Pound Sterling Price News and Forecast: GBP/USD jumps as BoE delivers hawkish cut, US jobless claims climb

GBP/USD jumps as BoE delivers hawkish cut, US jobless claims climb

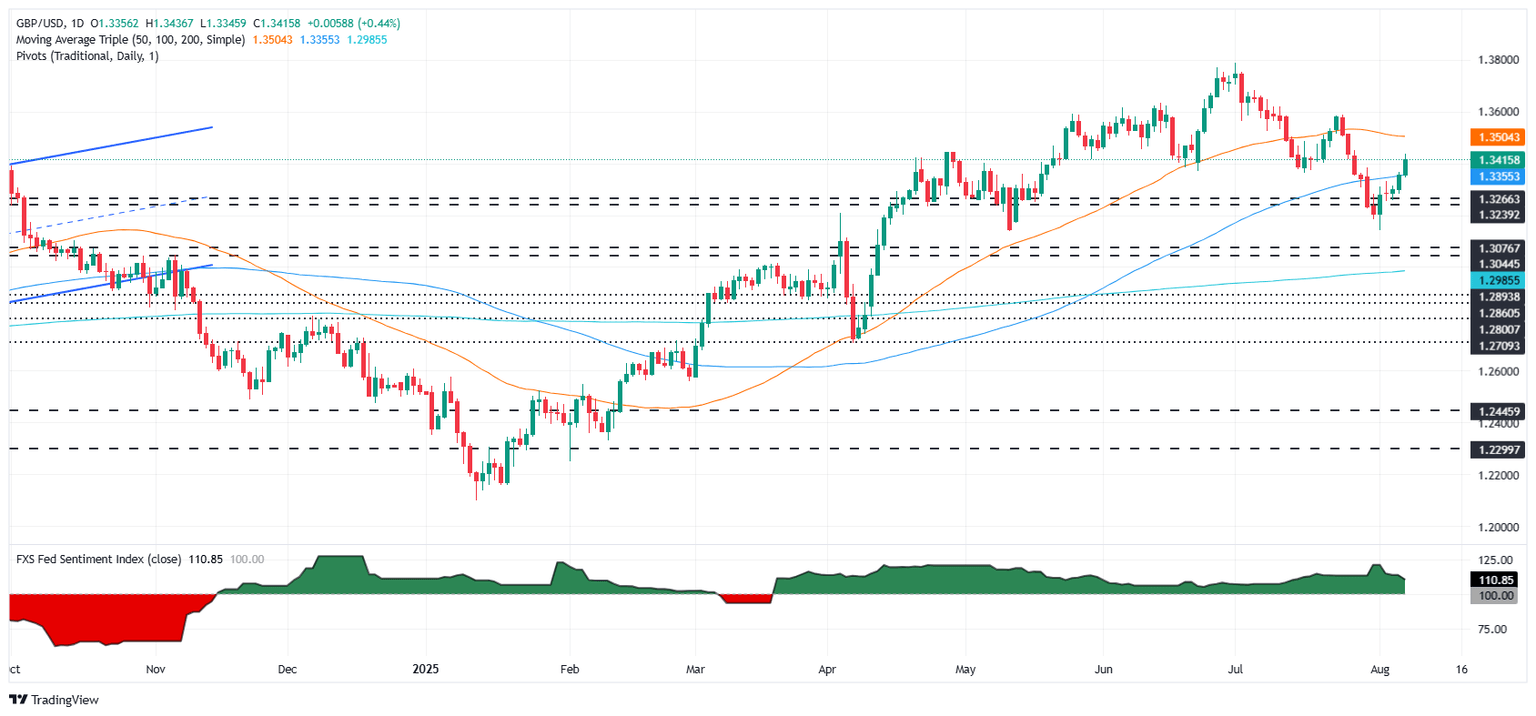

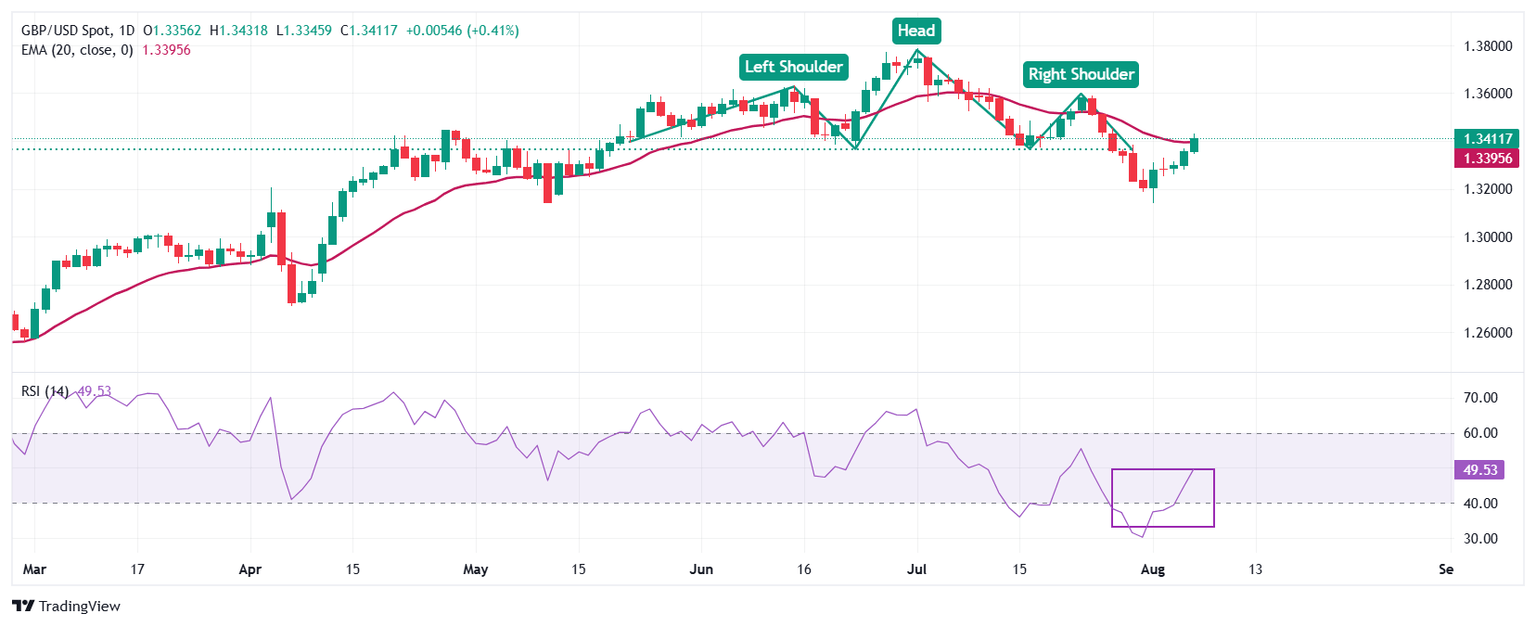

The GBP/USD surges during the North American session, though trading below an eight-day high reached at 1.3436 after the Bank of England (BoE) decided to cut interest rates on a close vote split, signaling that policymakers remained worried about inflation. Also, a jump in unemployment claims in the United States (US) keeps the Dollar pressured. The pair trades at 1.3410, up 0.48%. Read More...

Pound Sterling gains as BoE cuts interest rates to 4% with narrow majority

The Pound Sterling (GBP) attracts significant bids against its major peers on Thursday after the Bank of England (BoE) reduces interest rates by 25 basis points (bps) to 4%, with a 5-4 majority. This is the fifth interest rate cut by the BoE since August 2024, when it started the monetary-expansion cycle. Read More...

GBP/USD remains subdued near 1.3350 ahead of BoE policy decision

GBP/USD holds losses after two days of gains, trading around 1.3350 during the Asian hours on Thursday. The pair depreciates ahead of the Bank of England’s (BoE) interest rate decision due later in the day. Traders will shift their focus toward US weekly Initial Jobless Claims due later in the North American session. Read More...

Author

FXStreet Team

FXStreet