Pound Sterling Price News and Forecast: GBP/USD plunges as Israel-Iran conflict rattles markets

GBP/USD plunges as Israel-Iran conflict rattles markets, boosts US Dollar

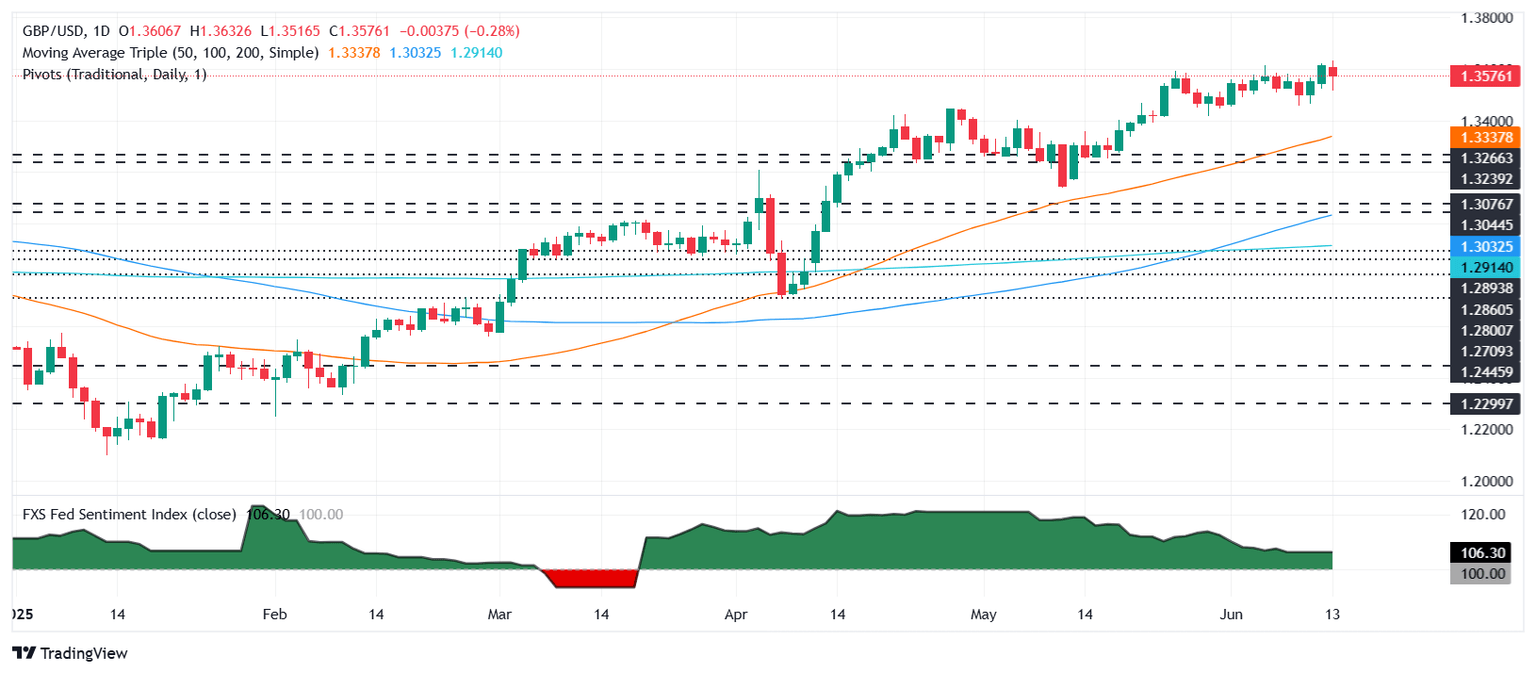

GBP/USD is tumbling over 0.40% on Friday as geopolitical tensions triggered a flow towards the US Dollar (USD) haven status after Israel launched an attack on Iran, which escalated the Middle East conflict. The pair traded near 1.3550s after hitting a three-year peak of 1.3632. Read More...

Pound Sterling corrects sharply against US Dollar amid Iran-Israel conflict

The Pound Sterling (GBP) underperforms against its major peers on Friday, except for antipodean currencies, as market sentiment turns risk-averse amid escalating geopolitical tensions in the Middle East. Read More...

GBP/USD tumbles below 1.3550 amid risk-off sentiment

The GBP/USD pair loses ground to near 1.3530 during the early European session on Friday. The Pound Sterling (GBP) weakens against US Dollar (USD) due to heightened geopolitical tensions in the Middle East. Investors brace for the preliminary reading of the US Michigan Consumer Sentiment report, which is due later on Friday. Read More...

Author

FXStreet Team

FXStreet