GBP/USD Forecast: Pound Sterling rally could lose steam after UK inflation data

- GBP/USD touched a fresh 2025-high in the European session on Wednesday.

- Annual CPI inflation in the UK softened to 2.6% in March.

- Investors await Fed Chairman Jerome Powell's speech later in the day.

GBP/USD stretched higher and touched its strongest level since early October above 1.3290 in the early European session on Wednesday. The pair corrects lower after latest UK data but remains in positive territory, while the near-term technical outlook continues to highlight overbought conditions.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.07% | -1.40% | -0.80% | 0.35% | -1.39% | -1.60% | -0.30% | |

| EUR | -0.07% | -0.99% | -0.41% | 0.74% | -0.73% | -1.24% | 0.07% | |

| GBP | 1.40% | 0.99% | 0.97% | 1.73% | 0.26% | -0.26% | 1.07% | |

| JPY | 0.80% | 0.41% | -0.97% | 1.15% | -0.81% | -1.00% | 0.71% | |

| CAD | -0.35% | -0.74% | -1.73% | -1.15% | -1.67% | -1.92% | -0.70% | |

| AUD | 1.39% | 0.73% | -0.26% | 0.81% | 1.67% | -0.51% | 0.79% | |

| NZD | 1.60% | 1.24% | 0.26% | 1.00% | 1.92% | 0.51% | 1.36% | |

| CHF | 0.30% | -0.07% | -1.07% | -0.71% | 0.70% | -0.79% | -1.36% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

The UK's Office for National Statistics (ONS) reported on Wednesday that annual inflation, as measured by the change in the Consumer Price Index (CPI), softened to 2.6% in March from 2.8% in February. This reading came in below the market expectation of 2.7% and made it difficult for GBP/USD to gather further bullish momentum. On a monthly basis, the CPI rose 0.3% following the 0.4% increase recorded previously.

On the flip side, the US Dollar (USD) struggles to find demand as the latest headlines surrounding the US-China trade relations revive fears over a deepening conflict.

The Wall Street Journal reported late Tuesday that US President Donald Trump's administration was planning to use ongoing tariff negotiations to pressure US trading partner to limit their dealings with China.

The US Census Bureau will publish Retail Sales data for March later in the day. Markets forecast an increase of 1.3% on a monthly basis, following February's 0.2% rise. A stronger-than-expected growth in Retail Sales could support the USD with the initial reaction.

More importantly, Federal Reserve Chairman Jerome Powell will speak on the economic outlook at the Economic Club of Chicago. According to the CME FedWatch Tool, markets are currently pricing in about a 20% probability of the Fed cutting the policy rate by 25 basis points at the next policy meeting. In case Powell reiterates the need to be patient regarding policy-easing, the market positioning suggests that the USD could gather some strength.

GBP/USD Technical Analysis

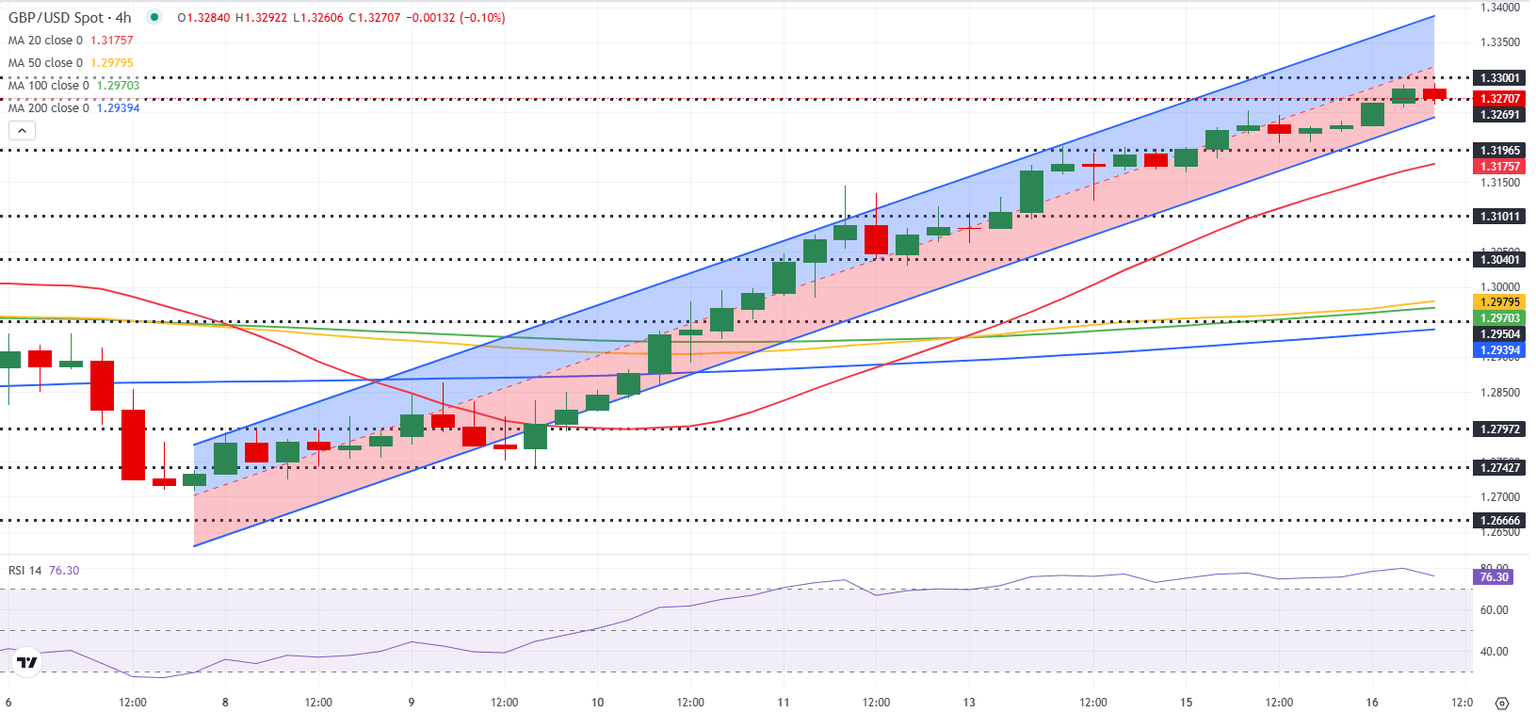

The Relative Strength Index (RSI) indicator on the 4-hour chart stays near 80, suggesting that GBP/USD is yet to correct its overbought conditions.

On the upside, 1.3300 (static level, round level) aligns as immediate resistance before 1.3320 (mid-point of the ascending channel) and 1.3380 (upper limit of the ascending channel). Looking south, supports could be spotted at 1.3270 (lower limit of the ascending channel), 1.3200 (static level, round level) and 1.3175 (20-period Simple Moving Average).

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.