Pound Sterling Price News and Forecast: GBP/USD pullback steadies at key support before Fed/BoE rate decisions

GBP/USD outlook: Pullback finds footstep at key supports ahead of Fed/BoE rate decisions

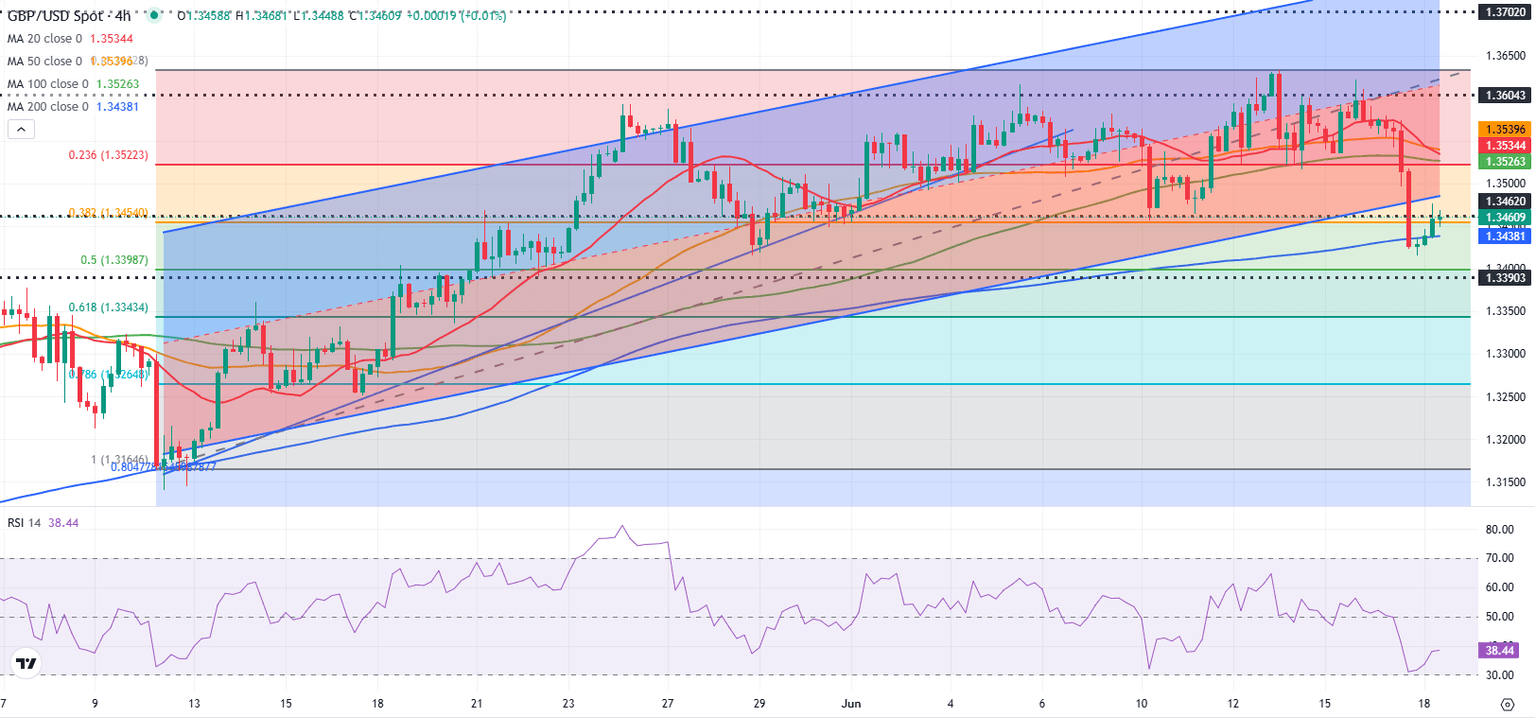

Cable bounced from new three-week low (1.3415), hit after Tuesday’s 1.2% drop, boosted by weaker than expected UK inflation in May. Weaker dollar also helps Wednesday’s recovery, as markets await Fed’s decision today and BOE’s monetary policy meeting (Thursday).

Both central banks are widely expected to hold rates this time, with market focus on signals from projections for the rest of the year. Near-term structure weakened after Tuesday’s close below 10/20DMA’s and probe through pivotal support at 1.3444 (Fibo 38.2% of 1.3195/1.3632, also the floor of recent range) though close below this level is needed to validate negative signal and open way for deeper pullback. Read more...

GBP/USD Forecast: Pound Sterling turns bearish as attention shifts to Fed

GBP/USD trades marginally higher on the day above 1.3450 after falling to its lowest level in nearly a month on Tuesday. Despite the recent recovery, the pair's technical outlook suggests that the bearish bias remains intact in the near term.

The risk-averse market atmosphere allowed the US Dollar (USD) to gather strength on Tuesday and weighed on GBP/USD. Safe-haven flows dominated the action in financial markets after comments from United States (US) President Donald Trump hinted at a direct involvement of the US in the Iran-Israel Conflict. "We now have complete and total control of the skies over Iran,” Trump said and added that Ayatollah Ali Khamenei is "an easy target." Read more...

GBP/USD Elliott Wave technical analysis [Video]

The GBPUSD daily chart presents a bullish trend characterized by impulsive price movement, indicating continued strength. Currently, the market is unfolding orange wave 5 within the broader navy blue wave 1 cycle. This positioning signals that GBPUSD is in the final stage of an impulsive advance, typically suggesting strong upward momentum. Read more...

Author

FXStreet Team

FXStreet

-638858412060380146.png&w=1536&q=95)