Pound Sterling Price News and Forecast: GBP/USD has scope to extend lower in zigzag correction [Video]

![Pound Sterling Price News and Forecast: GBP/USD has scope to extend lower in zigzag correction [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/british-currency-series-5297542_XtraLarge.jpg)

GBP/USD Forecast: Pound Sterling struggles to attract bulls despite improving risk mood

GBP/USD gained traction in the Asian session and climbed above 1.2600 after posting small gains on Monday. The pair, however, is yet to show signs of a bullish reversal.

Wall Street's main indexes opened higher on Monday and made it difficult for the US Dollar (USD) to gather strength against its rivals. As risk flows continued to dominate the financial markets during the Asian trading hours on Tuesday, the USD struggled to find demand, allowing GBP/USD to build on Monday's recover gains. Read more...

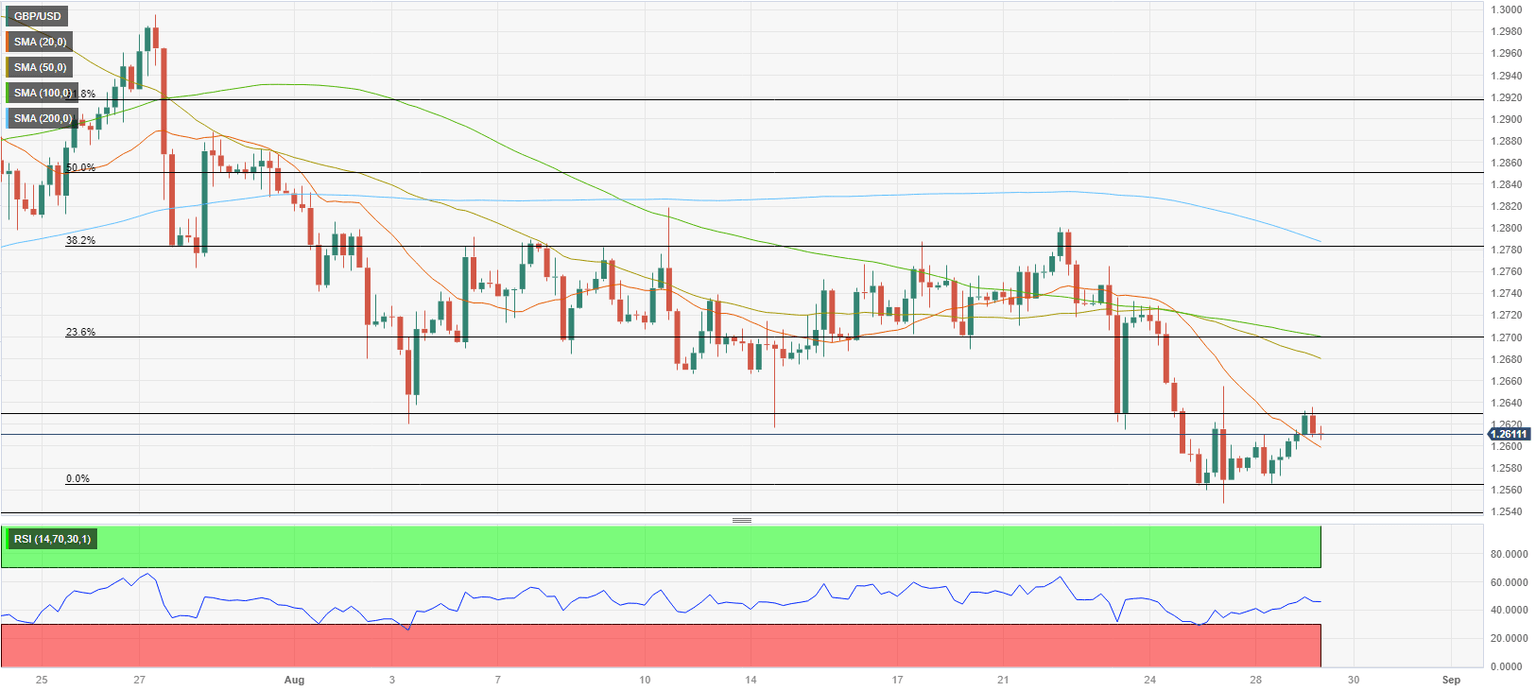

GBP/USD has scope to extend lower in zigzag correction [Video]

Short Term Elliott Wave view suggests decline from 7.14.2023 high is in progress as a zigzag structure. Down from 7.14.2023 high, wave (i) ended at 1.2797 and wave (ii) rally ended at 1.299. The pair then extended lower in wave (iii) towards 1.2619 and wave (iv) rally ended at 1.2819. Final leg lower wave (v) ended at 1.2615 which completed wave ((a)). The 1 hour chart below shows the wave ((a)) as a starting point. Wave ((b)) corrective rally then unfolded as a double three Elliott Wave structure. Up from wave ((a)), wave (w) ended at 1.278 and dips in wave (x) ended at 1.268. Wave (y) higher ended at 1.28 which completed wave ((b)) in higher degree. Read more...

GBP/USD trades higher around 1.2620, US economic data eyed

GBP/USD continues to gain for the second consecutive day, trading around 1.2620 during the Asian session on Tuesday. A sense of cautious optimism weakened the yields on US government bonds, contributing to the upward movement of the GBP/USD pair.

Additionally, the hawkish remarks made by the Bank of England (BoE) Deputy Governor Ben Broadbent at the Jackson Hole Symposium helped the Cable pair to snap a four-day losing streak. As said, Broadbent advocated for policy rates to remain higher for a prolonged period. Read more...

Author

FXStreet Team

FXStreet