Pound Sterling Price News and Forecast: GBP/USD draws support from a modest USD pullback

GBP/USD Weekly Outlook: Pound Sterling looks vulnerable as inflation and trade tensions loom

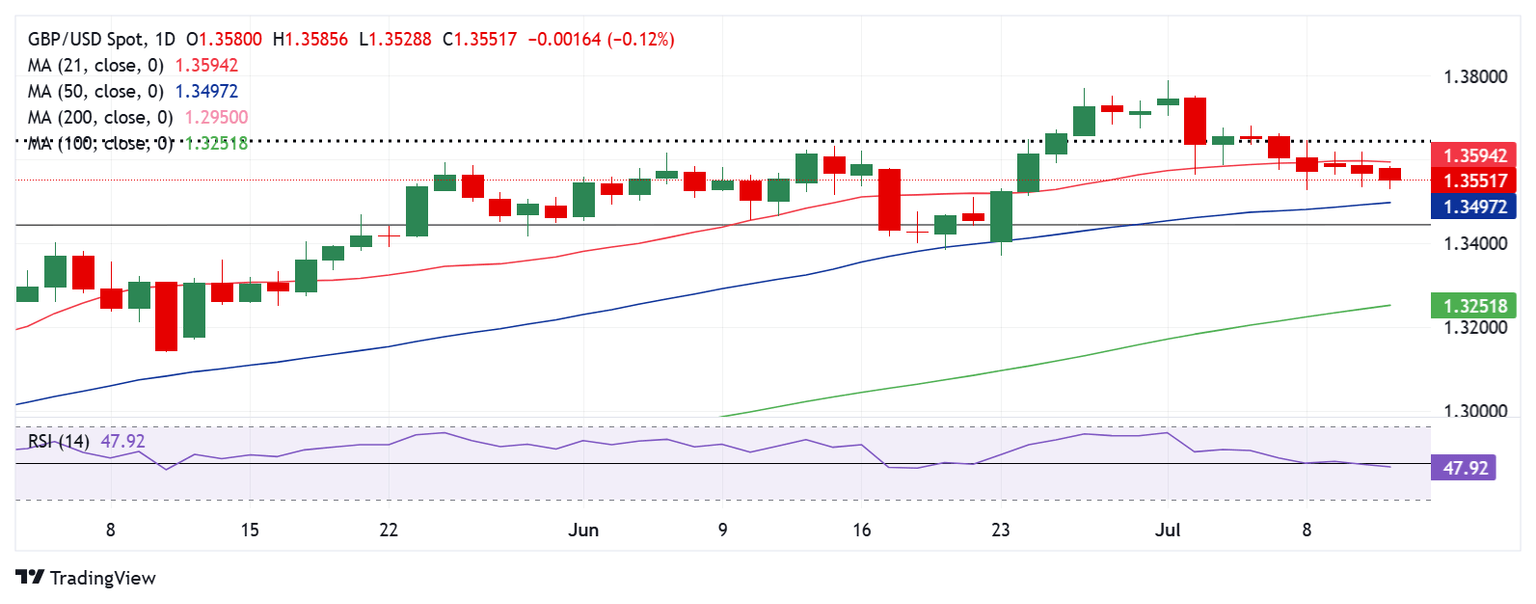

The Pound Sterling (GBP) entered a consolidative phase against the US Dollar (USD), following the recent GBP/USD correction from near four-year highs of 1.3789.

Despite the corrective consolidation, GBP/USD sellers held the upper hand amid a steady recovery staged by the US Dollar from multi-year troughs. Read more...

GBP/USD holds steady around 1.3500; seems vulnerable near multi-week low

The GBP/USD pair enters a bearish consolidation phase during the Asian session and oscillates in a narrow band around the 1.3500 psychological mark, just a few pips above a three-week low touched on Friday. Moreover, the fundamental backdrop suggests that the path of least resistance for spot prices remains to the downside.

A modest US Dollar (USD) pullback from its highest level since June 25 turns out to be a key factor lending some support to the GBP/USD pair. However, diminishing odds for a near-term reduction in borrowing costs by the Federal Reserve (Fed), amid concerns that US President Donald Trump's trade tariffs would boost inflation, should act as a tailwind for the buck. Apart from this, the risk-off impulse could further benefit the Greenback's relative safe-haven status and contribute to capping the currency pair. Read more...

Author

FXStreet Team

FXStreet