Pound Sterling Price News and Forecast: GBP/USD rallies on US PPI dip and Trump’s potential Powell removal

GBP/USD rallies on US PPI dip and Trump’s potential Powell removal

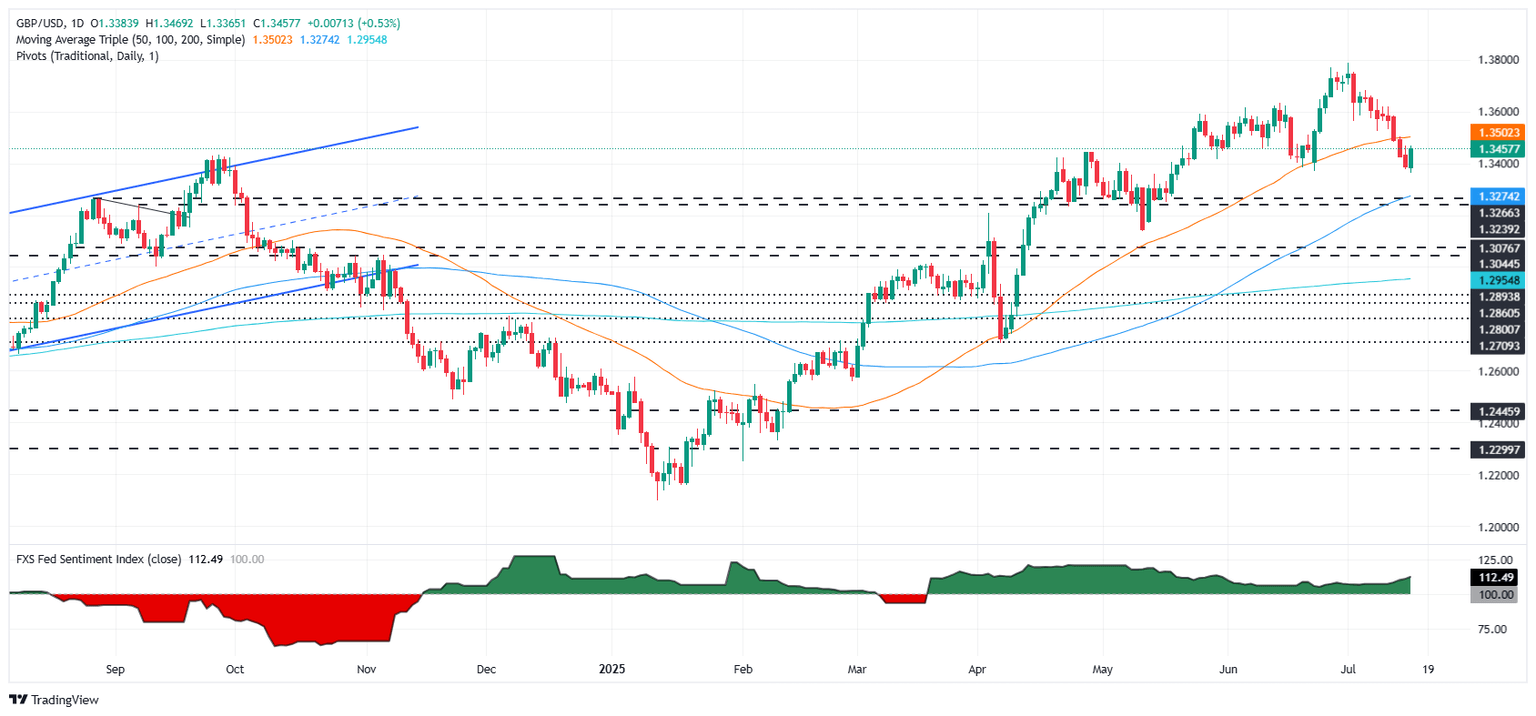

The GBP/USD pair reverses its course and rallies as the latest US Producer Price Index (PPI) data reignites hopes of a rate cut by the Federal Reserve (Fed), while headlines suggest that US President Donald Trump may consider firing Fed Chair Jerome Powell. At the same time, inflation on the consumer side in the UK surprised investors, exceeding forecasts. At the time of writing, the pair trades at 1.3454, up by 0.55%. Read More...

Pound Sterling ticks up as UK inflation accelerates more than expected

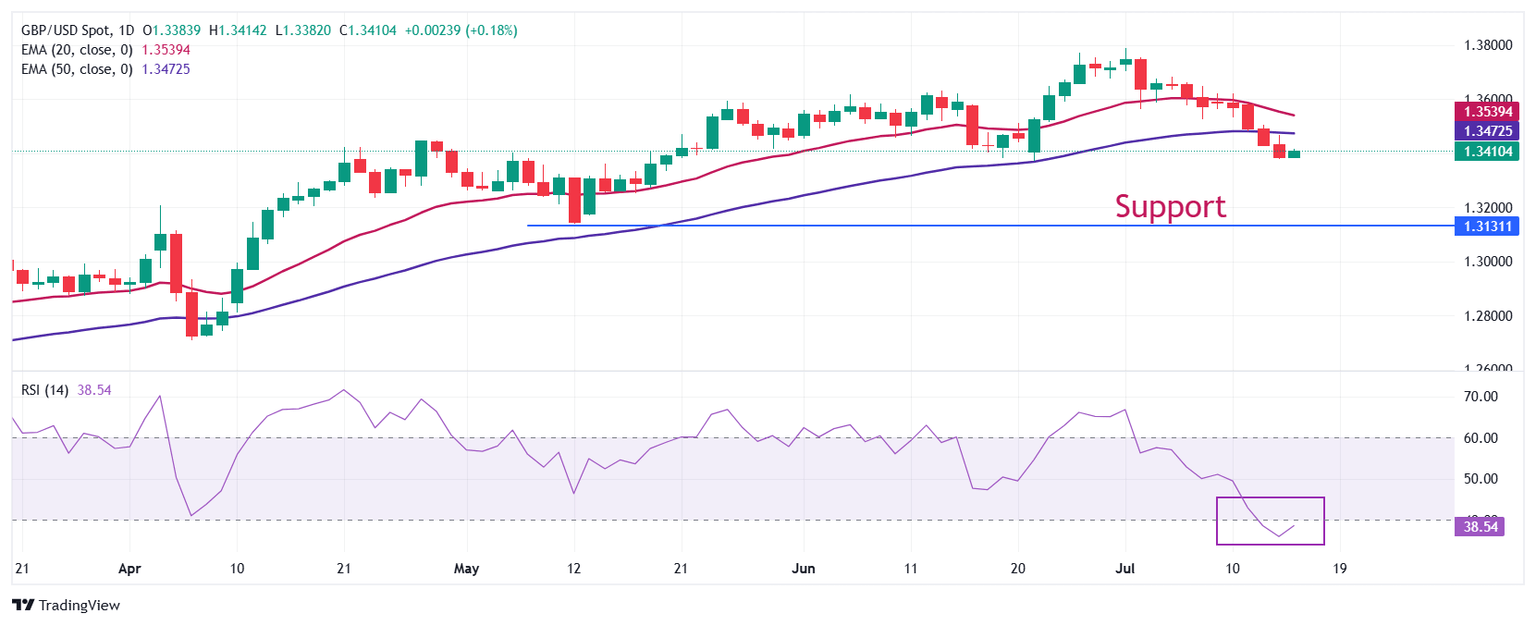

The Pound Sterling (GBP) attracts bids against its major peers on Wednesday after the release of a hotter-than-projected United Kingdom (UK) Consumer Price Index (CPI) data for June. Read More...

GBP/USD trades with positive bias below 1.3400, remains close to multi-week low ahead of UK CPI

The GBP/USD pair ticks higher during the Asian session on Wednesday, though it lacks follow-through buying and remains below the 1.3400 round-figure mark. Moreover, spot prices remain close to a three-and-a-half week low touched on Tuesday and seem vulnerable to prolonging the recent downward trajectory witnessed over the past two weeks or so. Read More...

Author

FXStreet Team

FXStreet