GBP/USD Forecast: Pound Sterling turns bearish as attention shifts to Fed

- GBP/USD clings to marginal gains above 1.3450 on Wednesday.

- Annual CPI inflation in the UK softened to 3.4% in May, as anticipated.

- The Fed is widely expected to keep the policy rate unchanged.

GBP/USD trades marginally higher on the day above 1.3450 after falling to its lowest level in nearly a month on Tuesday. Despite the recent recovery, the pair's technical outlook suggests that the bearish bias remains intact in the near term.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the weakest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.29% | 0.76% | 0.28% | 0.59% | -0.26% | -0.21% | 0.72% | |

| EUR | -0.29% | 0.35% | -0.05% | 0.30% | -0.43% | -0.50% | 0.43% | |

| GBP | -0.76% | -0.35% | -0.37% | -0.05% | -0.77% | -0.84% | 0.08% | |

| JPY | -0.28% | 0.05% | 0.37% | 0.32% | -0.84% | -0.81% | 0.04% | |

| CAD | -0.59% | -0.30% | 0.05% | -0.32% | -0.78% | -0.80% | 0.13% | |

| AUD | 0.26% | 0.43% | 0.77% | 0.84% | 0.78% | -0.07% | 0.87% | |

| NZD | 0.21% | 0.50% | 0.84% | 0.81% | 0.80% | 0.07% | 0.93% | |

| CHF | -0.72% | -0.43% | -0.08% | -0.04% | -0.13% | -0.87% | -0.93% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

The risk-averse market atmosphere allowed the US Dollar (USD) to gather strength on Tuesday and weighed on GBP/USD. Safe-haven flows dominated the action in financial markets after comments from United States (US) President Donald Trump hinted at a direct involvement of the US in the Iran-Israel Conflict. "We now have complete and total control of the skies over Iran,” Trump said and added that Ayatollah Ali Khamenei is "an easy target."

Early Wednesday, the data published by the UK's Office for National Statistics showed that annual inflation, as measured by the change in the Consumer price Index (CPI), softened to 3.4% in May from 3.5% in April. This reading came in line with the market expectation. On a monthly basis, the CPI rose 0.2% following the 1.2% increase recorded in April. These figures failed to trigger a noticeable market reaction. The Bank of England will announce the interest rate decision on Thursday.

The Fed is forecast to keep the policy rate steady at the range of 4.25%-4.5% after the June policy meeting. Alongside the policy statement, the Fed will publish the revised Summary of Economic Projections (SEP).

The latest SEP, published in March, showed that policymakers projected a total of 50 basis points (bps) reduction in the policy rate in 2025. A hawkish revision to the SEP, with officials shifting their preference toward a single rate cut this year, could boost the USD and force GBP/USD to stay in the back foot.

On the other hand, GBP/USD could extend its rebound if the SEP highlights that policymakers still anticipate two 25 bps rate cuts. According to the CME FedWatch Tool, markets are currently pricing in about a 65% probability that the US central bank will lower rates at least twice in 2025.

GBP/USD Technical Analysis

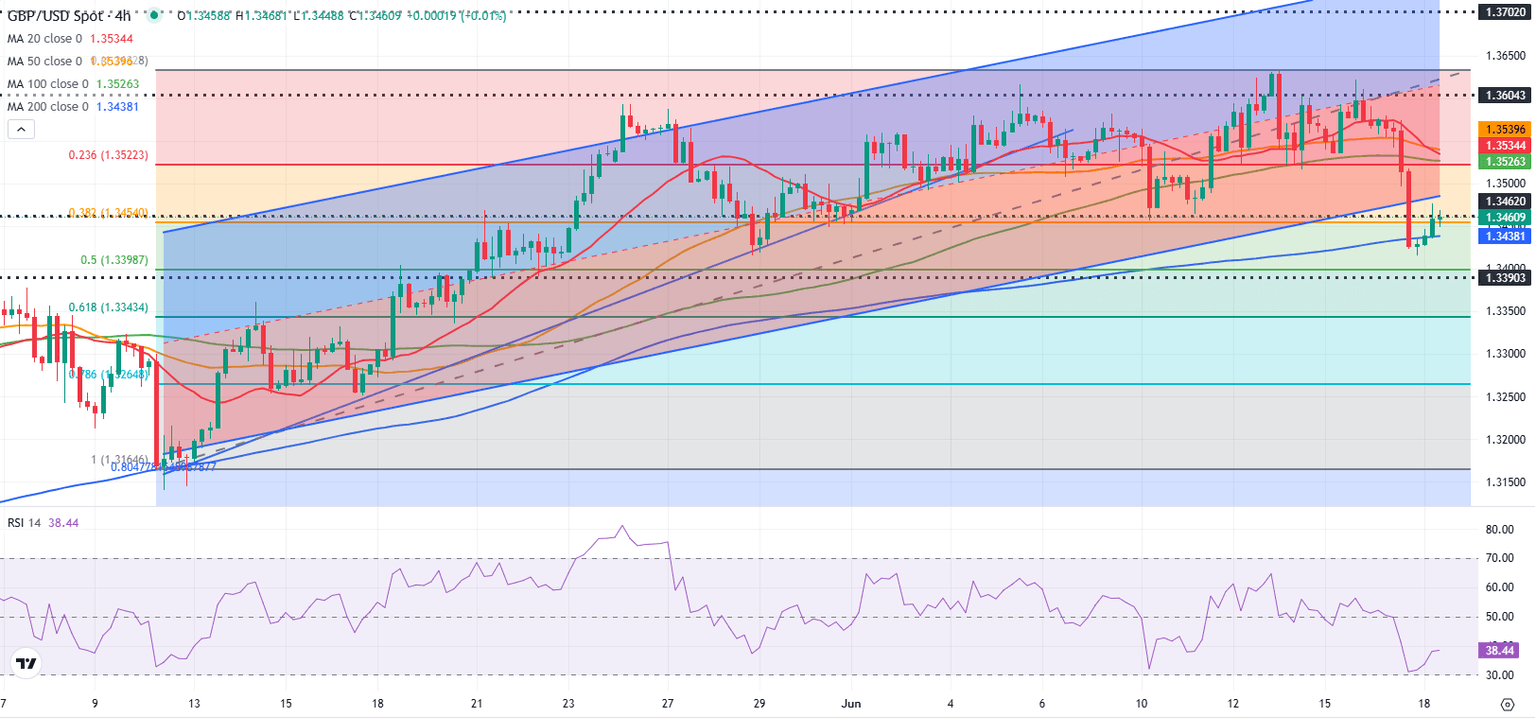

GBP/USD trades below the lower limit of the ascending regression channel and the Relative Strength Index (RSI) indicator on the 4-hour chart stays slightly below 40, suggesting that the bearish bias remains intact.

On the downside, the 200-period Simple Moving Average (SMA) aligns as the immediate support level at 1.3440 before 1.3400 (Fibonacci 50% retracement level of the latest uptrend) and 1.3340 (Fibonacci 61.8% retracement). Looking north, resistance levels could be spotted at 1.3500 (static level, round level), 1.3530 (100-period SMA, Fibonacci 23.6% retracement) and 1.3600 (static level, round level).

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.