Pound Sterling Price News and Forecast: GBP/USD edges higher as mixed US data weighs on Greenback

GBP/USD weakens to near 1.3550 on modest US Dollar strength

The GBP/USD pair loses ground to near 1.3555 during the early Asian session on Monday, pressured by a firmer US Dollar (USD). Markets turn cautious ahead of a meeting between US President Donald Trump and Ukrainian President Volodymyr Zelenskiy later on Monday. The UK July Consumer Price Index (CPI) inflation report will be released on Tuesday.

The Greenback strengthens as caution prevails before Trump’s talks with Zelenskiy. Traders await the Trump-Zelenskiy meeting in Washington on Monday, as it might offer some hints about a ceasefire deal or new sanctions on Russia or buyers of its crude. Any signs of persistent geopolitical tensions might boost the safe-haven demand and create a headwind for the major pair in the near term. Read more...

GBP/USD Weekly Forecast: Further gains appear likely in the near term

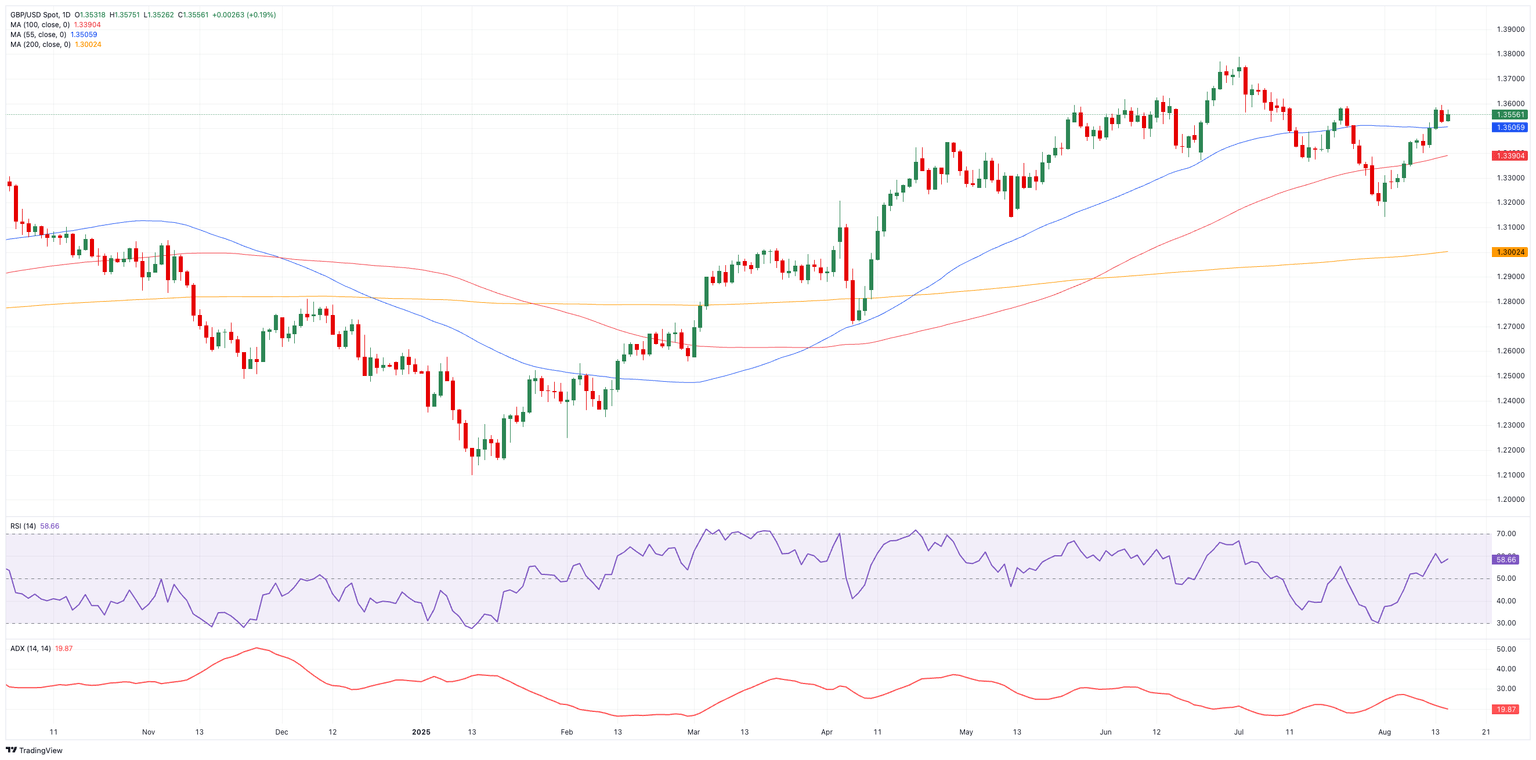

The Pound Sterling (GBP) extended its multi-day march north against the US Dollar (USD) this week, lifting GBP/USD to levels just shy of the 1.3600 hurdle. The uptick in Cable was also underpinned by the equally strong recovery in 10-year gilt yields, which rose to levels last seen in early June, past 4.70% on Friday. GBP/USD closed in the red in only two days since the beginning of August, gaining more than 4 cents since lows around 1.3140 recorded on August 1, and currently navigating around the 38.2% Fibo retracement of the July-August steep decline.

Cable’s strong rebound comes in part due to the renewed weakness surrounding the Greenback so far this month, as progress on the trade front, coupled with expectations of further rate cuts by the Federal Reserve (Fed), left the US Dollar on the defensive. In the same direction, persistent threats from US President Donald Trump to the Fed’s independence also added an extra layer of bearishness to the currency’s near-term outlook. Read more...

Author

FXStreet Team

FXStreet