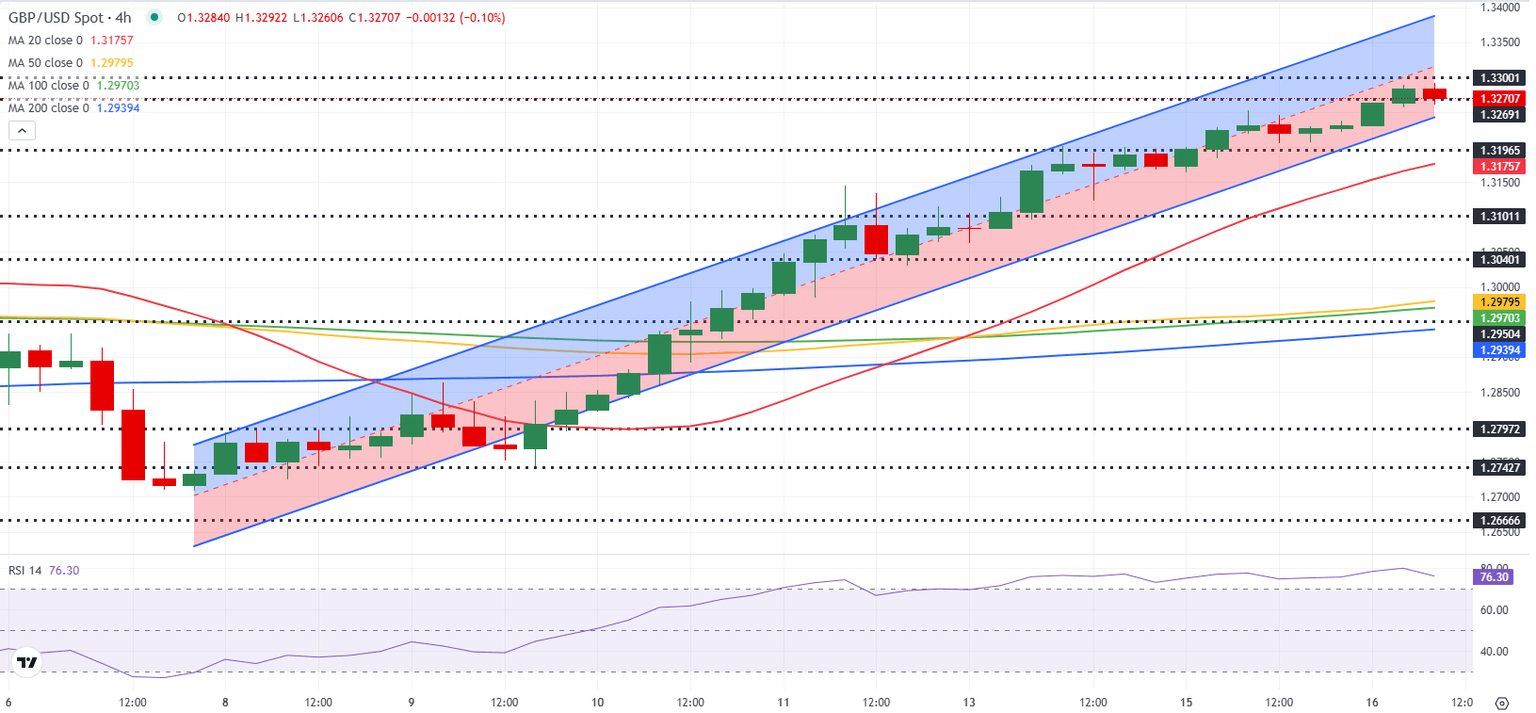

GBP/USD stretched higher and touched its strongest level since early October above 1.3290 in the early European session on Wednesday. The pair corrects lower after latest UK data but remains in positive territory, while the near-term technical outlook continues to highlight overbought conditions.

The UK's Office for National Statistics (ONS) reported on Wednesday that annual inflation, as measured by the change in the Consumer Price Index (CPI), softened to 2.6% in March from 2.8% in February. This reading came in below the market expectation of 2.7% and made it difficult for GBP/USD to gather further bullish momentum. On a monthly basis, the CPI rose 0.3% following the 0.4% increase recorded previously. Read more...

GBP/USD has resumed its upward move [Video]

GBP/USD has recently broken above its April 3, 2025 peak of 1.3207, which we identified as wave (1) in the chart. This breakout signals a bullish trend starting from the January 13, 2025 low of 1.2705, suggesting more upward movement ahead. The rally from this low follows a five-wave Elliott Wave pattern. This is a common structure in technical analysis indicating a strong trend. Read more...

Author

FXStreet Team

FXStreet