GBP/USD rallies on US PPI dip and Trump’s potential Powell removal

- US PPI slows to 2.3% YoY, reigniting July Fed cut speculation.

- Trump reportedly considers removing Fed Chair Powell, adding to market volatility.

- UK CPI jumps to 3.6% YoY, the highest since January 2024, reducing BoE cut odds.

The GBP/USD pair reverses its course and rallies as the latest US Producer Price Index (PPI) data reignites hopes of a rate cut by the Federal Reserve (Fed), while headlines suggest that US President Donald Trump may consider firing Fed Chair Jerome Powell. At the same time, inflation on the consumer side in the UK surprised investors, exceeding forecasts. At the time of writing, the pair trades at 1.3454, up by 0.55%.

Cable jumps to 1.3454 amid weaker US factory prices and speculation that Trump may fire Fed Powell

The Producer Price Index in the US showed that factory prices remained unchanged in June, while PPI dipped from 2.6% to 2.3% YoY, below forecasts of 2.5%. The underlying prices edged lower, from 3% to 2.6%, which is below estimates of 2.7%.

Sources cited by Reuters revealed that “The inflation threat is alive and very real, and if this does not put a Fed rate cut in July out of the question, then nothing will.” At the upcoming meeting, the Fed is expected to keep rates unchanged at the 4.25%-4.50% range, with odds standing at 96.9%.

In the meantime, US President Donald Trump reportedly questioned Republican lawmakers about whether he should fire the Fed Chair Jerome Powell, as revealed by CBS, citing sources.

Bloomberg revealed that Trump is likely to fire Fed Chair Powell soon, according to White House sources.

Across the pond, UK’s inflation recorded its highest print since January 2024, as CPI hit 3.6% YoY, dampening expectations for rate cuts by the Bank of England. The consensus expected a rise to 3.4%. Furthermore, core CPI is also up, by 3.7% YoY, up from estimates and May’s 3.5%.

Although the data should put rate cuts to bed, investors had already priced in an 80% chance of a 25-basis-point rate cut in August.

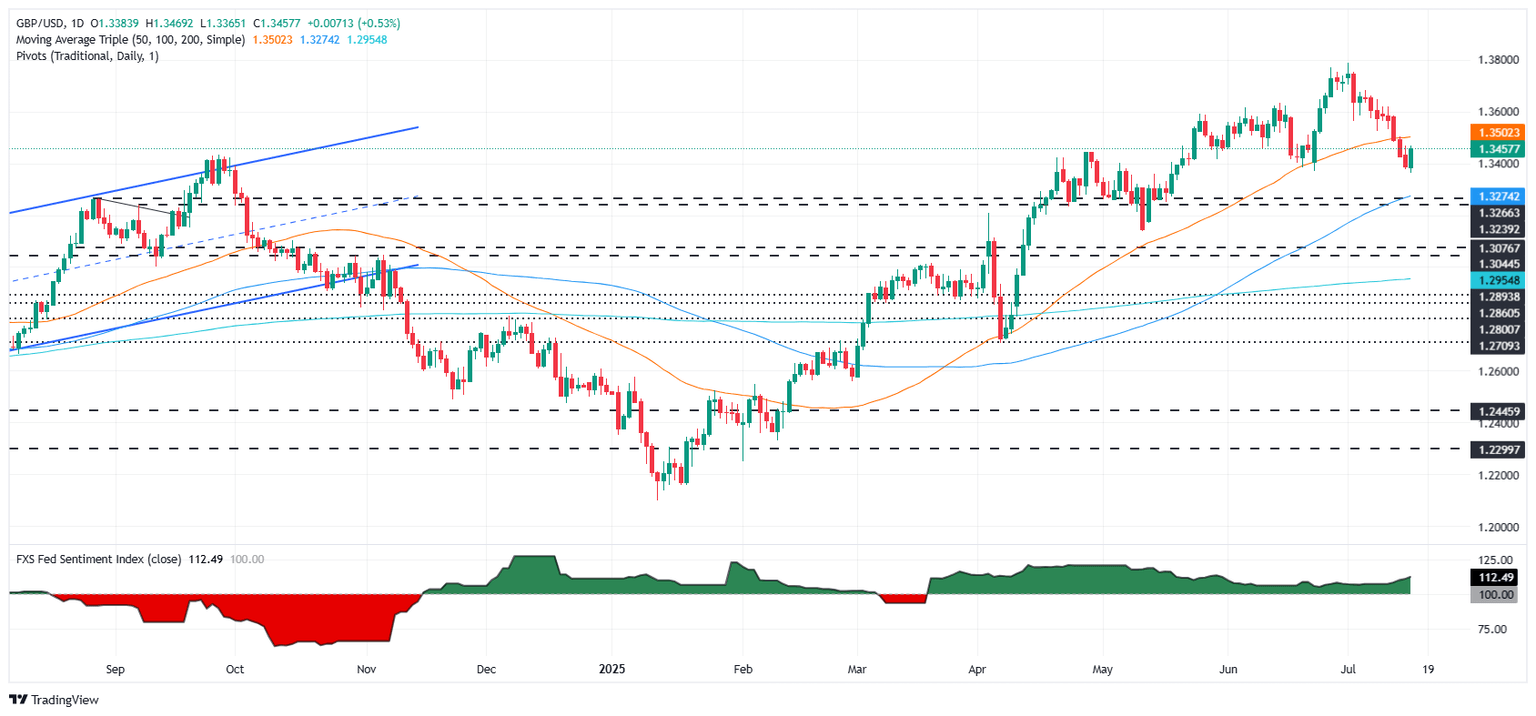

GBP/USD Price Forecast: Technical outlook

GBP/USD remains upward biased, found support at the June 23 low of 1.3369, with sellers unable to decisively push prices below to test the 1.3350 mark. Bullish momentum is picking up on Trump’s remarks, as depicted by the Relative Strength Index (RSI).

If GBP/USD stays above 1.3400, expect a test of the 50-day SMA at 1.3495 in the near term. Further resistance lies overhead at 1.3500 and the 20-day SMA at 1.3581. On the flip side, if the pair tumbles below 1.3350, expect a test of the 100-day SMA at 1.3270.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.