GBP/USD gains traction and reclaimed 1.2000 as the GBP prepares for weekly losses

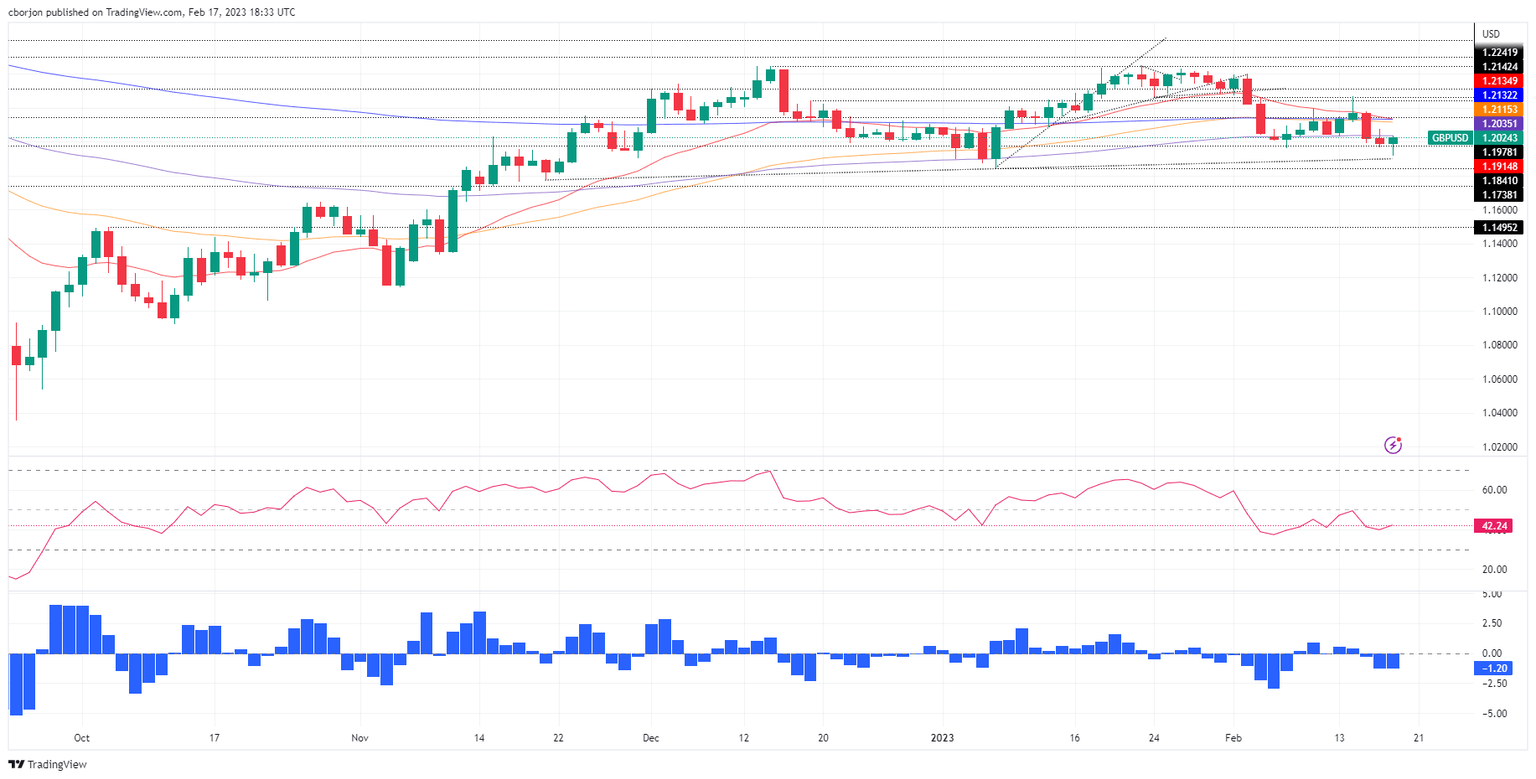

The GBP/USD is staging a recovery after diving to fresh February lows around 1.1914 in the mid-North American session, bolstered by overall US Dollar (USD) weakness. Nevertheless, it remains trading below the important 200-day Exponential Moving Average (EMA) at 1.2132, keeping the downtrend intact. At the time of writing, the GBP/USD is exchanging hands above the 1.2020 figure, above its opening price by 0.30%.

Read More...

GBP/USD slides below 200 DMA support, seems vulnerable near its lowest level since January

The GBP/USD pair remains under heavy selling pressure for the third straight day on Friday and drops to its lowest level since January 6 during the first half of the European session.

Read More...

GBP/USD risks a probable drop to 1.1900 – UOB

In the opinion of UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang,

GBP/USD could extend the decline to the 1.1900 region in the next weeks.

Read More...