GBP/USD holding above 1.2700 after US PCE inflation keeps rate cut hopes pinned to the ceiling

The GBP/USD is on the high side amidst some rough chop in the US market session, holding above the 1.2700 handle the pair reclaimed during the European trading window after the UK reported better-than-expected Retail Sales in November.

Read More...

Pound Sterling eyes more upside on upbeat UK Retail Sales, soft US core PCE data

The Pound

Sterling (GBP) extends its recovery on Friday, supported by upbeat UK Retail Sales data for November. The Office for National Statistics (ONS) reported that households’ retail spending surprisingly remained positive compared with the previous year, while market participants projected a sharp decline. Strong Retail Sales were boosted by a 2.8% increase in non-food retail stores as major discounts were offered amid the Black Friday Sale.

Read More...

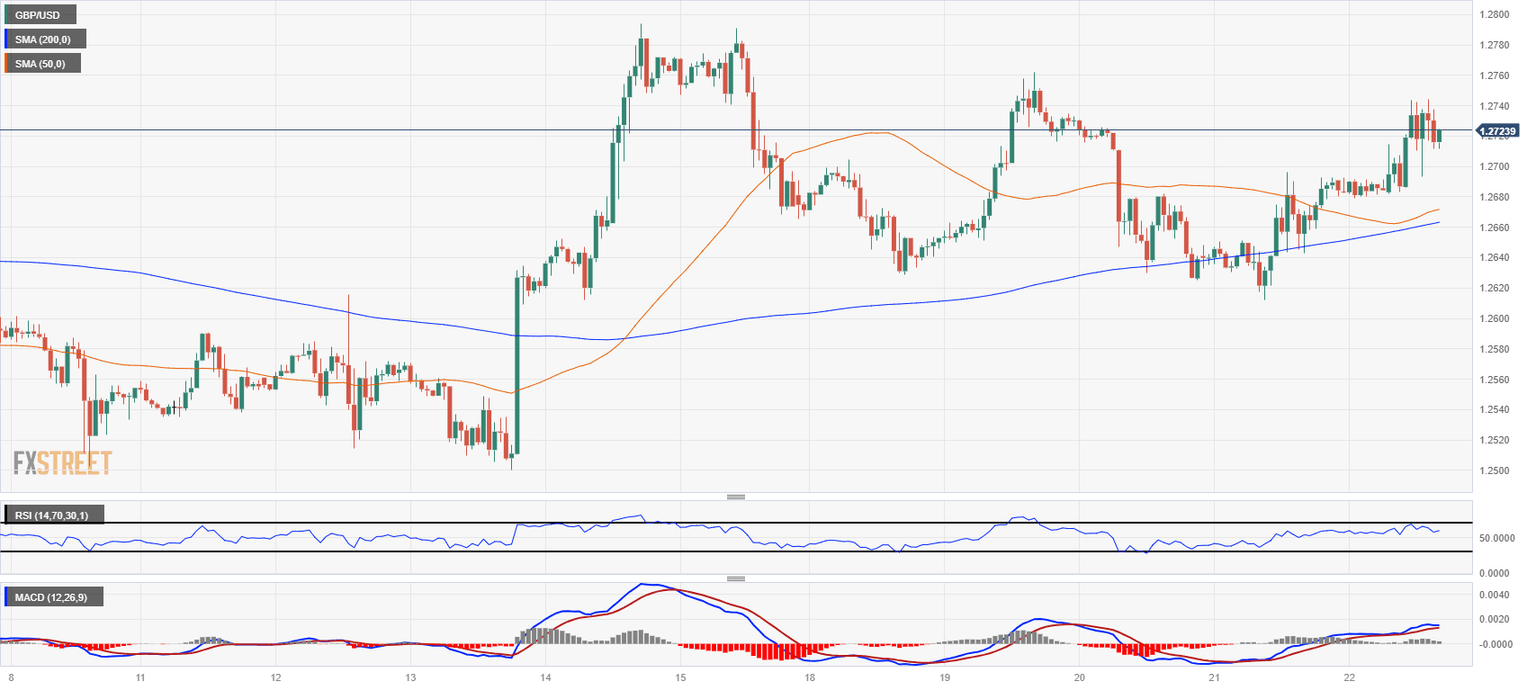

GBP/USD Price Analysis: The immediate upside barrier is seen at 1.2740

The GBP/USD pair struggles to gain ground during the early European session on Friday. The major pair remains capped below the 1.2700 psychological mark ahead of the top-tier economic data from both the United Kingdom (UK) and the

United States (US). At press time, GBP/USD is trading at 1.2682, down 0.04% on the day.

Read More...

-638388198185832557.png&w=1536&q=95)