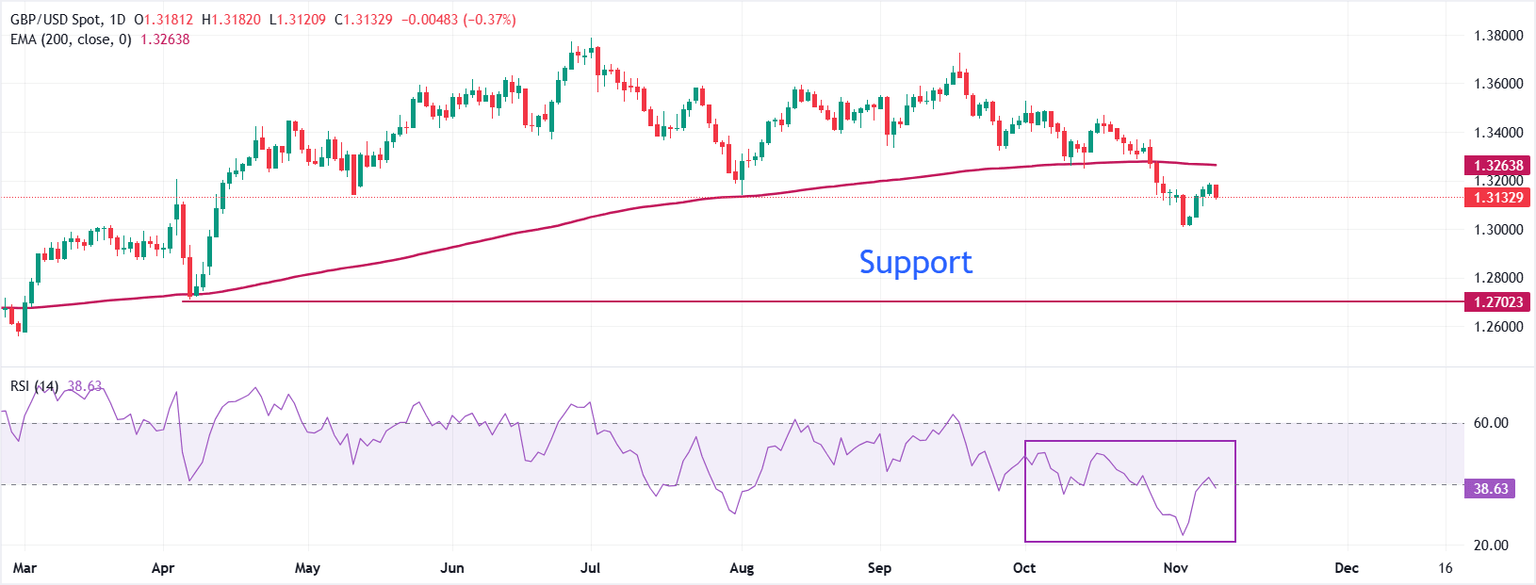

Pound Sterling Price News and Forecast: GBP/USD likely to edge higher within a range of 1.3065/1.3230

Pound Sterling underperforms as UK job market deteriorates further

The Pound Sterling (GBP) falls sharply against its major currency peers on Tuesday. The British currency weakens as the United Kingdom (UK) labour market data for the three months ending September has signaled that job market conditions have deteriorated further. Read more...

GBP/USD: Likely to edge higher within a range of 1.3065/1.3230 – UOB Group

Pound Sterling (GBP) is likely to trade in a range between 1.3130 and 1.3190. In the longer run, GBP is likely to edge higher within a range of 1.3065/1.3230, UOB Group's FX analysts Quek Ser Leang and Peter Chia note. Read more...

GBP: Dovish vibes from jobs market – ING

This morning’s UK jobs numbers came in on the soft side, ING's FX analyst Francesco Pesole notes.

"Unemployment rose to 5.0% in the three months to September (exp. 4.9%) and October’s employment contracted by -32k, following a revised -32k (first print was -10k) for September. Weekly earnings slowed across the board, with the headline (3M/YoY) measure undershooting expectations at 4.8%." Read more...

Author

FXStreet Team

FXStreet